Wisconsin Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

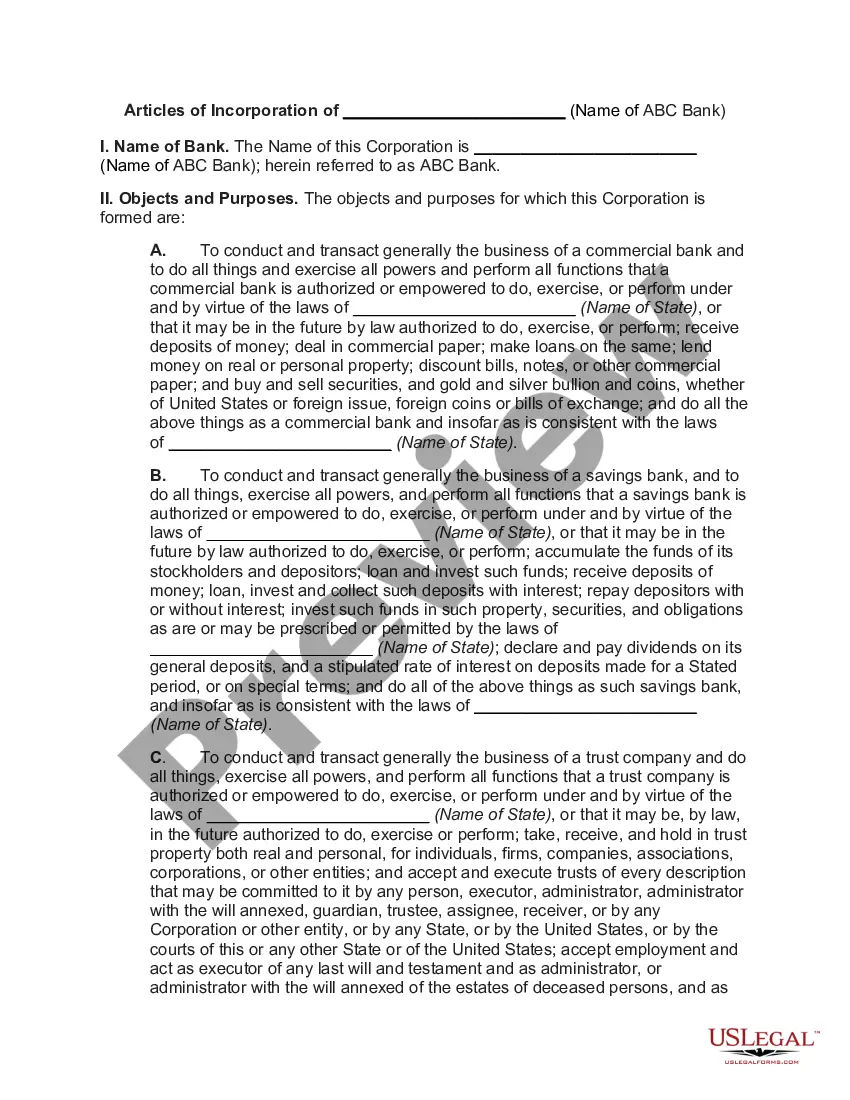

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

US Legal Forms - one of several largest libraries of lawful kinds in the United States - delivers an array of lawful document templates it is possible to acquire or produce. While using website, you may get 1000s of kinds for organization and person functions, sorted by groups, claims, or search phrases.You will discover the most recent models of kinds such as the Wisconsin Articles of Incorporation, Not for Profit Organization, with Tax Provisions in seconds.

If you currently have a monthly subscription, log in and acquire Wisconsin Articles of Incorporation, Not for Profit Organization, with Tax Provisions in the US Legal Forms library. The Down load key will show up on each form you perspective. You get access to all earlier delivered electronically kinds from the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, here are straightforward directions to get you started off:

- Be sure you have picked the right form to your city/region. Click the Review key to analyze the form`s articles. See the form description to actually have selected the appropriate form.

- In case the form does not satisfy your specifications, utilize the Lookup area at the top of the screen to get the one that does.

- In case you are happy with the form, verify your choice by clicking the Acquire now key. Then, select the rates plan you prefer and give your accreditations to register to have an accounts.

- Procedure the purchase. Use your charge card or PayPal accounts to perform the purchase.

- Select the formatting and acquire the form on your product.

- Make adjustments. Complete, edit and produce and indicator the delivered electronically Wisconsin Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Each web template you included in your bank account does not have an expiry time which is your own forever. So, if you want to acquire or produce one more copy, just go to the My Forms portion and then click in the form you need.

Get access to the Wisconsin Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms, one of the most substantial library of lawful document templates. Use 1000s of expert and state-specific templates that fulfill your business or person needs and specifications.

Form popularity

FAQ

To become a nonprofit corporation in Wisconsin you must file the Articles of Incorporation with the State of Wisconsin. In order to qualify for 501(c)(3) status, the organization's purpose must explicitly be limited to one or more of the following: Charitable. Religious.

In Wisconsin, the Department of Financial Institutions, the Attorney General and the Department of Agriculture, Trade and Consumer Affairs share responsibility for regulating charities.

Wisconsin charges $35 to file nonprofit articles of incorporation. If you file by mail, you can add on a $25 expedite fee to speed up the filing process. Online filings already take less time than mailed filings.

To start a nonprofit corporation in Wisconsin, you must file a document called the Articles of Incorporation Non-Stock, Not for Profit Corporation with the Wisconsin Department of Financial Institutions. You can file your articles by mail or online. The articles cost $35 to file.

Form 990 is required for nonprofit organizations, and it has information about our mission, programs and finances. It's a public document, and as investigative journalists we use it all the time to understand what organizations do.

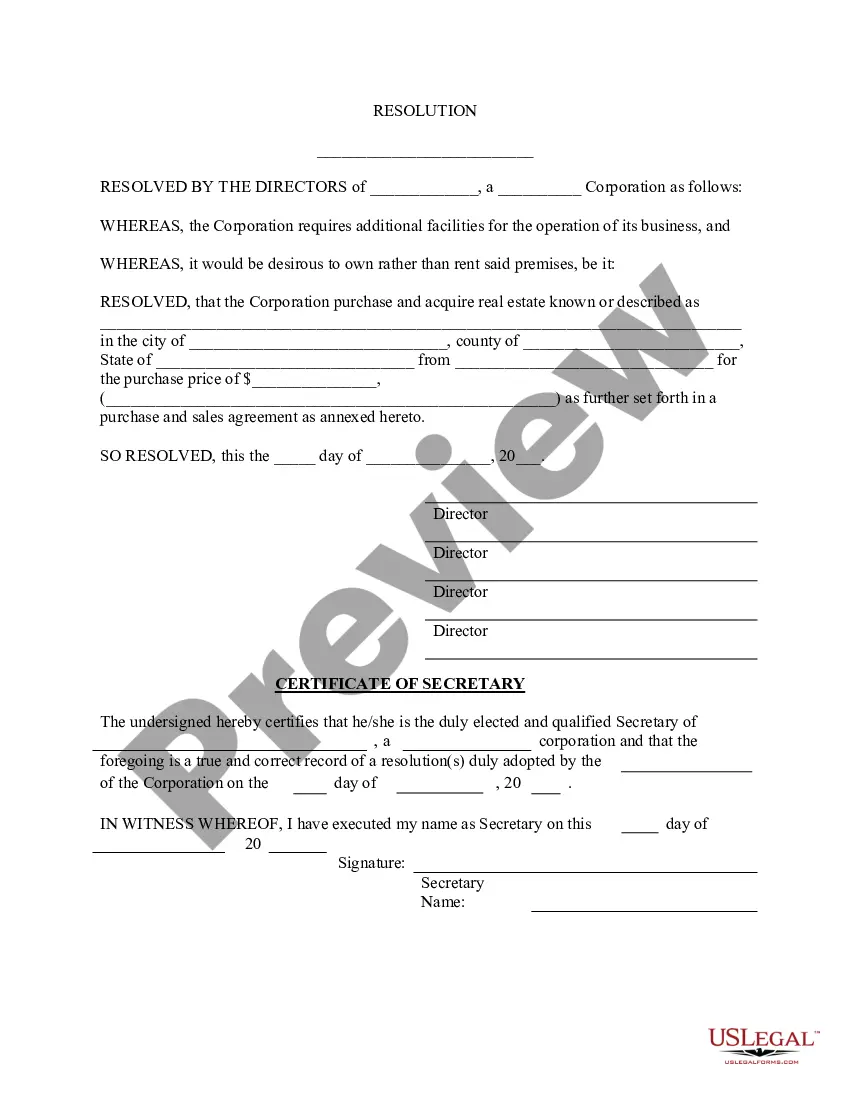

How to Form a Wisconsin Nonprofit Corporation Choose directors for your nonprofit. Choose a name for your nonprofit. Appoint a registered agent. File Wisconsin nonprofit Articles of Incorporation. Prepare nonprofit bylaws. Hold a meeting of your board of directors. Obtain an employer identification number (EIN).

Wisconsin Nonprofit 501(c)(3) Filing Requirements To obtain tax exempt status for your Wisconsin nonprofit, you must complete and file IRS Form 1023, and include the following information on your articles of incorporation: A statement reading, ?This Corporation shall be a nonprofit corporation.?

To start a corporation in Wisconsin, you must file Articles of Incorporation with the Wisconsin Department of Financial Institutions. You can file the document online or by mail. The Articles of Incorporation cost $100 to file. Once filed with the state, this document formally creates your Wisconsin corporation.