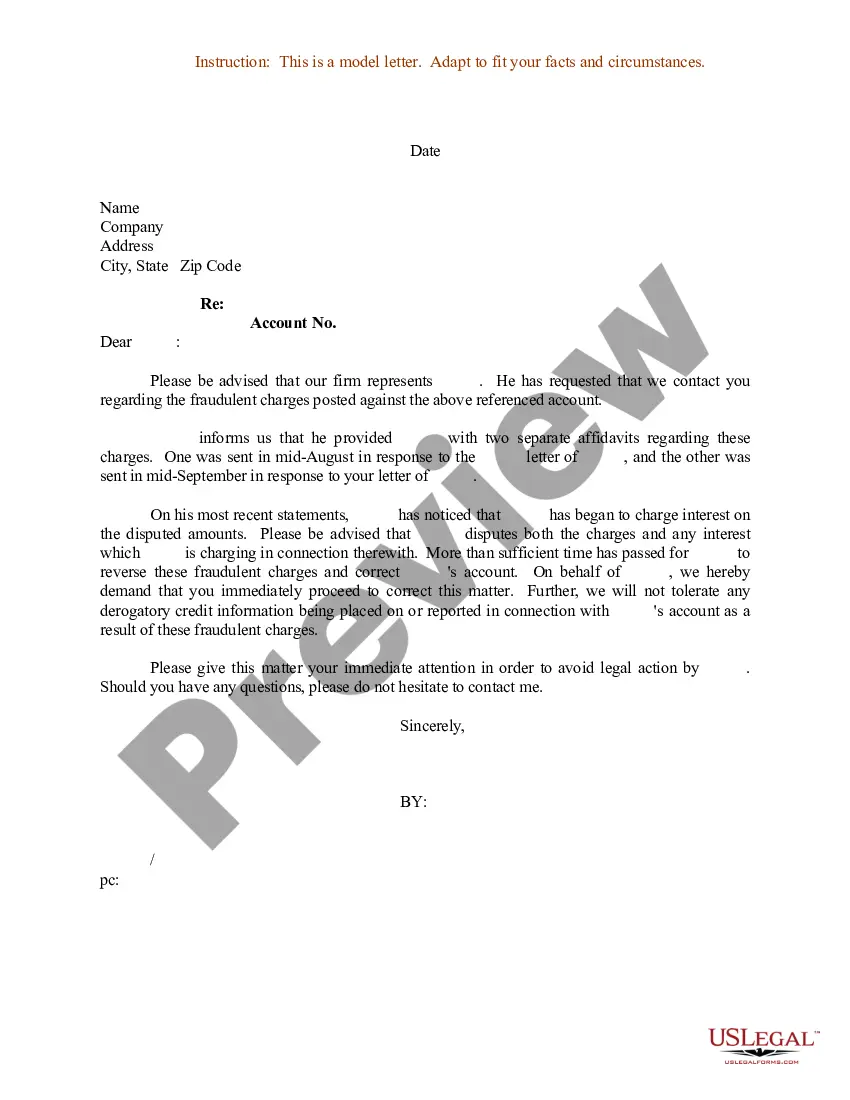

Title: Comprehensive Guide: Wisconsin Sample Letter for Fraudulent Charges against Client's Account Introduction: In Wisconsin, fraudulent charges on a client's account are a serious matter that requires immediate action. To address this issue and protect the rights of your client, it is vital to draft a well-structured and detailed letter to report the fraudulent charges. This article will provide a comprehensive guide on how to write a Wisconsin Sample Letter for Fraudulent Charges against Client's Account, helping you effectively convey the necessary information. Keywords: Wisconsin, sample letter, fraudulent charges, client's account 1. Header and Contact Information: The first step in crafting a Wisconsin Sample Letter for Fraudulent Charges against Client's Account is to include a clear header and concise contact information at the beginning of the letter. This information should typically contain: — Youfunnymanam— - Address - Phone number — Email address 2. Date: Immediately following the contact information, add the date when the letter is being written. 3. Recipient Information: Include the name, address, and contact details of the recipient, which is usually the financial institution or bank involved. 4. Salutation: Begin the body of the letter with a polite salutation, addressing the recipient by name or using a general greeting such as "To Whom It May Concern." 5. Account Details: Offer a comprehensive overview of the client's account that has experienced fraudulent charges. Include crucial information like the account number, account holder's name, and any additional relevant details. 6. Fraudulent Charges Overview: Provide a detailed explanation of the specific fraudulent charges that have been detected on the client's account. Include the exact amounts, dates, and brief descriptions of each suspicious transaction. This section helps ensure that the recipient understands the gravity of the situation. 7. Timeline of Discovery: Briefly outline when and how the client discovered the fraudulent charges, as well as any additional actions taken to address the issue. This timeline will showcase the client's diligence and commitment in resolving the matter promptly. 8. Supporting Documentation: Mention any supporting evidence or documentation being attached to the letter, such as copies of bank statements, receipts, or any other relevant paperwork. This will help strengthen your case against the fraudulent charges. 9. Request for Investigation: Politely request that the recipient investigate the matter thoroughly and launch an immediate investigation into the fraudulent charges. Emphasize the urgency and importance of their quick action. 10. Contact Information and Expectations: Reiterate your contact information and let the recipient know that they can reach you at any time for further information or clarification. State your expectations for a prompt response and resolution to the issue. 11. Closing: End the letter with a courteous closing expression, such as "Sincerely" or "Thank you for your attention." Remember to sign your name below the closing expression. Types of Wisconsin Sample Letters for Fraudulent Charges against Client's Account: 1. Wisconsin Sample Letter for Fraudulent Credit Card Charges 2. Wisconsin Sample Letter for Fraudulent Debit Card Charges 3. Wisconsin Sample Letter for Fraudulent Bank Account Charges Conclusion: By adhering to the guidelines provided in this comprehensive guide, you can effectively draft a Wisconsin Sample Letter for Fraudulent Charges against Client's Account. Ensuring that all necessary information is included and using a professional tone will increase the likelihood of a successful resolution to the fraudulent charges.

Wisconsin Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Wisconsin Sample Letter For Fraudulent Charges Against Client's Account?

If you need to complete, down load, or produce legitimate document layouts, use US Legal Forms, the greatest assortment of legitimate types, that can be found on the web. Utilize the site`s basic and practical search to find the documents you require. Different layouts for organization and individual functions are sorted by groups and states, or keywords. Use US Legal Forms to find the Wisconsin Sample Letter for Fraudulent Charges against Client's Account within a couple of click throughs.

In case you are currently a US Legal Forms consumer, log in to your bank account and then click the Obtain option to have the Wisconsin Sample Letter for Fraudulent Charges against Client's Account. You can also access types you formerly saved from the My Forms tab of your respective bank account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your appropriate city/nation.

- Step 2. Utilize the Preview solution to look over the form`s content material. Do not forget about to see the outline.

- Step 3. In case you are not happy together with the type, make use of the Lookup industry at the top of the monitor to find other types from the legitimate type format.

- Step 4. When you have discovered the form you require, go through the Acquire now option. Choose the costs prepare you like and add your accreditations to register for an bank account.

- Step 5. Method the financial transaction. You may use your bank card or PayPal bank account to complete the financial transaction.

- Step 6. Select the file format from the legitimate type and down load it in your system.

- Step 7. Total, edit and produce or signal the Wisconsin Sample Letter for Fraudulent Charges against Client's Account.

Every single legitimate document format you buy is your own eternally. You have acces to every type you saved in your acccount. Select the My Forms area and pick a type to produce or down load yet again.

Contend and down load, and produce the Wisconsin Sample Letter for Fraudulent Charges against Client's Account with US Legal Forms. There are millions of skilled and express-distinct types you can utilize for the organization or individual demands.

Form popularity

FAQ

6 Steps for Disputing a Chargeback Step 1: Collect customer transaction details. ... Step 2: Check the deadlines for filing a chargeback dispute. ... Step 3: Gather compelling evidence for the disputed transaction. ... Step 4: Submit chargeback dispute documents by the deadline. ... Step 5: Present your chargeback rebuttal.

Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

Contact the Credit Card Company Log into your credit card account or call the number on the back of your credit card to inform the card issuer. Submitting a dispute online can often be done in under a minute. You just need to submit information identifying the charge, such as the date and amount of the transaction.

You have up to 60 days from the date your credit card statement is issued to dispute a charge, ing to the Fair Credit Billing Act. Once you've filed a dispute, the issuer has 90 days to investigate and either resolve the dispute or deliver a written explanation detailing why the dispute was rejected.

What happens if you falsely dispute a credit card charge? Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

Fortunately, most major card networks have a ?zero liability? policy that ensures you will not be held responsible for fraudulent charges. And federal law limits your losses for unauthorized credit card use to $50.

Under the Fair Credit Billing Act of 1974, all payment card issuers must offer a chargeback process to remedy fraud and abuse. If a customer brings a valid dispute claim to their bank, a chargeback will result. Chargebacks are more costly than refunds?they carry additional fees that the merchant must pay.

Generally, you'll have two options when disputing a transaction: refund or chargeback. A refund comes directly from a merchant, while a chargeback comes from your card issuer. The first step in the dispute process should be to go directly to the merchant and request a refund.