Wisconsin Affidavit of Domicile

Description

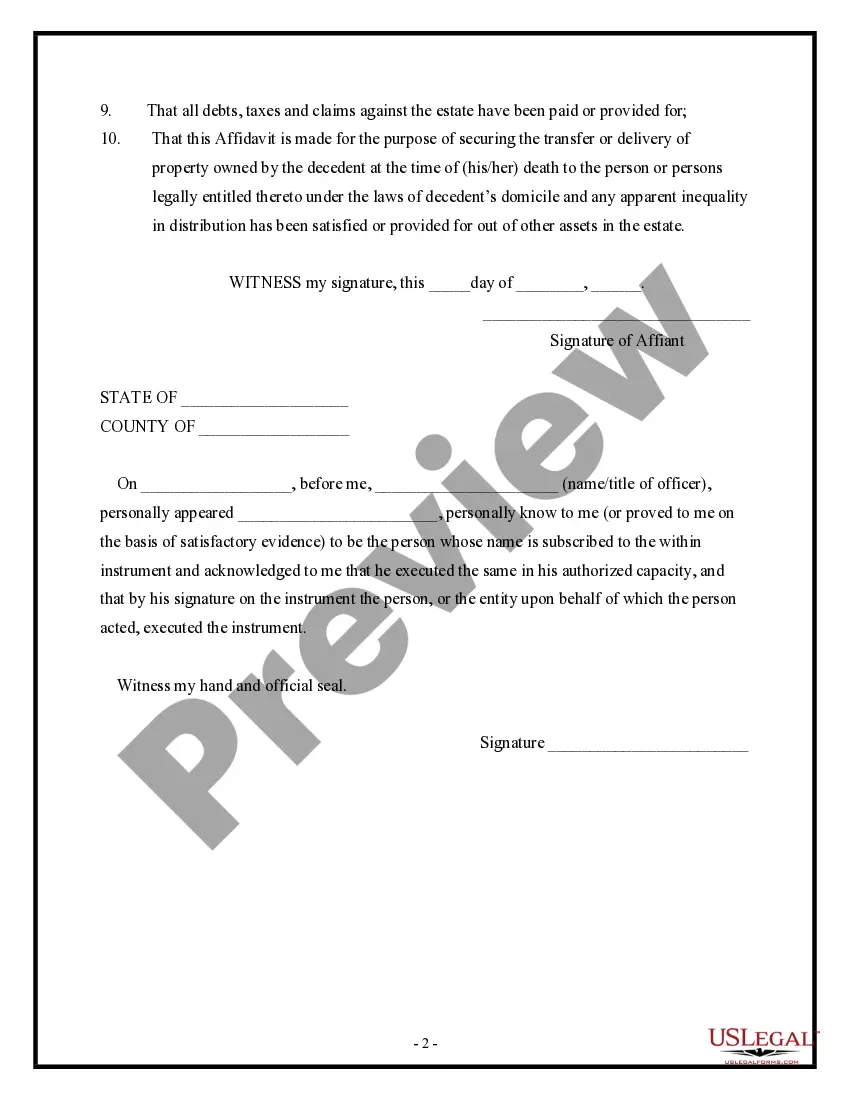

How to fill out Affidavit Of Domicile?

If you want to complete, down load, or produce legitimate document web templates, use US Legal Forms, the most important variety of legitimate kinds, that can be found on the Internet. Take advantage of the site`s simple and hassle-free lookup to find the documents you will need. A variety of web templates for organization and individual functions are categorized by types and states, or keywords. Use US Legal Forms to find the Wisconsin Affidavit of Domicile with a number of mouse clicks.

Should you be already a US Legal Forms client, log in to the bank account and then click the Obtain switch to have the Wisconsin Affidavit of Domicile. You can even entry kinds you previously saved from the My Forms tab of your own bank account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have selected the form to the right town/nation.

- Step 2. Make use of the Review choice to examine the form`s content. Don`t forget to see the information.

- Step 3. Should you be not satisfied using the type, make use of the Look for industry on top of the screen to get other models of your legitimate type template.

- Step 4. Upon having identified the form you will need, go through the Buy now switch. Pick the prices strategy you favor and include your credentials to register for the bank account.

- Step 5. Process the deal. You should use your credit card or PayPal bank account to finish the deal.

- Step 6. Select the structure of your legitimate type and down load it on your own system.

- Step 7. Comprehensive, modify and produce or indication the Wisconsin Affidavit of Domicile.

Each and every legitimate document template you purchase is yours eternally. You may have acces to every type you saved with your acccount. Click the My Forms portion and pick a type to produce or down load yet again.

Remain competitive and down load, and produce the Wisconsin Affidavit of Domicile with US Legal Forms. There are thousands of expert and express-particular kinds you can utilize to your organization or individual requirements.

Form popularity

FAQ

To be eligible for in-state tuition, a student must be a bona fide resident of Wisconsin for at least the 12 months immediately prior to enrollment, or must qualify as a resident for tuition purposes under one of the provisions in the Statutes that waives the 12-month requirement.

Domicile refers to someone's true, principal, and permanent home. In other words, the place where a person has physically lived, regards as home, and intends to return even if currently residing elsewhere. Determining where a party is domiciled is of particular importance in the field of civil procedure.

What Is the Difference Between a Residence and a Domicile? A residence is a location where you may live part-time or full-time. A domicile is your legal address, and your domicile is located in the state where you pay taxes.

Domicile is a fancy word for the place where you live. Whether it's a mansion on 5th Avenue or a tee-pee in the desert, if you live in it, it's your domicile.

Section 29.001(69) of the Wisconsin Statutes defines residency: "Resident" means a person who has maintained his or her place of permanent abode in this state for a period of 30 days immediately preceding his or her application for an approval.

What's the Difference between Residency and Domicile? Residency is where one chooses to live. Domicile is more permanent and is essentially somebody's home base. Once you move into a home and take steps to establish your domicile in one state, that state becomes your tax home.

Your physical presence in a state plays an important role in determining your residency status. Usually, spending over half a year, or more than 183 days, in a particular state will render you a statutory resident and could make you liable for taxes in that state.

A resident is any individual who meets any of the following: ? Present in California for other than a temporary or transitory purpose. Domiciled in California, but outside California for a temporary or transitory purpose. See Section L, Meaning of Domicile. A nonresident is any individual who is not a resident.