Wisconsin Affidavit of Domicile for Deceased

Description

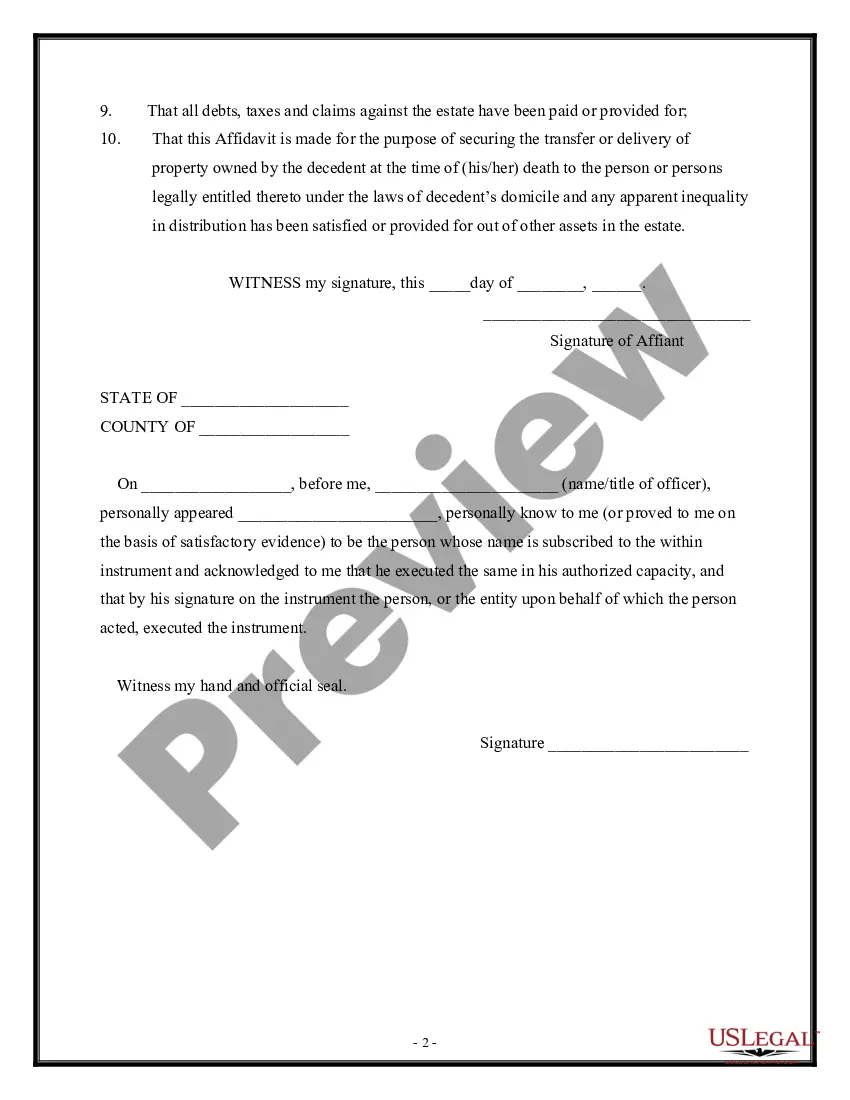

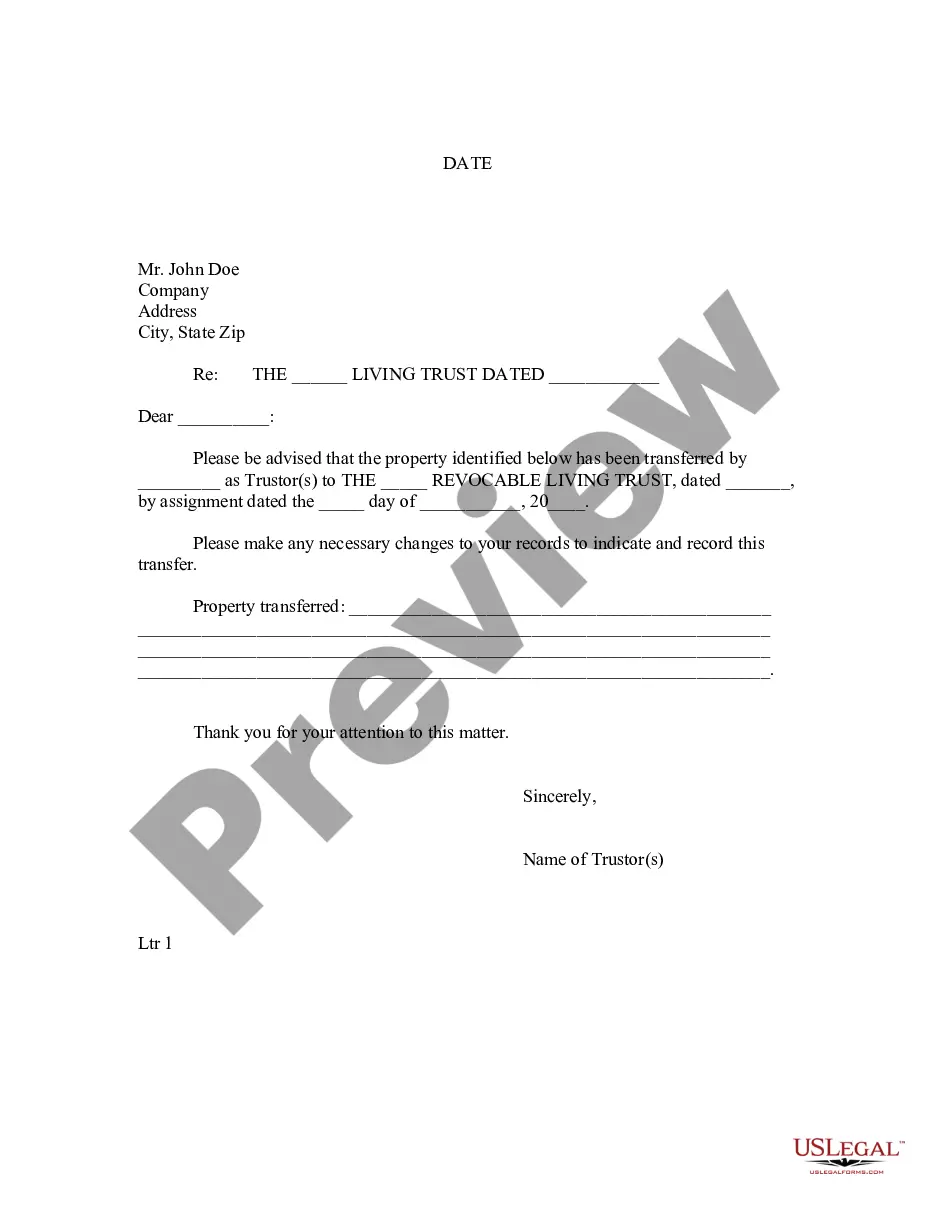

How to fill out Affidavit Of Domicile For Deceased?

US Legal Forms - among the largest libraries of legitimate forms in the States - provides a wide array of legitimate document themes you are able to down load or print. Making use of the internet site, you may get thousands of forms for enterprise and specific purposes, categorized by classes, states, or search phrases.You will find the newest variations of forms much like the Wisconsin Affidavit of Domicile for Deceased within minutes.

If you have a subscription, log in and down load Wisconsin Affidavit of Domicile for Deceased from your US Legal Forms catalogue. The Down load option can look on every single develop you look at. You have access to all in the past delivered electronically forms from the My Forms tab of your bank account.

If you want to use US Legal Forms initially, listed below are basic guidelines to obtain started out:

- Be sure you have picked the proper develop for your personal metropolis/state. Go through the Review option to check the form`s content material. Read the develop description to ensure that you have chosen the correct develop.

- When the develop doesn`t satisfy your requirements, utilize the Look for discipline towards the top of the display to obtain the one who does.

- If you are satisfied with the shape, affirm your choice by clicking on the Buy now option. Then, pick the rates prepare you prefer and offer your credentials to sign up for an bank account.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Choose the structure and down load the shape on your product.

- Make adjustments. Fill out, change and print and indication the delivered electronically Wisconsin Affidavit of Domicile for Deceased.

Every web template you put into your account does not have an expiry particular date and is also yours permanently. So, if you would like down load or print another backup, just visit the My Forms segment and click on on the develop you need.

Obtain access to the Wisconsin Affidavit of Domicile for Deceased with US Legal Forms, one of the most extensive catalogue of legitimate document themes. Use thousands of professional and condition-certain themes that satisfy your company or specific needs and requirements.

Form popularity

FAQ

Wisconsin's Small Estate Affidavit statute allows estates under $50,000 to avoid probate and instead be transferred via affidavit. See Wis Stat. §867.03. It can be used by an heir, a trustee of a revocable trust, a person named in the decedent's will, or a guardian after the passing of the decedent.

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

Wisconsin's Small Estate Affidavit statute allows estates under $50,000 to avoid probate and instead be transferred via affidavit. See Wis Stat. §867.03. It can be used by an heir, a trustee of a revocable trust, a person named in the decedent's will, or a guardian after the passing of the decedent.

Transfer by Affidavit ($50,000 and under) Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate. The original form Wisconsin Court System website must be sent via certified mail to the Wisconsin Department of Health and Family Services.

Pursuant to Wisconsin State Statute Section 867.03, Transfer by Affidavit is used for solely owned property within this state valued under $50,000. Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin.

Pursuant to Section 867.03 of the Wisconsin Statutes, when a decedent leaves property subject to administration in Wisconsin, which does not exceed $50,000 in value, an heir, trustee of trust created by decedent, or person who was guardian of the decedent at the time of decedent's death may have that property ...