Wisconsin Bylaws of a Nonprofit Organization — Multistate: The bylaws of a nonprofit organization in Wisconsin serve as a guiding document that outlines the internal structure, governance, and operations of the organization. It lays out the rules and procedures that the organization must follow to ensure compliance with state and federal laws, as well as to sustain its nonprofit status. The Wisconsin Bylaws also address the unique considerations of multistate nonprofits, which operate in multiple states. Some key components that are typically included in the Wisconsin Bylaws of a Multistate Nonprofit Organization are: 1. Name and Purpose: The bylaws specify the legal name of the organization and define its mission, goals, and activities. 2. Membership: If the nonprofit organization has a membership structure, the bylaws define the qualifications, rights, and responsibilities of its members. 3. Board of Directors: The composition, roles, powers, and responsibilities of the board of directors is outlined in the bylaws. It may include provisions for term limits, nomination and election process, officer roles, and meetings. 4. Committees: The bylaws may establish various committees that assist in the organization's functions, such as finance, fundraising, governance, or program-specific committees. They specify their composition, authority, and responsibilities. 5. Meetings: The bylaws outline the procedures for regular and special meetings, quorum requirements, notice periods, and the conduct of meetings. This includes rules for virtual or remote meetings, especially for coordinating with members or directors located in different states. 6. Amendments: The process for amending the bylaws is detailed, ensuring that any changes are properly documented and executed according to the legal requirements of Wisconsin. 7. Dissolution: In cases where a nonprofit organization decides to dissolve, the bylaws should address the proper procedures for liquidating assets and distributing remaining funds in compliance with state law. Different Types of Wisconsin Bylaws of a Nonprofit Organization — Multistate: While the content of bylaws generally follows a similar structure for all nonprofit organizations, there may be variations based on the specific needs and circumstances of each organization. Some potential types or variations of Wisconsin Bylaws for Multistate Nonprofit Organizations may include: 1. General Multistate Bylaws: These are standard bylaws applicable to any nonprofit organization operating in multiple states, addressing the common aspects of governance, internal structure, and procedures. 2. Regional Bylaws: For large nonprofits that have a regional or state chapter structure, separate bylaws may be created for each region or state. The regional bylaws provide guidance that is unique to the responsibilities and requirements of each regional chapter. 3. Collaboration Bylaws: In cases where multiple nonprofits collaborate on joint programs, initiatives, or shared resources across states, specific bylaws may be established to govern their collaborative efforts. These bylaws address issues related to decision-making processes, resource sharing, and financial management, among others. Remember that the specific content and types of Bylaws for Multistate Nonprofit Organizations may vary depending on the organization's size, purpose, and unique circumstances. It is important to consult legal professionals or advisors to ensure compliance with Wisconsin state laws and regulations.

Wisconsin Bylaws of a Nonprofit Organization - Multistate

Description

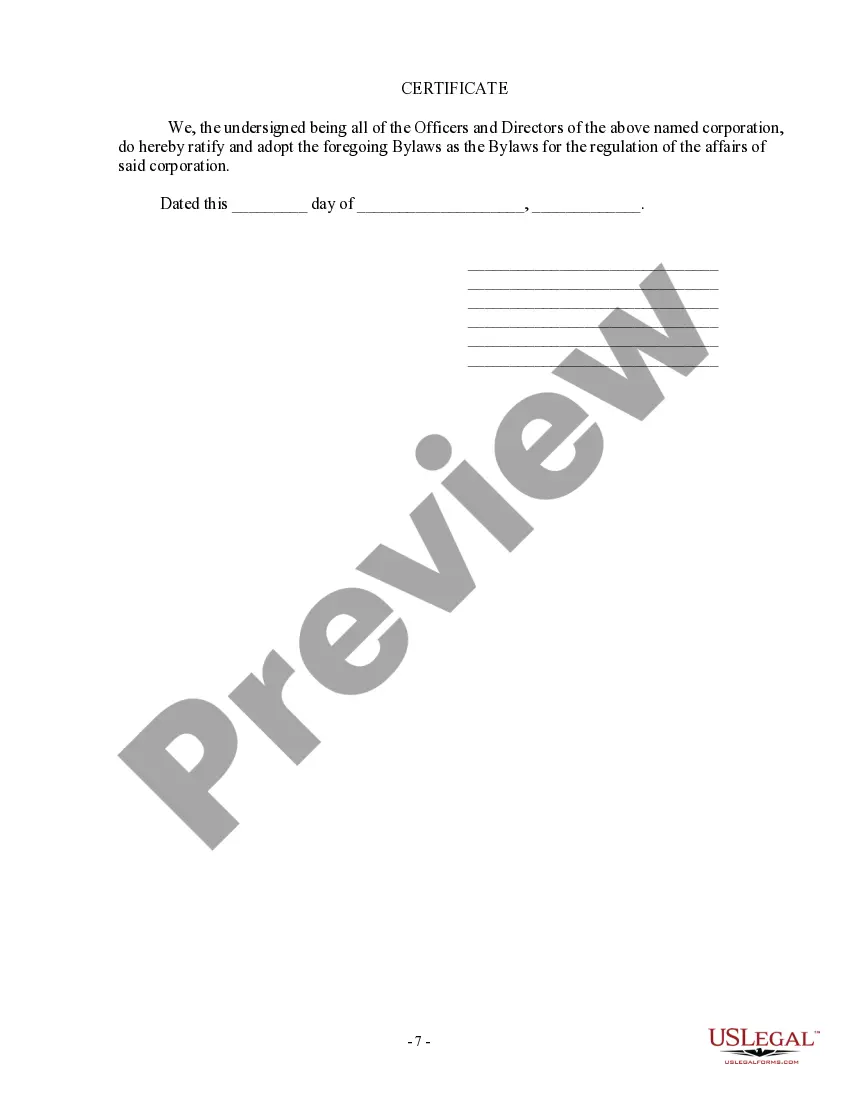

How to fill out Wisconsin Bylaws Of A Nonprofit Organization - Multistate?

US Legal Forms - among the greatest libraries of authorized forms in the United States - gives an array of authorized file layouts it is possible to obtain or print out. Making use of the site, you can get 1000s of forms for enterprise and personal uses, categorized by types, claims, or search phrases.You can find the most recent models of forms such as the Wisconsin Bylaws of a Nonprofit Organization - Multistate within minutes.

If you currently have a subscription, log in and obtain Wisconsin Bylaws of a Nonprofit Organization - Multistate from the US Legal Forms library. The Acquire key will show up on every kind you view. You gain access to all previously acquired forms in the My Forms tab of the bank account.

In order to use US Legal Forms initially, here are easy recommendations to get you started:

- Ensure you have picked out the right kind to your metropolis/county. Click the Review key to analyze the form`s content. Look at the kind outline to ensure that you have selected the proper kind.

- In the event the kind does not suit your demands, take advantage of the Search field on top of the monitor to find the one who does.

- Should you be pleased with the shape, affirm your selection by visiting the Buy now key. Then, select the rates strategy you like and offer your qualifications to register for an bank account.

- Procedure the financial transaction. Utilize your charge card or PayPal bank account to perform the financial transaction.

- Choose the file format and obtain the shape on your own gadget.

- Make modifications. Fill up, change and print out and signal the acquired Wisconsin Bylaws of a Nonprofit Organization - Multistate.

Every format you put into your money does not have an expiry day and is also the one you have for a long time. So, if you want to obtain or print out another backup, just proceed to the My Forms section and click on in the kind you want.

Get access to the Wisconsin Bylaws of a Nonprofit Organization - Multistate with US Legal Forms, probably the most comprehensive library of authorized file layouts. Use 1000s of specialist and condition-certain layouts that meet your company or personal requirements and demands.

Form popularity

FAQ

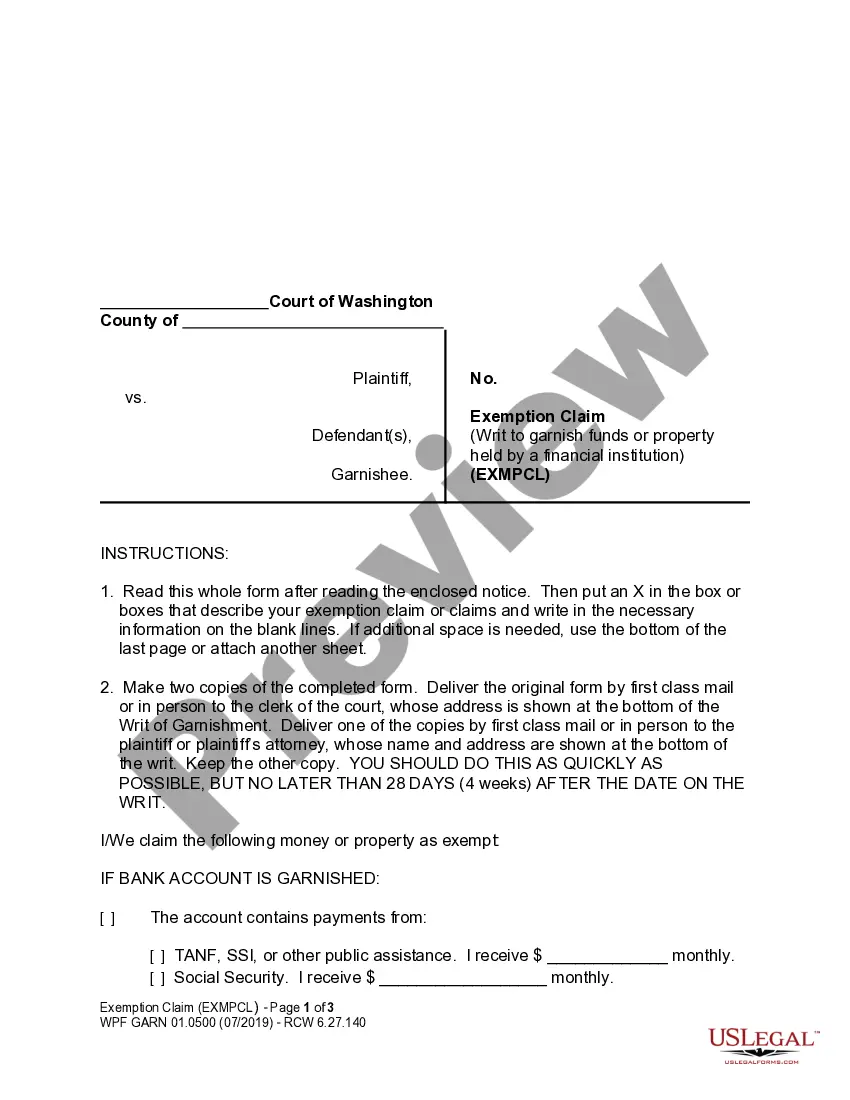

Federated Nonprofit Organizations can be structured as a Single Corporation operating in multiple locations; as Separate Subsidiary Corporations; or as separate corporations with affiliation agreements.

Yes, a nonprofit organization may create a subsidiary with either a for-profit or a nonprofit structure. In some situations creating a subsidiary may make sense.

An advisory board may contribute to the organization in many different waysand the same nonprofit may have multiple advisory boards. One advisory board, for example, could be established to involve prospective donors, offering them a forum to give advice as well as donate and fundraise.

Yes. But it is not a good idea and I certainly would not recommend doing it intentionally. Corporate names are a matter of state law, and because the states don't talk to each other about such matters, a for-profit incorporated in one state could have the same name as a nonprofit incorporated in another.

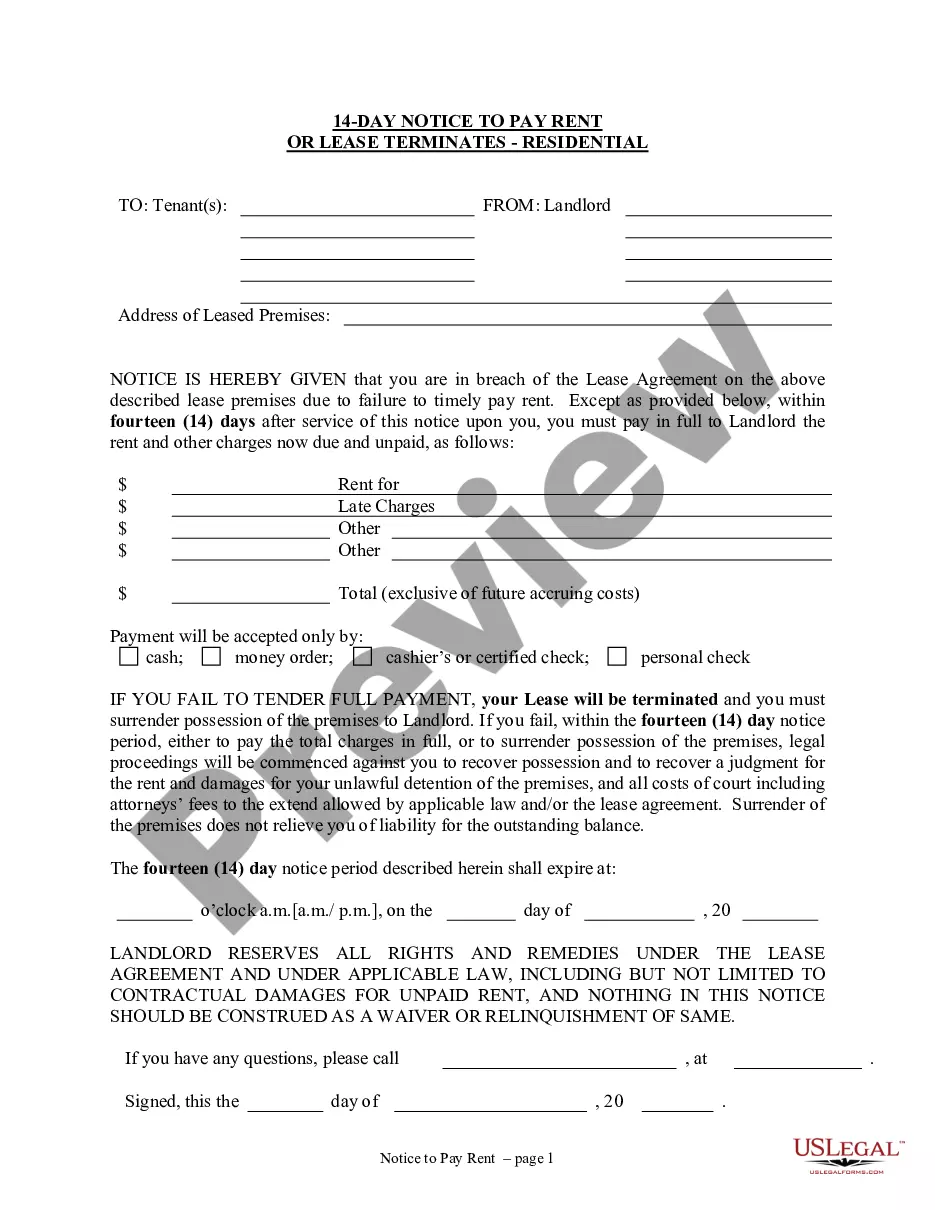

An organization can conduct or participate in events and fundraising activities in another state without being considered operating within that state. For these types of activities, the organization will likely need to file for charitable solicitations.

5 Best States to Start a Nonprofit#1: Delaware. The state of Delaware is home to more than 5,500 nonprofit organizations, including more than 3,000 501(c)(3) public charities.#2: Arizona.#3: Nevada.#4: Wisconsin.#5: Texas.#1: New York.#2: California.

In order to qualify as a tax-exempt, 501(c)(3) organization, a nonprofit must exist for one or more exclusively charitable purposes.

In order to qualify as a tax-exempt, 501(c)(3) organization, a nonprofit must exist for one or more exclusively charitable purposes.