A Wisconsin General Letter of Credit with Account of Shipment is a financial instrument used in international trade to provide assurance to the exporter that they will receive payment for their goods or services. It is an agreement issued by a bank on behalf of a buyer (importer) to the seller (exporter) which guarantees payment once the required documents are presented. This type of letter of credit is commonly used in Wisconsin for various trade transactions. It serves as a secure method of payment, mitigating the risk of non-payment and ensuring that both parties can engage in business with confidence. The letter of credit acts as a guarantee, assuring the exporter that they will receive payment upon fulfilling the terms and conditions outlined in the agreement. There are different types of Wisconsin General Letter of Credit with Account of Shipment, depending on the specific requirements of the trade transaction. These include: 1. Revocable Letter of Credit: This type of letter of credit can be altered or canceled by the buyer without the consent of the seller before payment is made. 2. Irrevocable Letter of Credit: In contrast to the revocable letter of credit, this type cannot be amended or canceled by the buyer once it is issued, providing more security to the seller. 3. Confirmed Letter of Credit: This type involves an additional bank, typically a bank in the exporter's country, adding its confirmation to the letter of credit, ensuring payment if the issuing bank fails to fulfill its obligations. 4. Unconfirmed Letter of Credit: This is a letter of credit without the additional confirmation of a second bank. The payment relies solely on the issuing bank's creditworthiness. 5. Transferable Letter of Credit: This type allows the exporter to transfer the credit to another party, usually when a portion of the goods or services is outsourced to another supplier. 6. Standby Letter of Credit: Although not specific to account of shipment transactions, a standby letter of credit functions as a backup payment method if the buyer fails to fulfill their obligations. It is typically used in situations where advance payment or performance guarantees are required. The Wisconsin General Letter of Credit with Account of Shipment is an essential tool in facilitating secure international trade transactions. By understanding the different types and their implications, importers and exporters can make informed decisions to ensure a smooth and reliable trade experience.

Wisconsin General Letter of Credit with Account of Shipment

Description

How to fill out Wisconsin General Letter Of Credit With Account Of Shipment?

Choosing the right lawful papers web template could be a battle. Needless to say, there are a lot of templates available on the Internet, but how would you obtain the lawful type you need? Utilize the US Legal Forms internet site. The services gives 1000s of templates, including the Wisconsin General Letter of Credit with Account of Shipment, that you can use for organization and private needs. Each of the types are examined by professionals and satisfy federal and state specifications.

When you are already signed up, log in to the bank account and click on the Download button to get the Wisconsin General Letter of Credit with Account of Shipment. Utilize your bank account to check throughout the lawful types you may have bought earlier. Proceed to the My Forms tab of your bank account and have another version of the papers you need.

When you are a whole new customer of US Legal Forms, listed here are straightforward instructions that you should adhere to:

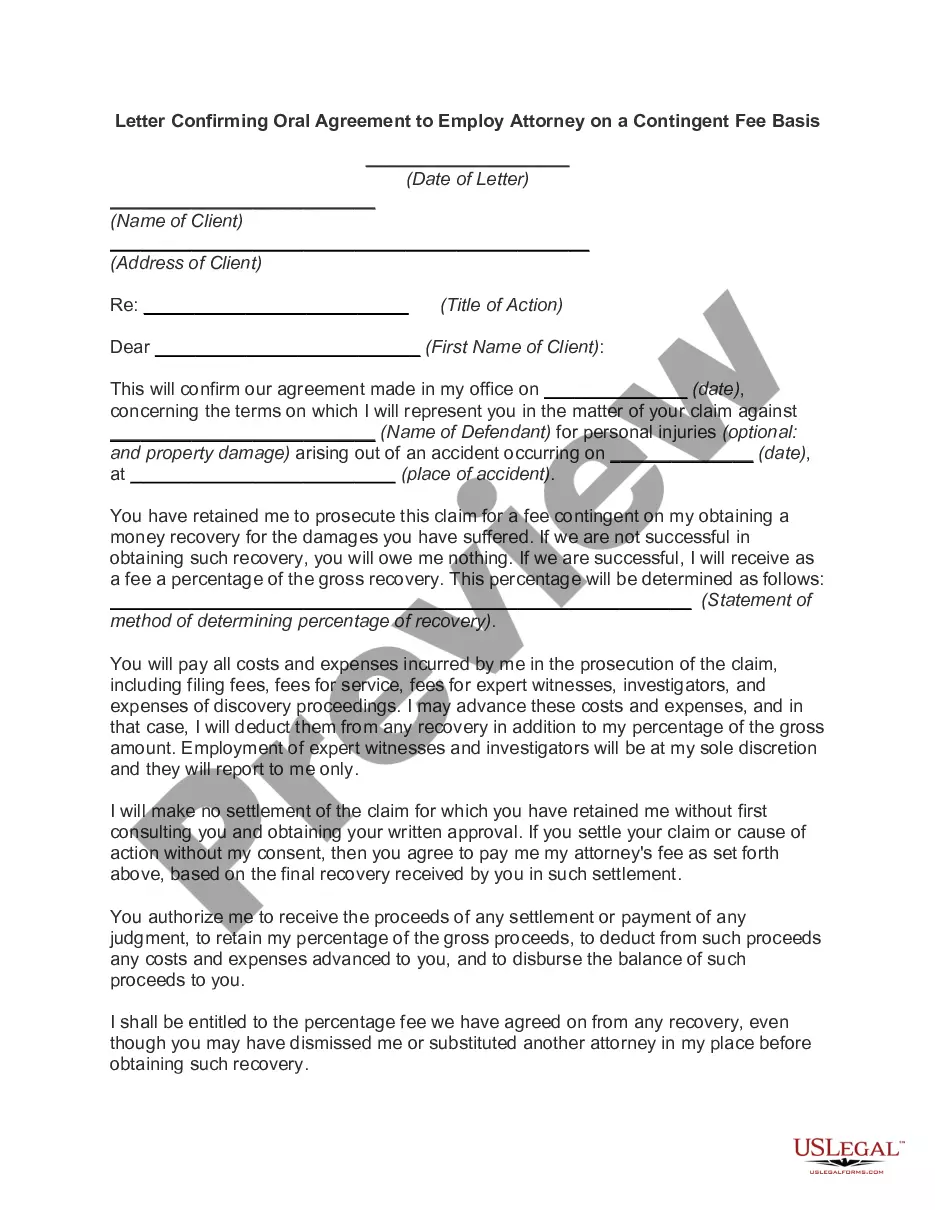

- Very first, make certain you have chosen the right type to your town/county. It is possible to examine the form using the Review button and study the form explanation to guarantee this is basically the best for you.

- When the type does not satisfy your preferences, make use of the Seach industry to find the correct type.

- When you are sure that the form is acceptable, go through the Acquire now button to get the type.

- Pick the rates program you want and enter in the required details. Build your bank account and pay money for an order using your PayPal bank account or bank card.

- Select the data file formatting and acquire the lawful papers web template to the system.

- Complete, revise and print and indicator the acquired Wisconsin General Letter of Credit with Account of Shipment.

US Legal Forms is the largest collection of lawful types where you can find numerous papers templates. Utilize the company to acquire expertly-made documents that adhere to condition specifications.