Wisconsin Income Projections Statement

Description

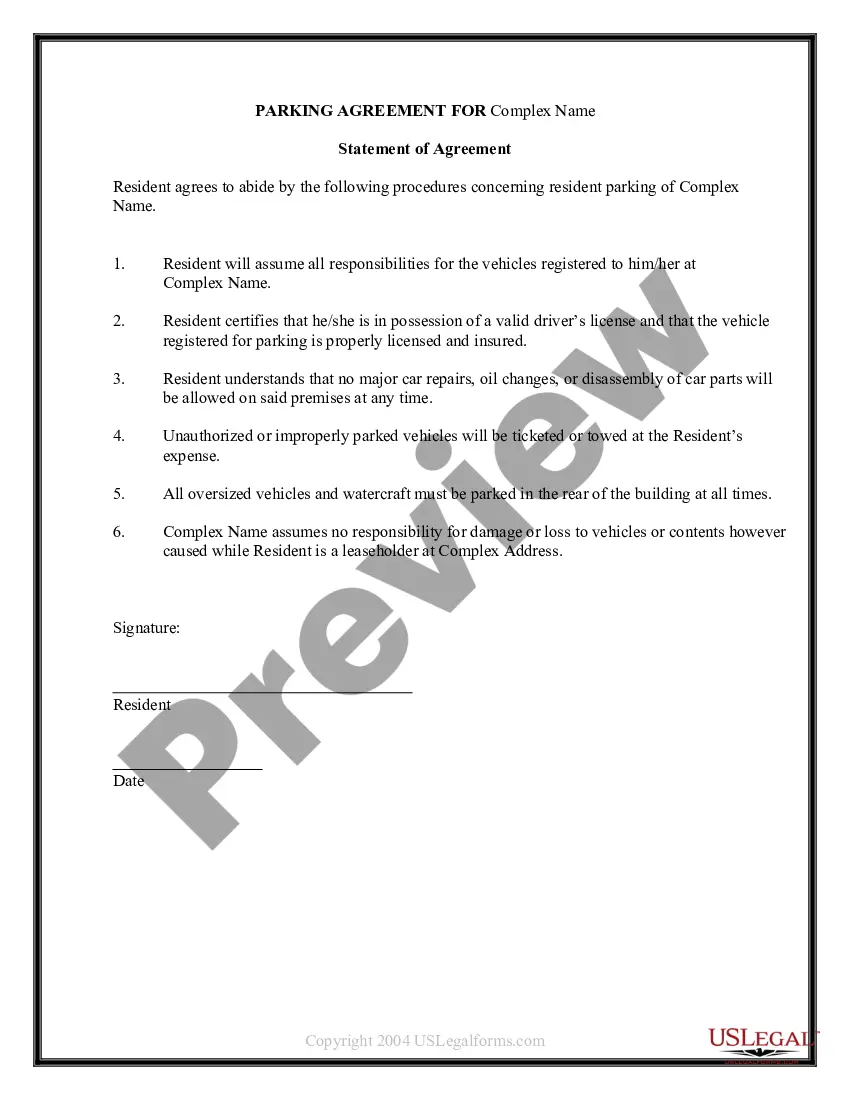

As monthly projections are developed and entered into the income projections statement, they can serve as definite goals for controlling the business operation. As actual operating results become known each month, they should be recorded for comparison with the monthly projections. A completed income statement allows the owner/manager to compare actual figures with monthly projections and to take steps to correct any problems.

How to fill out Income Projections Statement?

If you desire to complete, download, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's straightforward and convenient search feature to locate the documents you require.

Various templates for commercial and personal use are organized by categories and regions, or keywords. Utilize US Legal Forms to acquire the Wisconsin Income Projections Statement with just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Wisconsin Income Projections Statement. Each legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Go to the My documents section and choose a form to print or download again.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to find the Wisconsin Income Projections Statement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to read through the details.

- Step 3. If you are dissatisfied with the form, utilize the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, select the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

When answering the question, 'Are you exempt from withholding?' be prepared to provide accurate information based on your financial circumstances. It's crucial to understand your income sources and tax guidelines, for which the Wisconsin Income Projections Statement can be highly beneficial. This approach ensures you answer truthfully and avoid potential tax issues later on.

To find out if you have an exemption from withholding, review the IRS guidelines and your personal financial situation. Using the Wisconsin Income Projections Statement can clarify your estimated income and whether you can claim an exemption based on your expected tax liability. If in doubt, consult with a tax professional for tailored advice.

Form 1NPR is a Wisconsin Nonresident and Part-Year Resident Income Tax Form, used to report income earned in Wisconsin by individuals who do not reside in the state. Completing this form accurately ensures compliance with Wisconsin tax laws. For clarity on filling out Form 1NPR, you may refer to the Wisconsin Income Projections Statement, which helps project your income accurately.

To confirm your exemption status from Wisconsin withholding, consider reviewing your previous tax filings and current income projections. The Wisconsin Income Projections Statement provides valuable insights into your expected earnings and potential tax obligations, making it easier for you to estimate whether you qualify for exemption.

You may be exempt from Wisconsin withholding if you meet certain conditions, such as having no income tax liability in the previous year or expecting none in the current year. Additionally, using the Wisconsin Income Projections Statement effectively illustrates your anticipated income and tax scenario, aiding in understanding your exemption status.

To determine if you are exempt or non-exempt from withholding in Wisconsin, evaluate your tax situation and income level. If you expect to owe no income tax for the year and meet specific criteria, you may qualify as exempt. The Wisconsin Income Projections Statement can assist you in estimating your tax responsibilities and help clarify your withholding status.

The taxation on $100,000 income in Wisconsin will depend on various factors, including deductions and the specific tax brackets applicable for the year. Generally, Wisconsin has a progressive income tax system, so the effective tax rate can vary. It's essential to consider these details when calculating your Wisconsin Income Projections Statement to determine your expected tax liability.

The apportionment formula in Wisconsin typically uses a three-factor approach, considering property, payroll, and sales. This formula helps to fairly allocate business income for tax purposes. Understanding this formula is vital for ensuring that your Wisconsin Income Projections Statements are accurate and compliant with state tax regulations.

Wisconsin income tax forms are available on the Wisconsin Department of Revenue's website, where you can download or print them. You can also find these forms at local libraries and county offices. Having the correct forms is crucial for accurately reporting your income and preparing Wisconsin Income Projections Statements.

You can obtain your Wisconsin property tax statement through your local county treasurer’s office or by visiting their official website. Most counties provide online access to property tax statements for convenience. Accessing this information is important, especially when preparing your financial documents like Wisconsin Income Projections Statements.