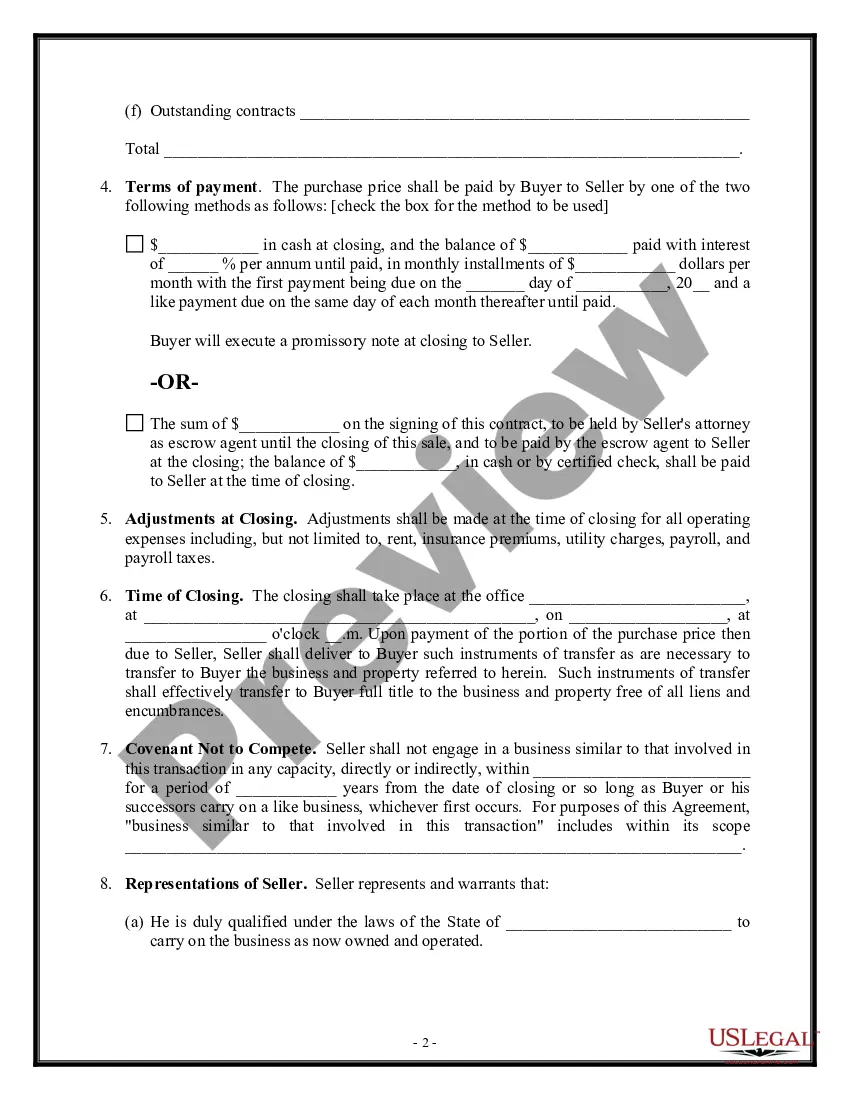

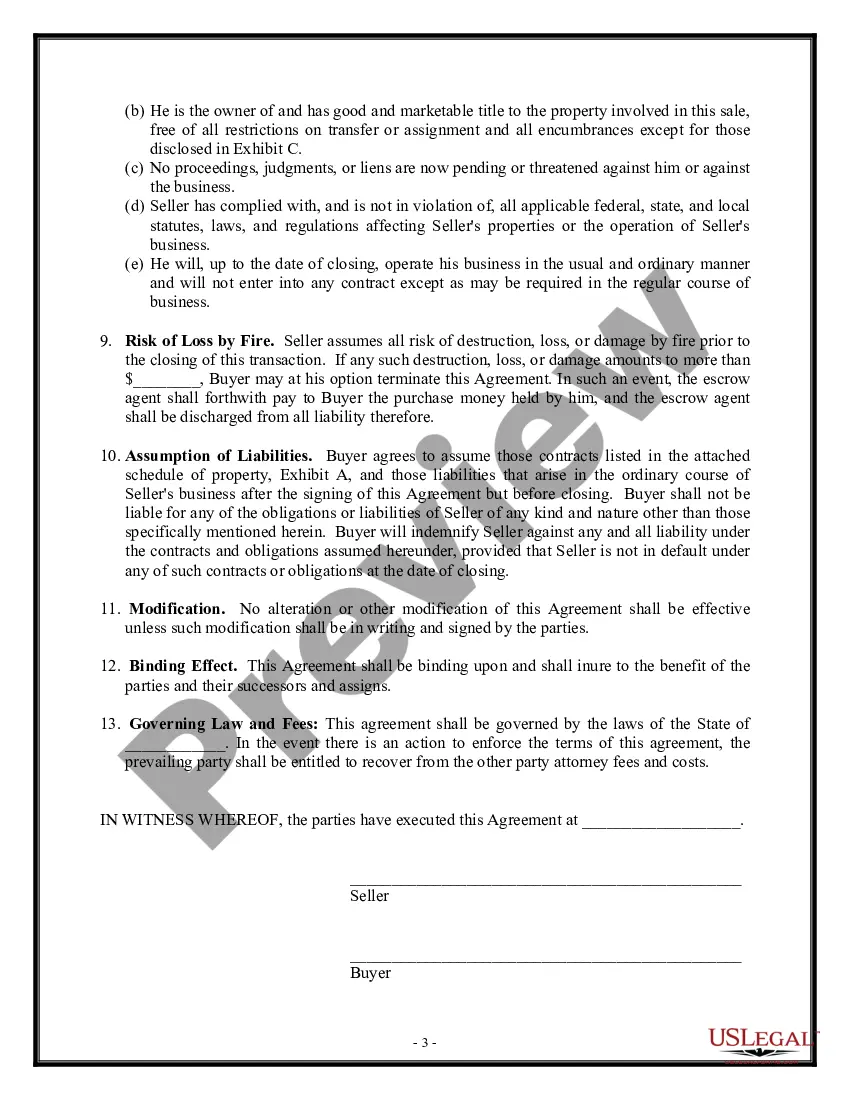

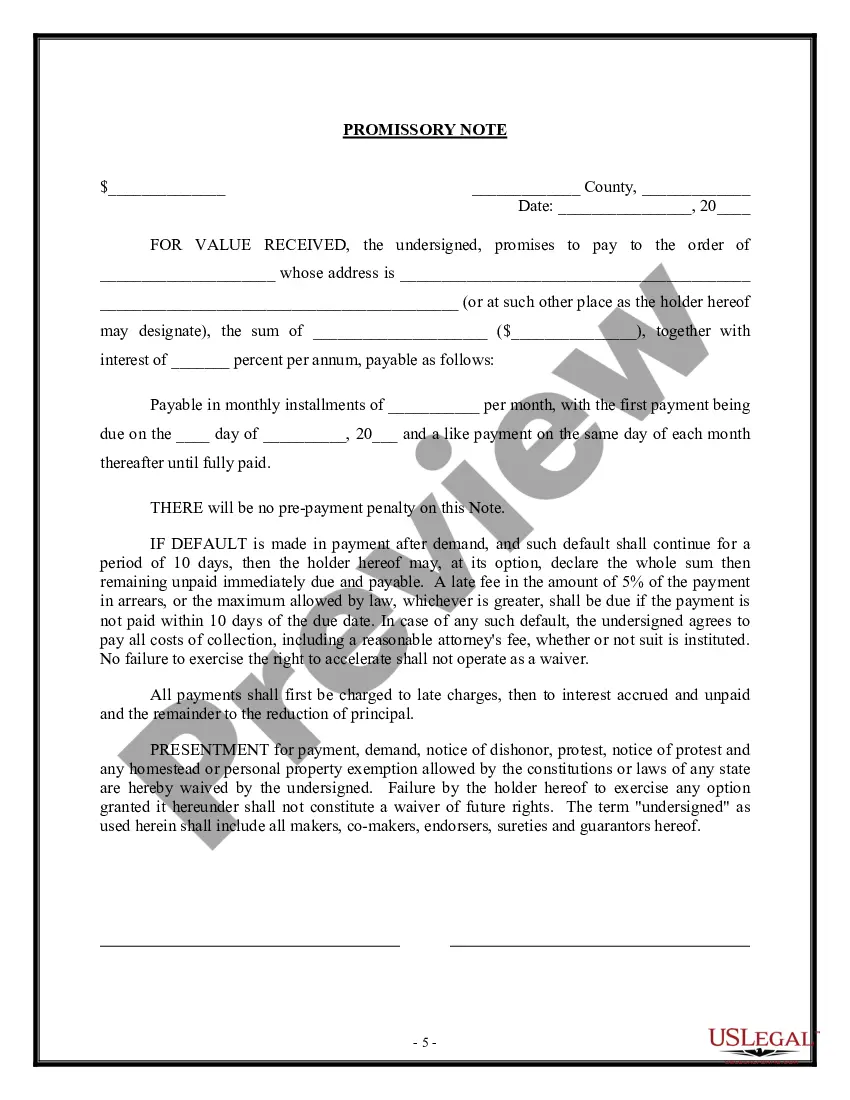

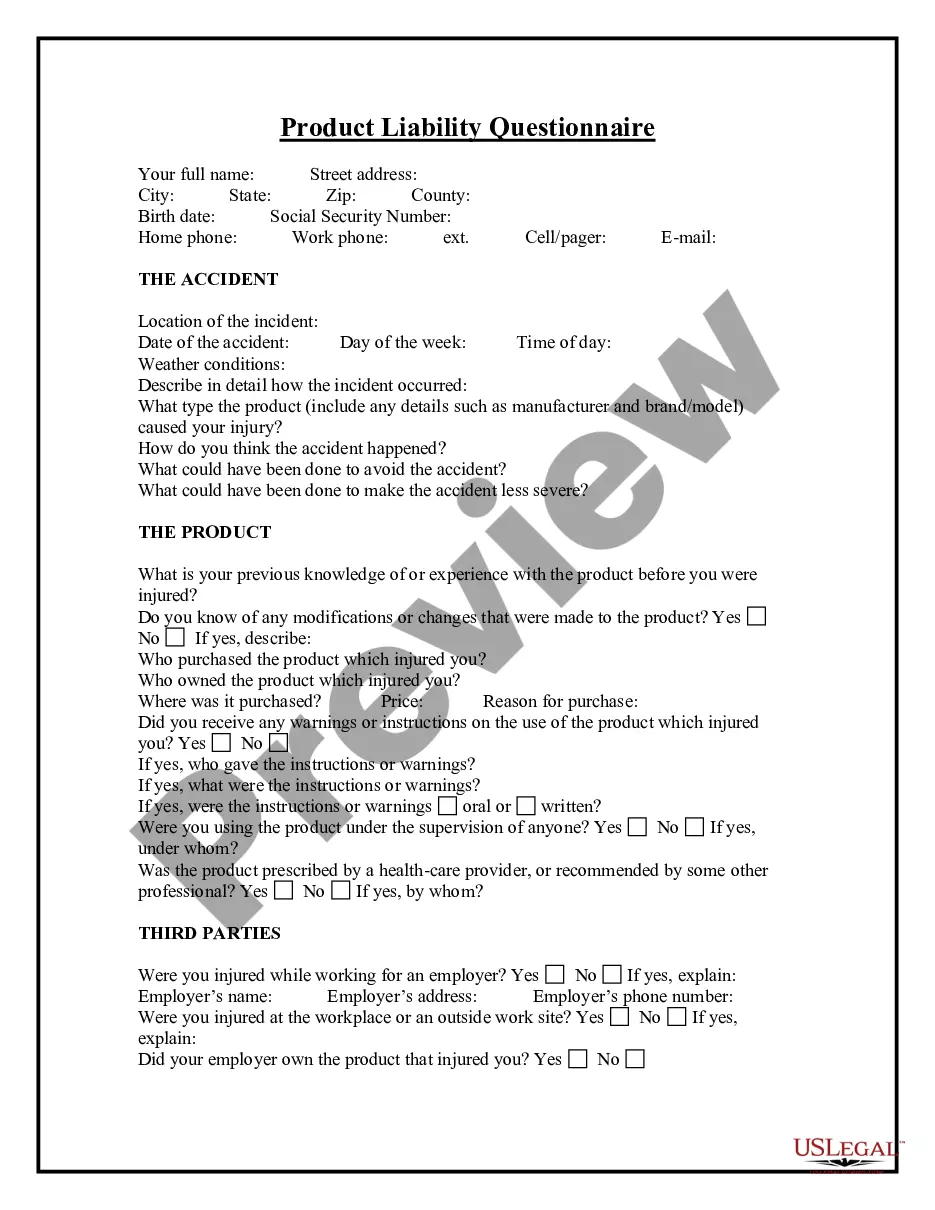

The Wisconsin Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legally binding document used in Wisconsin when a sole proprietor decides to sell their business to another party. This agreement outlines the terms and conditions of the sale, including the assets being transferred and the purchase price. It also serves to protect both the buyer and seller's interests and ensures a smooth transaction. When drafting this agreement, it is crucial to include relevant keywords to indicate the specific type of transaction involved. These keywords may include: 1. Wisconsin: This keyword specifies that the agreement adheres to the legal regulations and requirements of the state of Wisconsin. 2. Agreement for Sale of Business: This phrase highlights that the purpose of the document is to facilitate the sale of a business from one party to another. 3. Sole Proprietorship: In this case, the agreement pertains to the sale of a business operated solely by an individual rather than a partnership or corporation. 4. Asset Purchase: This term clarifies that the sale revolves around the transfer of business assets such as equipment, inventory, intellectual property, customer lists, and goodwill. Different varieties, categories, or variants of the Wisconsin Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase may include: 1. Asset Purchase Agreement with Non-Compete Clause: This type of agreement may include provisions restricting the seller from competing with the business being sold for a specified period of time and within a defined geographic location. 2. Installment Sale Agreement: This variation allows for the purchase price to be paid over time in installments rather than a lump sum. It typically includes clauses regarding interest rates, payment schedule, and potential penalties for late payments. 3. Stock Purchase Agreement: Instead of buying only the assets, this type of agreement involves the purchase of the entire corporation or entity that operates the business, including all liabilities, contracts, and obligations associated with it. 4. Business Transition Agreement: In cases where the seller wishes to remain involved in the business during a transitional period, this agreement outlines the terms for such collaboration, including training, consulting, or advisory services. Each of these Wisconsin Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase variants serves specific purposes, addressing different aspects of the sale and protecting the rights and responsibilities of all parties involved. It is important to consult legal counsel and customize the agreement to fit the unique circumstances of the business and the desires of the buyer and seller.

Wisconsin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Wisconsin Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

US Legal Forms - one of the largest libraries of authorized forms in the States - provides a wide array of authorized file themes you can acquire or printing. Making use of the internet site, you can find a large number of forms for company and person reasons, sorted by categories, states, or key phrases.You can find the newest models of forms like the Wisconsin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase in seconds.

If you currently have a subscription, log in and acquire Wisconsin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase in the US Legal Forms library. The Down load key can look on every single type you view. You gain access to all in the past acquired forms within the My Forms tab of your respective bank account.

If you want to use US Legal Forms initially, here are simple directions to obtain started off:

- Be sure to have selected the best type to your town/region. Click on the Preview key to check the form`s content. Look at the type information to ensure that you have chosen the right type.

- If the type doesn`t match your demands, utilize the Research field towards the top of the display to find the one who does.

- When you are happy with the shape, confirm your option by visiting the Buy now key. Then, select the prices plan you want and give your references to sign up on an bank account.

- Approach the financial transaction. Use your credit card or PayPal bank account to perform the financial transaction.

- Select the file format and acquire the shape on your own product.

- Make modifications. Complete, edit and printing and signal the acquired Wisconsin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

Each and every template you included with your bank account does not have an expiry time and is also your own eternally. So, if you want to acquire or printing yet another backup, just check out the My Forms segment and then click on the type you will need.

Obtain access to the Wisconsin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase with US Legal Forms, by far the most considerable library of authorized file themes. Use a large number of skilled and state-specific themes that meet your small business or person needs and demands.