A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

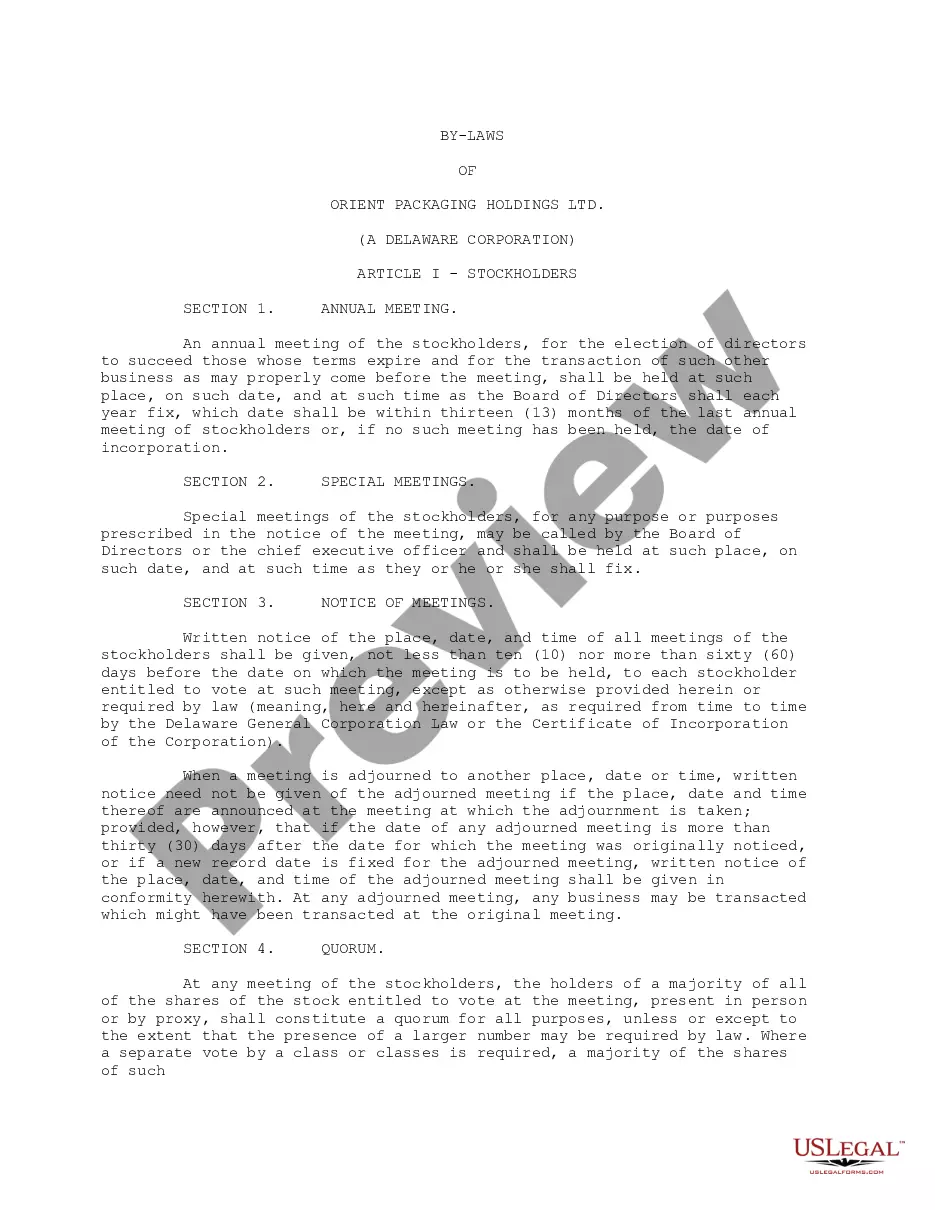

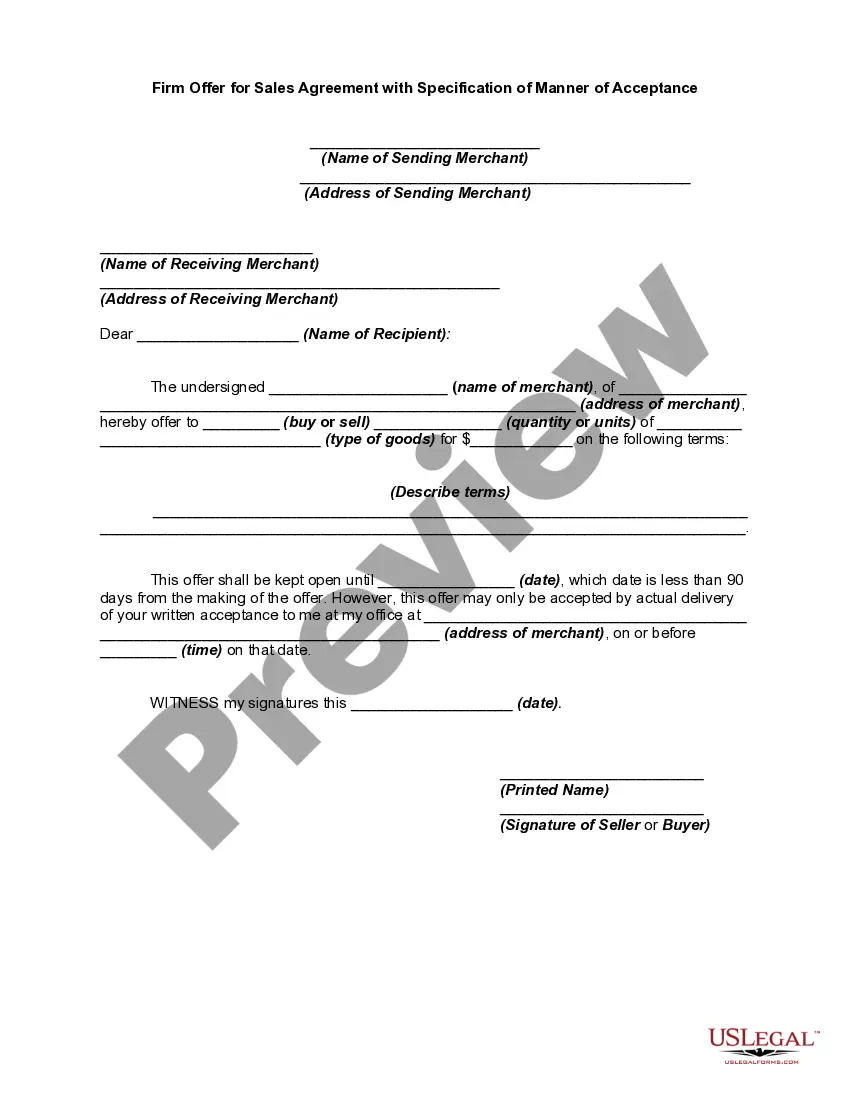

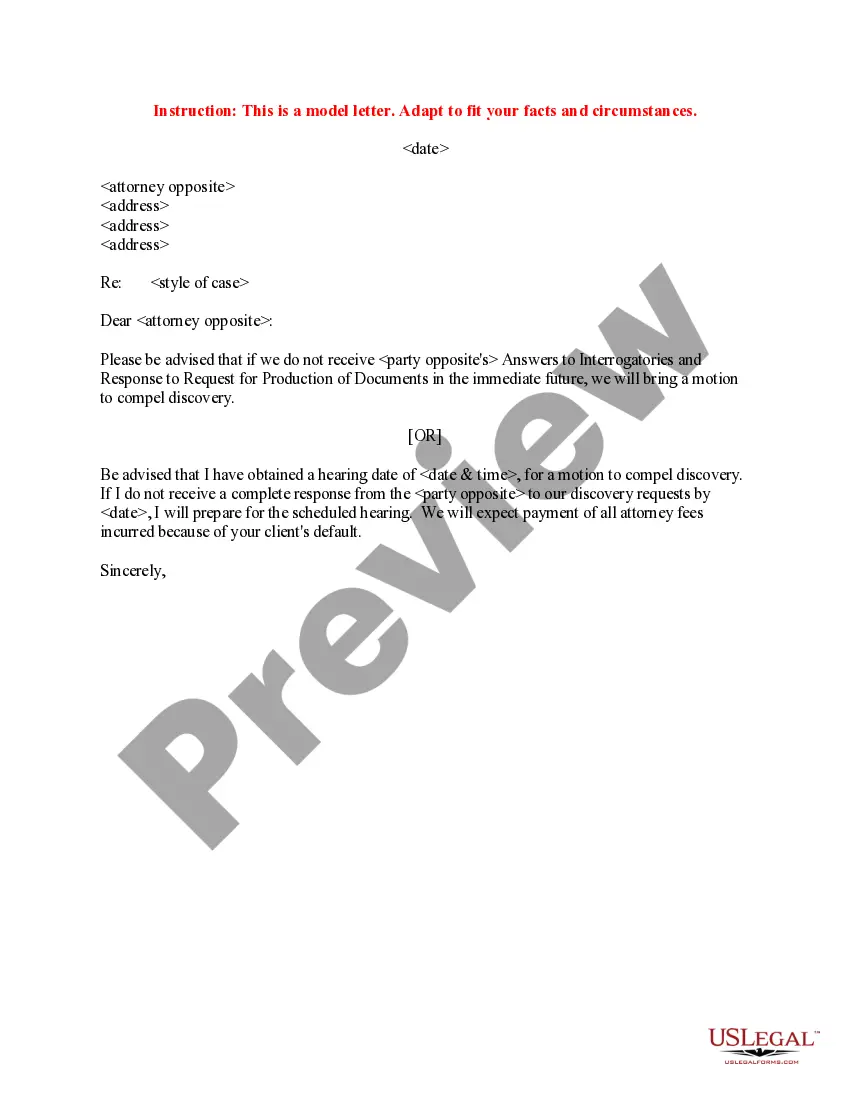

A Wisconsin Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the transfer of shares between shareholders. It helps address potential conflicts and ensures a smooth transition of ownership in the event of certain triggering events. Here are the key aspects and types of Wisconsin Buy-Sell Agreements that can exist: 1. Wisconsin Buy-Sell Agreement Overview: A Wisconsin Buy-Sell Agreement is a crucial document for closely held corporations, which are typically small businesses owned by a limited number of shareholders. It provides a framework for the purchase or sale of shares in specific circumstances, ensuring an agreed-upon mechanism for valuation, pricing, and transfer of ownership interests. 2. Triggering Events: Various triggering events can prompt the activation of a buy-sell agreement, such as death, disability, retirement, resignation, bankruptcy, divorce, or voluntary sale. These events may significantly impact the corporation and its shareholders, making it essential to have clear guidelines in place. 3. Types of Wisconsin Buy-Sell Agreements: a. Cross-Purchase Agreement: This type of agreement involves the remaining shareholder(s) buying the departing shareholder's interest. Each shareholder typically purchases an equal proportion of the departing shareholder's shares, maintaining their proportional ownership in the corporation. b. Stock Redemption Agreement: In this agreement, the corporation itself buys back the shares of the departing or deceased shareholder. The corporation utilizes its funds or insurance policies to acquire the shares and cancel them, thereby redistributing the ownership among the remaining shareholders. c. Hybrid Agreement: A hybrid agreement combines elements of both the cross-purchase and stock redemption agreements. It allows certain shareholders to redeem their shares while others purchase the shares directly. This type of agreement suits cases where the circumstance of a triggering event may vary among shareholders. 4. Valuation Methods: The Buy-Sell Agreement should stipulate the valuation process to determine the fair price of shares during a triggering event. The most common methods used include book value, fair market value, earnings multiples, formula-based approaches, or the use of an independent appraiser. 5. Funding Mechanisms: The agreement must address how the purchasing shareholder(s) will finance the acquisition of shares. Funding sources can include personal savings, third-party loans, corporate funds, or even insurance policies specifically designed for buy-sell agreements, such as key person or life insurance policies. 6. Terms and Restrictions: The agreement may include specific terms and restrictions on the transfer of shares, ensuring that shareholders have a first right of refusal before any sale to external parties. These provisions help maintain the ownership structure and control within the closely held corporation. In conclusion, a Wisconsin Buy-Sell Agreement is a vital document for closely held corporations to establish a structured and organized approach to share transfers. By addressing various triggering events, defining the types of agreements, establishing valuation methods, and outlining funding mechanisms, this agreement helps mitigate potential conflicts and facilitates a seamless shift in ownership.