If you have to full, obtain, or print out legitimate document templates, use US Legal Forms, the largest variety of legitimate varieties, that can be found on the web. Use the site`s simple and easy handy look for to find the paperwork you require. Numerous templates for business and individual functions are categorized by types and claims, or keywords. Use US Legal Forms to find the Wisconsin Affidavit in Support of Slow Pay Motion in just a couple of clicks.

If you are currently a US Legal Forms buyer, log in for your accounts and then click the Down load key to obtain the Wisconsin Affidavit in Support of Slow Pay Motion. You can also gain access to varieties you previously saved in the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form to the appropriate city/land.

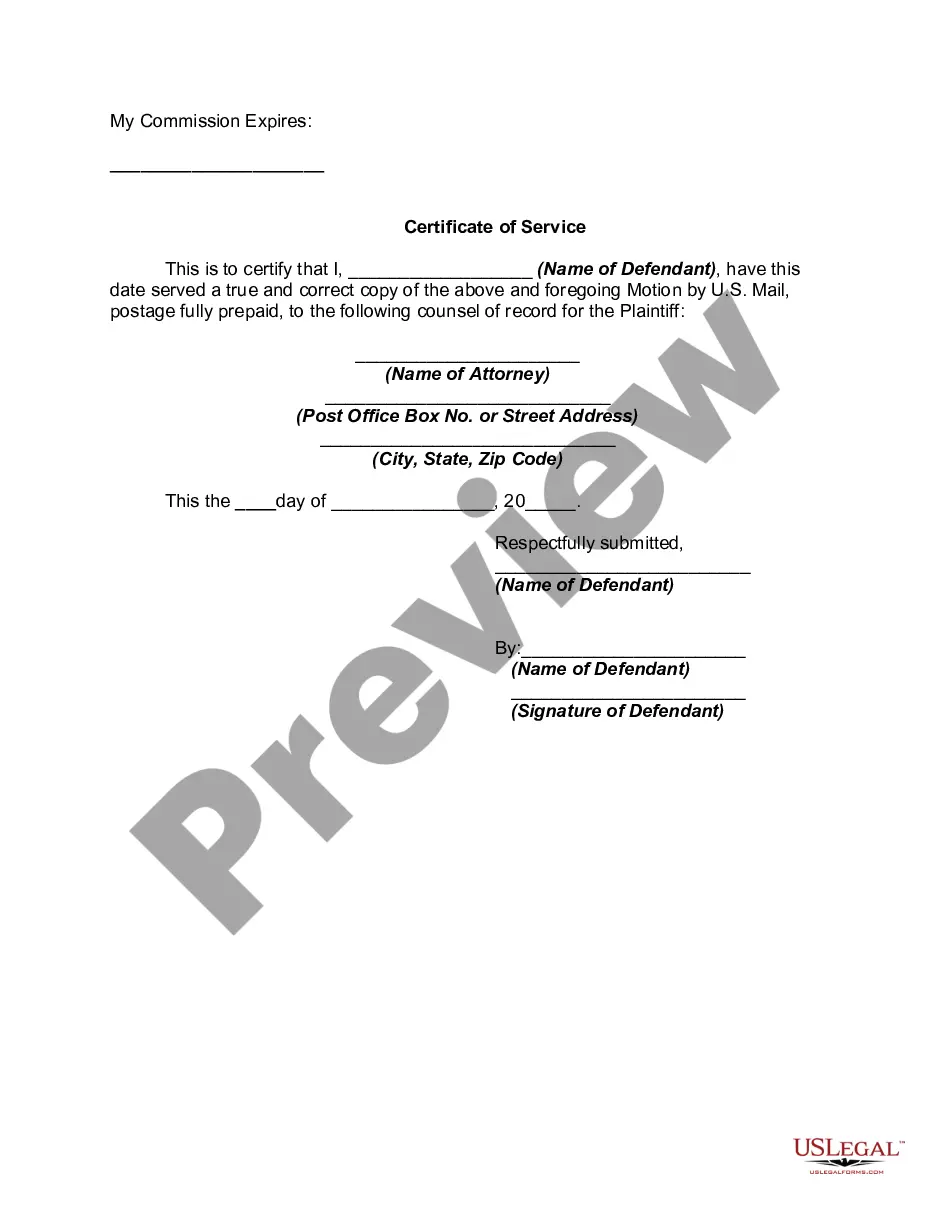

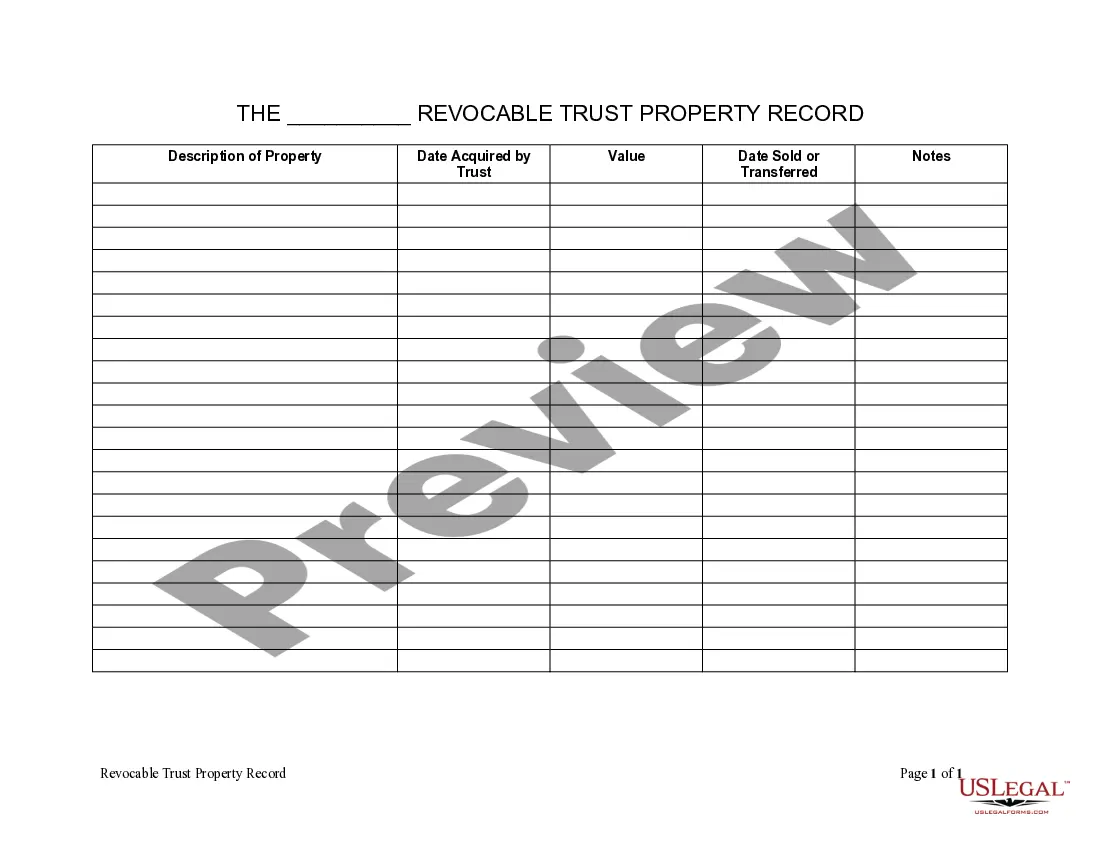

- Step 2. Make use of the Review choice to examine the form`s content material. Do not overlook to learn the outline.

- Step 3. If you are not happy with all the develop, use the Search discipline near the top of the screen to locate other versions of the legitimate develop web template.

- Step 4. After you have discovered the form you require, click on the Get now key. Pick the pricing plan you prefer and include your references to sign up on an accounts.

- Step 5. Procedure the deal. You can use your charge card or PayPal accounts to perform the deal.

- Step 6. Select the file format of the legitimate develop and obtain it in your device.

- Step 7. Comprehensive, revise and print out or signal the Wisconsin Affidavit in Support of Slow Pay Motion.

Each legitimate document web template you purchase is your own forever. You might have acces to every single develop you saved in your acccount. Click on the My Forms segment and decide on a develop to print out or obtain yet again.

Remain competitive and obtain, and print out the Wisconsin Affidavit in Support of Slow Pay Motion with US Legal Forms. There are many expert and state-certain varieties you can utilize for your business or individual demands.