In this agreement, a senior attorney desires to be relieved of the active management and business of the law practice, and to eventually retire. His younger partner will undertake the active management and business of the law practice, with the view of eventually taking it over.

Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner

Description

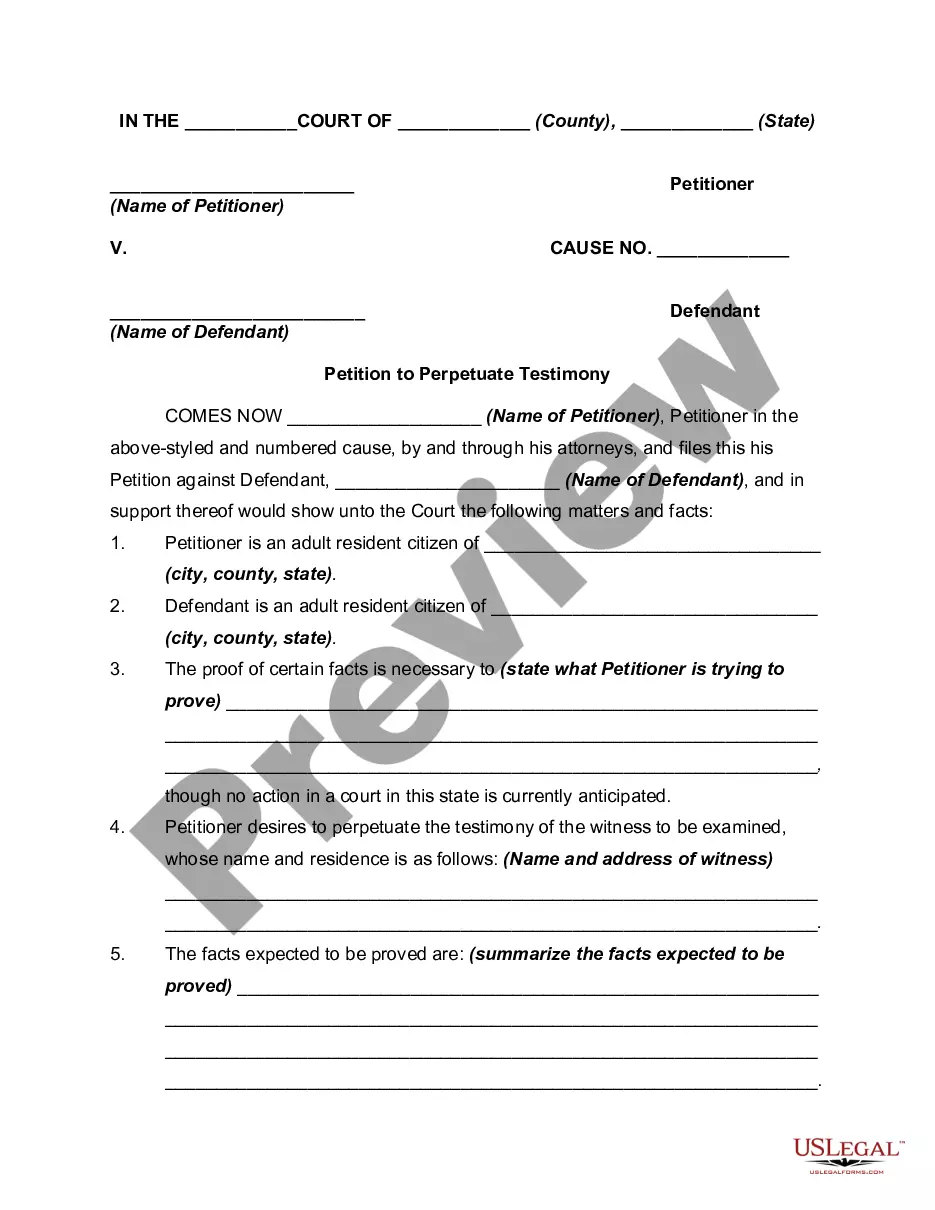

How to fill out Law Partnership Agreement Between Two Partners With Provisions For Eventual Retirement Of Senior Partner?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal form templates that you can obtain or create.

By using the site, you will find thousands of forms for commercial and personal purposes, organized by categories, claims, or keywords. You can discover the latest versions of forms like the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner within moments.

If you have an account, Log In and obtain the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner through the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Edit. Fill out, modify, print, and sign the downloaded Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner.

Every form you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or create an additional copy, just visit the My documents section and click on the form you need. Access the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you select the correct form for your area/region. Click the Preview button to review the content of the form. Check the form outline to confirm you have the right one.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the file format and download the form to your device.

Form popularity

FAQ

A partner typically retires from a partnership firm according to the terms set in the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. This agreement specifies the timing and conditions for retirement, as well as the financial arrangements for the retiring partner. Adhering to these provisions enables both parties to navigate retirement smoothly and ensure the firm's stability.

If one partner dies, the partnership can face significant changes unless the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner includes specific clauses addressing this situation. In most cases, the partnership may need to negotiate how to handle the deceased partner's share, which could involve buying out the estate. This planning helps ensure that the remaining partners can maintain operations with minimal disruption.

Yes, a partnership can continue if one partner leaves, provided there are provisions in the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. Typically, the agreement outlines the steps to take when a partner departs, including buying out that partner’s stake and continuing the business. Open communication among the remaining partners is essential to ensure a smooth transition.

When a partner retires under the Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner, the partnership may buy out the retiring partner's interest. This process usually involves evaluating the partner's contributions and the overall value of the partnership. Additionally, the remaining partners must consider how the retirement impacts the partnership's operations and finances.

A partnership of two parties is generally referred to as a general partnership. In the framework of a Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner, this structure allows for a straightforward approach to collaboration and joint ventures. Understanding the legalities involved once again emphasizes the importance of having a clear agreement to guide the partnership.

The retirement of a partner can significantly impact the partnership, potentially leading to changes in profit distribution, decision-making, and overall structure. A Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner should address these transitions to minimize disruption. Proper planning and communication can help ensure the remaining partners adjust smoothly to the departure.

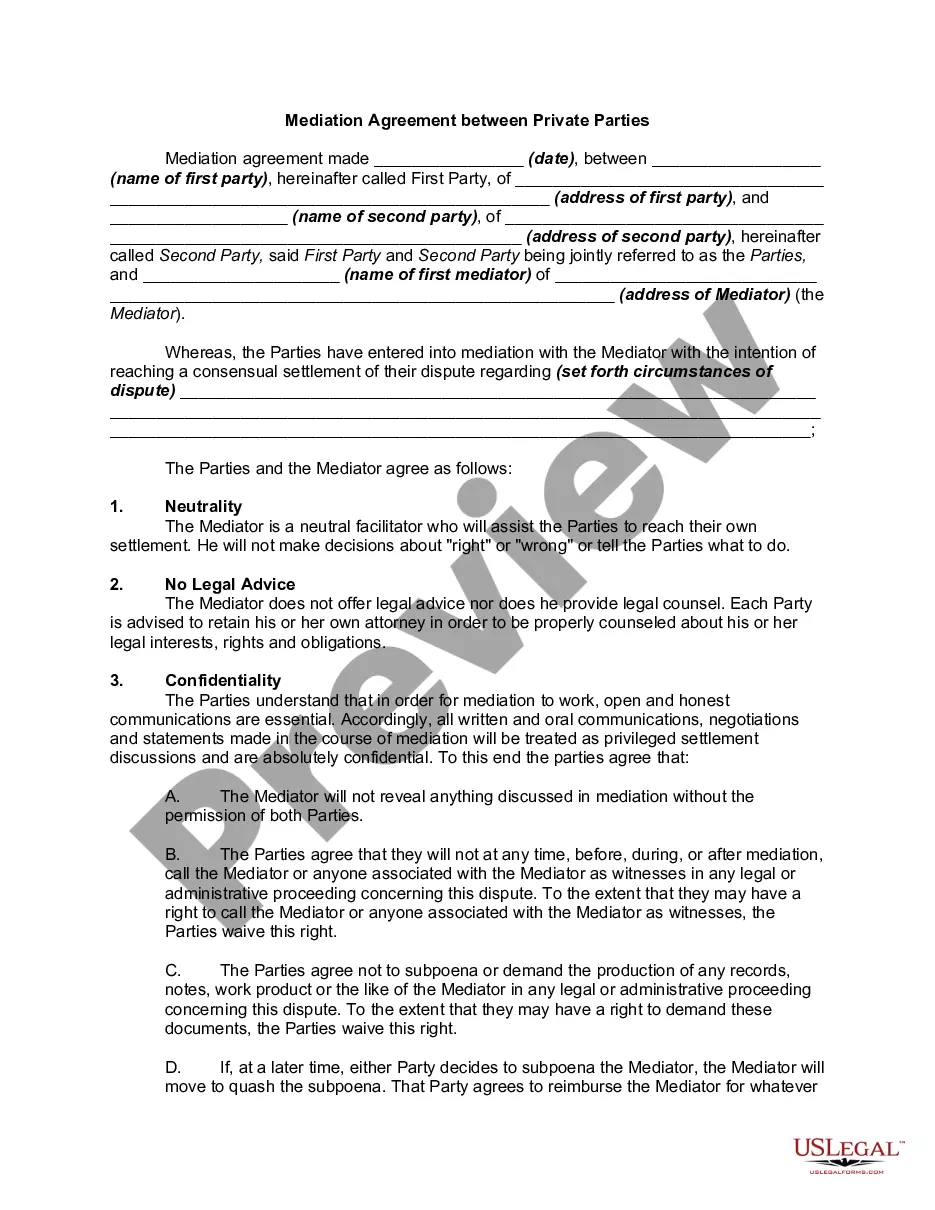

The agreement between two parties for partnership is called a partnership agreement. A Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner is a specific form of this agreement, designed to clarify the partners' roles and contributions. This helps partners navigate responsibilities and plan for future scenarios, such as retirements or exits.

Filling out a partnership agreement involves detailing essential elements such as the partners' names, contributions, and specific duties. In addition, you can integrate provisions for the eventual retirement of a senior partner to make transitions smoother. Utilizing a reliable platform like uslegalforms can simplify this process, offering templates that ensure compliance with Wisconsin laws and address key considerations for both partners.

The agreement between two partners is commonly known as a partnership agreement. A well-crafted Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner outlines the specific terms and conditions under which the partnership operates. This agreement should cover aspects such as profit sharing, decision-making processes, and provisions for a partner's eventual retirement.

An agreement between two parties is typically referred to as a contract. In the context of business, a Wisconsin Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner serves as this contract, detailing the roles, contributions, and expectations of each partner. Such clarity helps prevent misunderstandings and fosters a collaborative working environment.