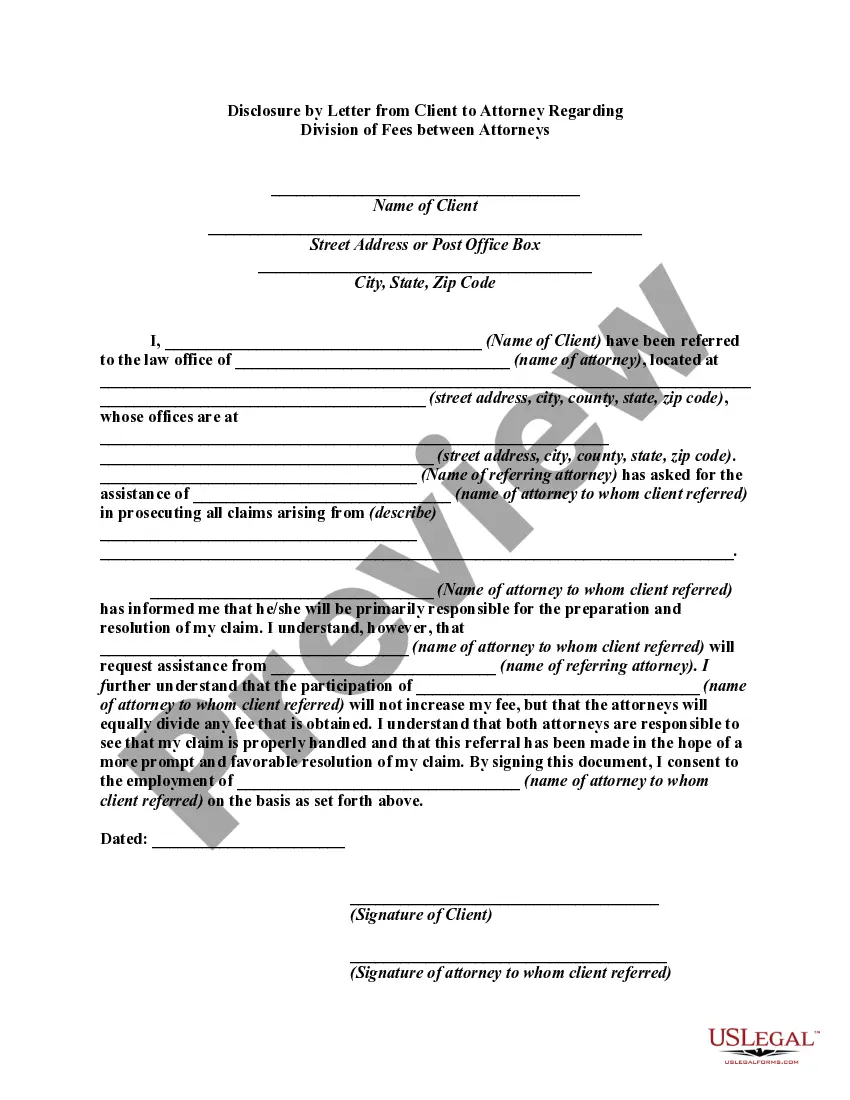

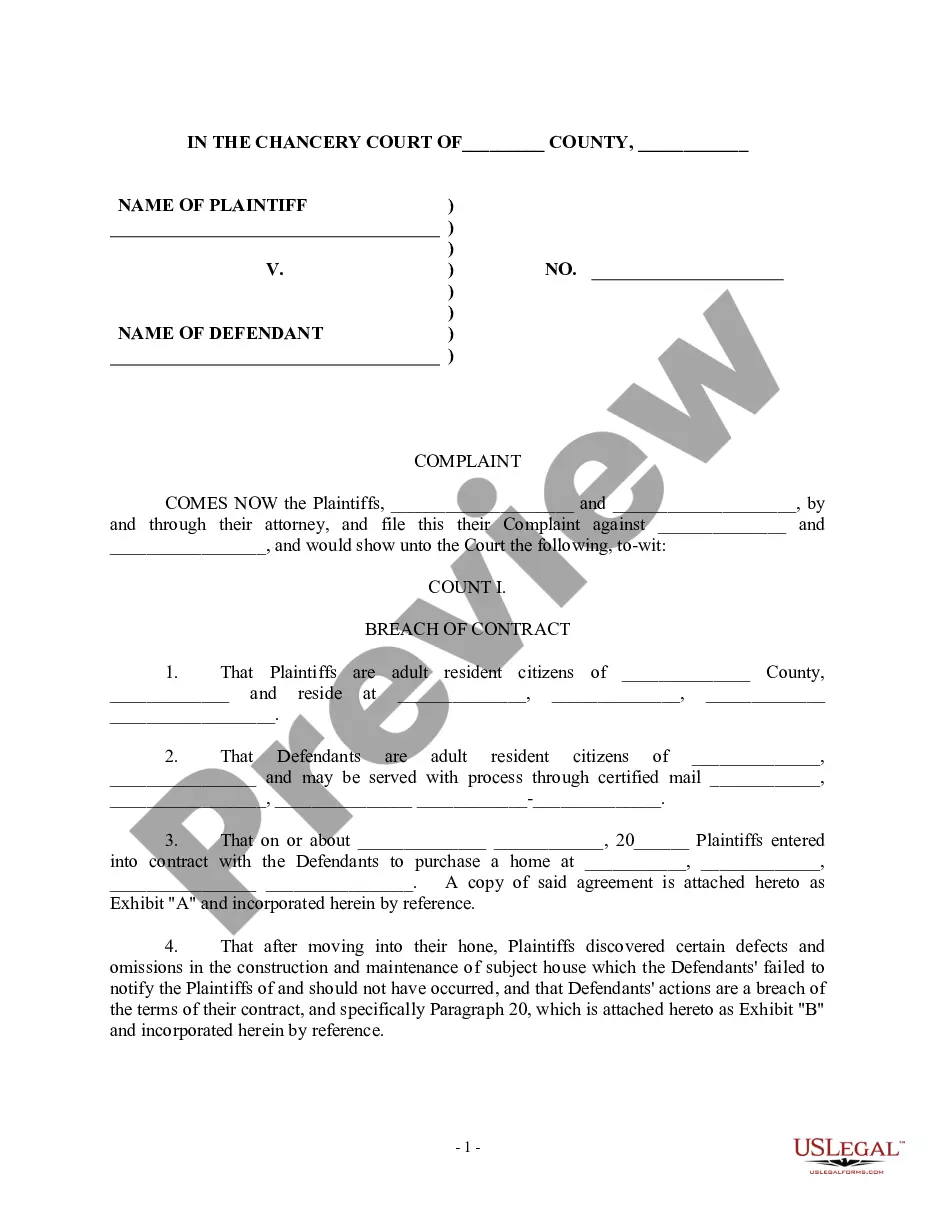

Title: Understanding Wisconsin Demand for Payment of an Open Account by Creditor Introduction: In Wisconsin, creditors have legal options to pursue unpaid debts. One such avenue is the use of a demand for payment of an open account. This article aims to provide a comprehensive overview of what Wisconsin demand for payment of an open account entails, its purpose, and various types that may exist. Keywords: Wisconsin, Demand for Payment, Open Account, Creditor, Unpaid Debts 1. What is a Demand for Payment of an Open Account by Creditor? A demand for payment of an open account is a formal request made by a creditor to collect unpaid debts from a debtor. It serves as a precursor to initiating legal action and encourages the debtor to address their obligations promptly. Keywords: Formal Request, Unpaid Debts, Legal Action, Debtor, Obligations 2. Purpose of Wisconsin Demand for Payment of an Open Account: The primary purpose of a Wisconsin demand for payment of an open account is to notify the debtor of their outstanding debt while prompting immediate settlement or negotiation. It helps both parties seek a resolution without resorting to costly legal proceedings. Keywords: Notification, Outstanding Debt, Settlement, Negotiation, Legal Proceedings 3. Elements of a Wisconsin Demand for Payment of an Open Account: a. Clear Identification: The demand should contain detailed information identifying both the creditor and debtor, including names, addresses, and relevant account numbers. b. Debt Details: It should outline the amount owed, any outstanding interests or fees, along with the original invoice or transaction information. c. Payment Deadline: A specific date by which payment must be made or arrangements must be agreed upon needs to be clearly specified. d. Consequences of Non-Compliance: The potential legal actions that the creditor may take if the debtor fails to respond or make suitable arrangements should be mentioned. e. Method of Delivery: The demand can be sent via certified mail, regular mail, or delivered in person, while retaining proof of delivery. Keywords: Identification, Debt Details, Payment Deadline, Consequences, Delivery Method Types of Wisconsin Demand for Payment of an Open Account by Creditor: 1. Initial Demand Letter: The creditor sends a preliminary letter demanding payment or resolution within a specified timeframe. 2. Follow-Up Demand: If the debtor fails to respond to the initial demand, a subsequent follow-up letter is sent, often using stronger language while stressing the importance of prompt action. 3. Final Demand: After multiple unsuccessful attempts to receive payment or negotiation, the creditor may issue a final demand letter, serving as the last opportunity for the debtor to rectify the situation before legal action is initiated. Keywords: Initial Demand Letter, Follow-Up Demand, Final Demand, Payment Resolution, Legal Action Conclusion: Wisconsin demand for payment of an open account by creditors is a crucial step in seeking debt recovery. By sending a properly composed demand letter, creditors can prompt debtors to address their obligations or engage in negotiations to avoid legal proceedings. Understanding this process helps protect the rights and responsibilities of both parties involved. Keywords: Debt Recovery, Debtors' Obligations, Negotiations, Legal Proceedings, Rights, Responsibilities

Wisconsin Demand for Payment of an Open Account by Creditor

Description

How to fill out Wisconsin Demand For Payment Of An Open Account By Creditor?

If you need to complete, down load, or print lawful file web templates, use US Legal Forms, the biggest assortment of lawful kinds, which can be found online. Use the site`s basic and hassle-free look for to find the papers you want. Different web templates for business and person reasons are sorted by classes and suggests, or keywords. Use US Legal Forms to find the Wisconsin Demand for Payment of an Open Account by Creditor in just a few click throughs.

In case you are previously a US Legal Forms buyer, log in in your profile and click the Obtain option to obtain the Wisconsin Demand for Payment of an Open Account by Creditor. You can even accessibility kinds you in the past downloaded within the My Forms tab of your profile.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate area/land.

- Step 2. Utilize the Preview option to look over the form`s articles. Don`t forget about to see the information.

- Step 3. In case you are unsatisfied using the develop, take advantage of the Research field on top of the screen to discover other types in the lawful develop template.

- Step 4. Once you have identified the shape you want, click on the Purchase now option. Pick the rates plan you favor and add your references to sign up for an profile.

- Step 5. Procedure the transaction. You should use your charge card or PayPal profile to finish the transaction.

- Step 6. Select the file format in the lawful develop and down load it on the gadget.

- Step 7. Full, modify and print or indication the Wisconsin Demand for Payment of an Open Account by Creditor.

Every lawful file template you purchase is the one you have eternally. You might have acces to every single develop you downloaded inside your acccount. Select the My Forms segment and choose a develop to print or down load once more.

Compete and down load, and print the Wisconsin Demand for Payment of an Open Account by Creditor with US Legal Forms. There are millions of specialist and status-certain kinds you can use for your business or person requires.