Wisconsin Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

If you need to compile, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Utilize the site's simple and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of your legal form and download it to your device.

Step 7. Complete, revise, and print or sign the Wisconsin Accounts Receivable Write-Off Approval Form.

Every legal document template you acquire is yours indefinitely. You have access to each form you saved within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Wisconsin Accounts Receivable Write-Off Approval Form with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Wisconsin Accounts Receivable Write-Off Approval Form with just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and hit the Acquire button to get the Wisconsin Accounts Receivable Write-Off Approval Form.

- You can also access forms you previously saved under the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form appropriate for your area/state.

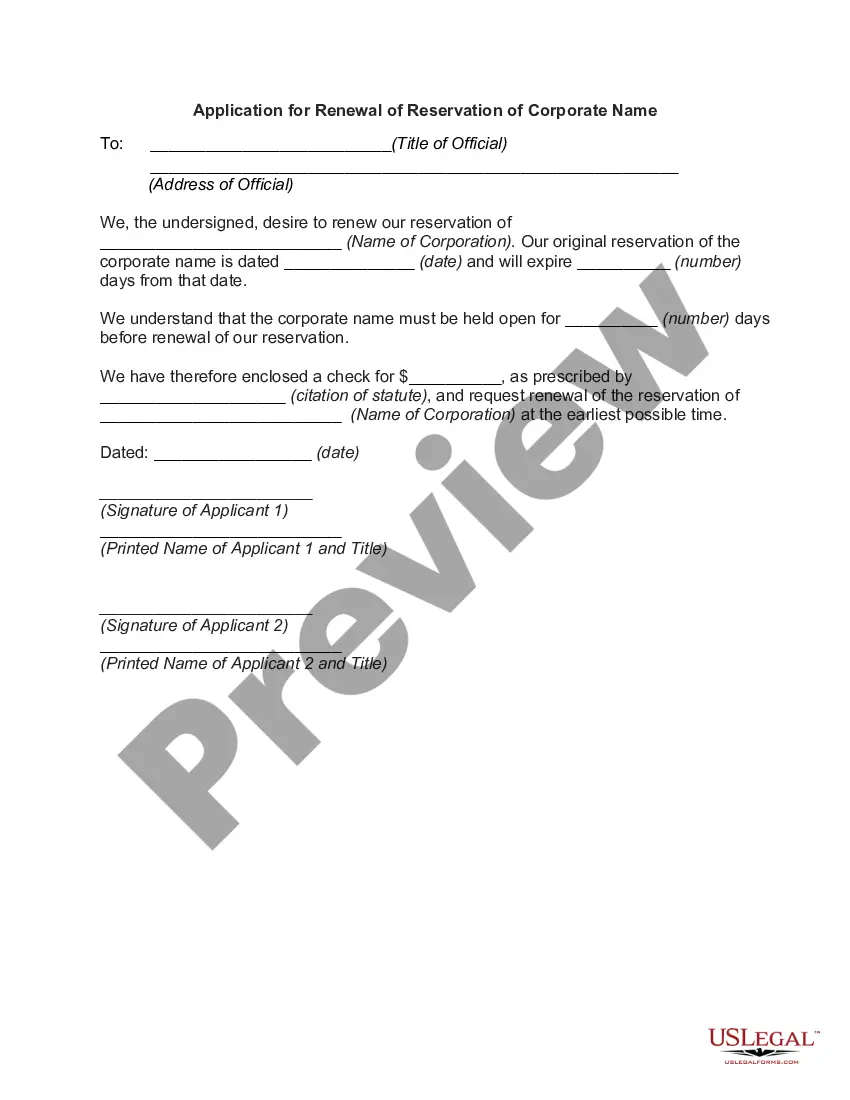

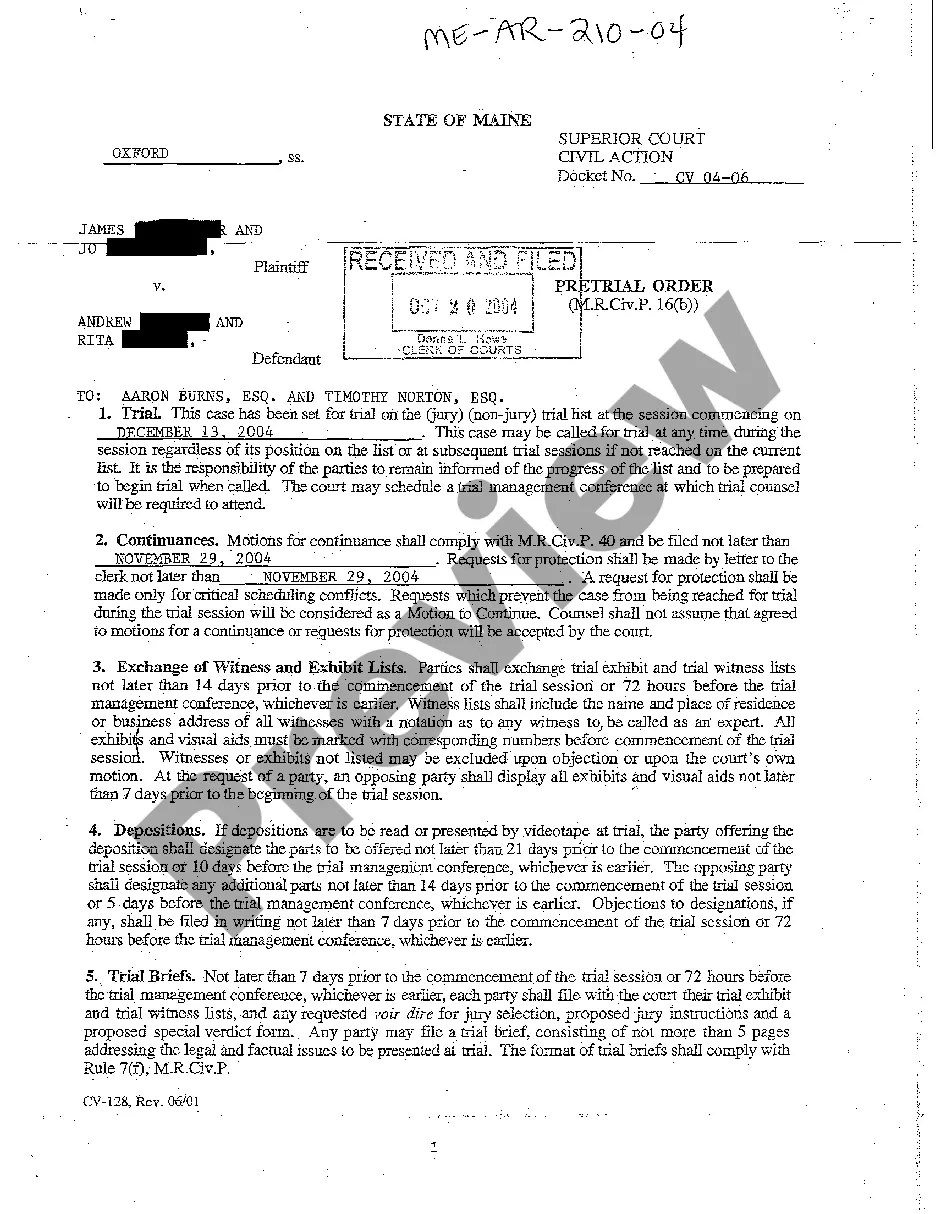

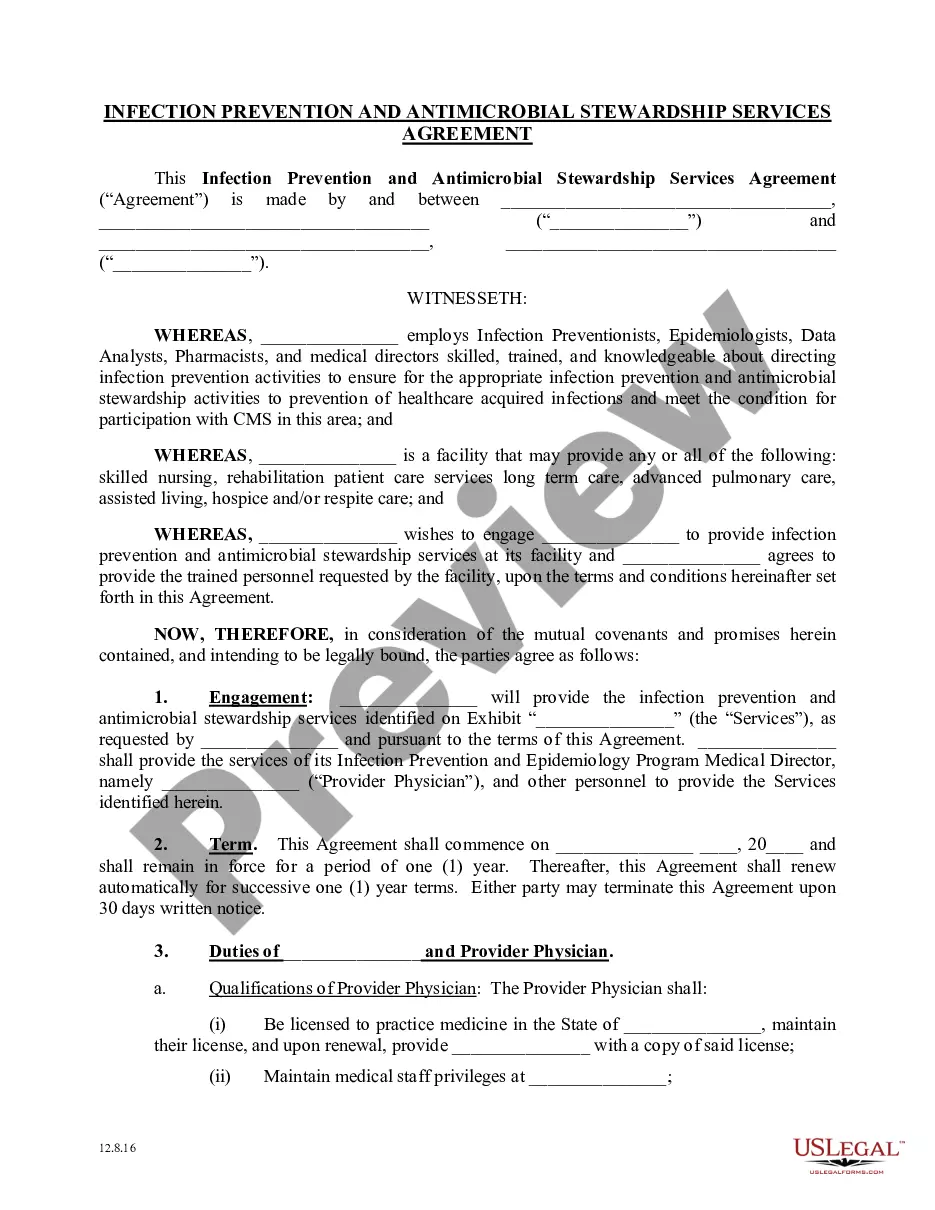

- Step 2. Use the Review feature to examine the form's content. Remember to read through the information.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

To record the write-off of accounts receivable, create a journal entry that debits bad debt expense and credits the accounts receivable account. This entry effectively reduces both your assets and your income, ensuring accurate financial reporting. Using the Wisconsin Accounts Receivable Write-Off Approval Form simplifies your record-keeping by providing a structured process to follow.

When an account receivable is written off, it is removed from your balance sheet and recognized as an expense. This action reflects the financial reality that the amount is uncollectible, impacting profits and assets. Completing a Wisconsin Accounts Receivable Write-Off Approval Form ensures that this process is documented clearly, providing evidence for your financial records.

A direct write-off occurs when a specific account is deemed uncollectible and is removed directly from the accounts receivable ledger. This method is straightforward but may not comply with the matching principle in accounting. By leveraging the Wisconsin Accounts Receivable Write-Off Approval Form, you can ensure that your company's write-off policies are clearly documented and aligned with best practices.

Accounts receivable can be written off when all collection efforts have been exhausted, and it is deemed unlikely that the debt will be collected. Often, businesses set a time limit after which unpaid invoices become eligible for write-off. Using the Wisconsin Accounts Receivable Write-Off Approval Form helps formalize this process, providing documentation for tax purposes and audits.

The journal entry for writing off an account receivable typically involves debiting the bad debt expense and crediting the accounts receivable account. This entry reduces both the assets and the income on your financial statements. Utilizing the Wisconsin Accounts Receivable Write-Off Approval Form can aid in maintaining transparency and managing your business’s financial health.

Under the allowance method, the entry to write-off accounts receivable consists of debiting the allowance for doubtful accounts and crediting accounts receivable. This action allows the company to recognize losses without impacting net income for that period. Leveraging a Wisconsin Accounts Receivable Write-Off Approval Form can streamline this process, ensuring all necessary approvals are documented.

For the allowance method, the journal entry typically includes an estimation of potential bad debts at the end of each period, debiting bad debt expense and crediting the allowance for doubtful accounts. This practice ensures that your financial statements remain accurate and reflect expected losses. A Wisconsin Accounts Receivable Write-Off Approval Form can assist in documenting these allowances effectively.

The journal entry for writing off accounts receivable typically involves debiting the allowance for doubtful accounts and crediting accounts receivable. This entry decreases receivables on the balance sheet, reflecting the anticipated loss. Including a Wisconsin Accounts Receivable Write-Off Approval Form in this process adds an extra layer of validation and helps keep track of write-offs.

To record a write-off of accounts receivable, you need to make a journal entry that reduces both the accounts receivable and the allowance for doubtful accounts. This entry reflects the loss and maintains accurate financial statements. Using a Wisconsin Accounts Receivable Write-Off Approval Form helps standardize this process and ensures you adhere to established guidelines.

Writing off other receivables involves recognizing that a specific amount will not be collected. This process typically requires documenting the decision and updating financial records accordingly. Utilizing a Wisconsin Accounts Receivable Write-Off Approval Form simplifies this task and provides a clear audit trail, ensuring your accounting remains transparent.