Wisconsin Non-Exclusive Online Affiliate Program Agreement

Description

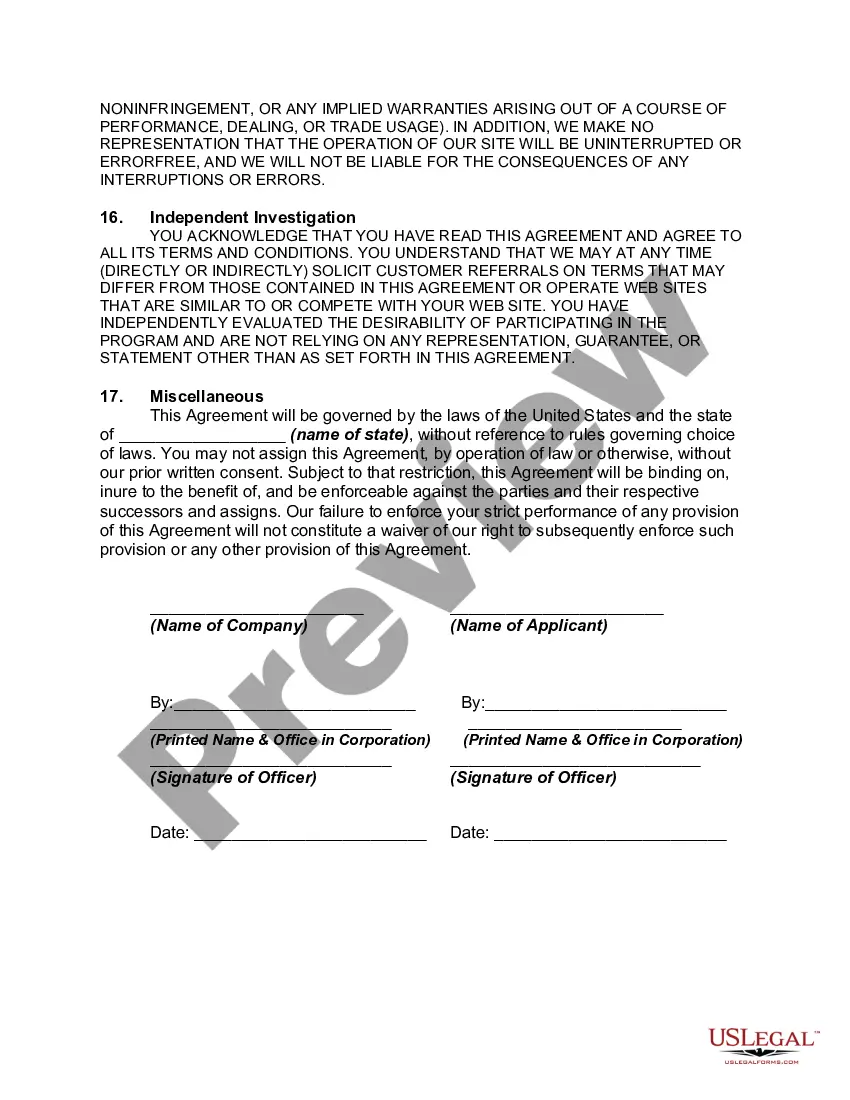

How to fill out Non-Exclusive Online Affiliate Program Agreement?

US Legal Forms - one of the premier collections of legal templates in the United States - provides a diverse selection of legal document formats that you can download or print.

By using the website, you can access thousands of templates for both business and personal use, categorized by types, states, or keywords. You can find the latest forms such as the Wisconsin Non-Exclusive Online Affiliate Program Agreement in just minutes.

If you already have a membership, Log In and download the Wisconsin Non-Exclusive Online Affiliate Program Agreement from the US Legal Forms catalog. The Download button will be visible on every form you view. You can access all previously downloaded forms within the My documents section of your account.

Make edits. Fill out, modify and print and sign the downloaded Wisconsin Non-Exclusive Online Affiliate Program Agreement.

Every template you add to your account does not have an expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Wisconsin Non-Exclusive Online Affiliate Program Agreement with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the appropriate form for your city/state. Click on the Review option to examine the form's contents. Check the form outline to confirm that you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Next, select the payment plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Choose the format and download the form to your device.

Form popularity

FAQ

The form 1 or 1NPR is integral to Wisconsin tax filing for both residents and non-residents. It assists individuals in reporting their income accurately while ensuring compliance with state tax laws. If you are part of a Wisconsin Non-Exclusive Online Affiliate Program Agreement, understanding how to complete these forms can help you manage your tax situations effectively.

Yes, Wisconsin requires an e-file authorization form when filing electronically. This form gives tax professionals permission to file on behalf of clients. If you are participating in a Wisconsin Non-Exclusive Online Affiliate Program Agreement and filing taxes, understanding this requirement can streamline your e-filing process.

Form 1 NR is the non-resident income tax return form for Wisconsin. This form facilitates the reporting of income earned by non-residents within the state. For those participating in a Wisconsin Non-Exclusive Online Affiliate Program Agreement, using Form 1 NR is essential for meeting tax responsibilities and ensuring proper compliance.

Yes, Wisconsin recognizes federal extensions for partnerships, which can provide additional time to file state returns. This means if a partnership files for a federal extension, it can also benefit from this extension at the state level. This is particularly useful for partnerships engaged in a Wisconsin Non-Exclusive Online Affiliate Program Agreement as it allows for better planning and compliance.

A Class 1 notice in Wisconsin refers to a specific type of public notice that must be published in a local newspaper. Such notices usually pertain to legal matters like court proceedings or business filings. Understanding this notice is critical for businesses, especially those involved in agreements such as a Wisconsin Non-Exclusive Online Affiliate Program Agreement.

Form 1 and form 1 NR PY are tax forms used to file Wisconsin state income taxes. Form 1 is for residents, while form 1 NR PY serves non-residents specifically. Completing these forms accurately is important for anyone participating in a Wisconsin Non-Exclusive Online Affiliate Program Agreement to ensure that they meet their state tax obligations.

A 1NPR form in Wisconsin is a part of tax filings for non-residents. This form allows non-residents to report income earned within Wisconsin. It is essential for ensuring compliance with state tax laws, particularly if you are involved in a Wisconsin Non-Exclusive Online Affiliate Program Agreement. Using this form can simplify the reporting process for people earning income in the state.

In an agreement, an affiliate refers to an individual or entity that promotes a business's products or services in exchange for compensation. This relationship is defined within a Wisconsin Non-Exclusive Online Affiliate Program Agreement, which specifies the roles, responsibilities, and payment terms of the affiliate. By formalizing this partnership, both parties benefit from a clear understanding and framework for collaboration.

Having a contract for affiliate marketing is essential for clarity and legal protection. It sets the terms of engagement, rights, and responsibilities for both the business and the affiliates. A Wisconsin Non-Exclusive Online Affiliate Program Agreement serves as a comprehensive legal document that helps avoid misinterpretations and outlines the commission structure, performance metrics, and payment methods.

A participating affiliate agreement outlines the relationship between a business and an affiliate who promotes its products or services. This type of agreement helps both parties understand the expectations and obligations involved in the promotion process. Additionally, a Wisconsin Non-Exclusive Online Affiliate Program Agreement allows affiliates to work with multiple businesses, increasing their earning potential without being tied to a single brand.