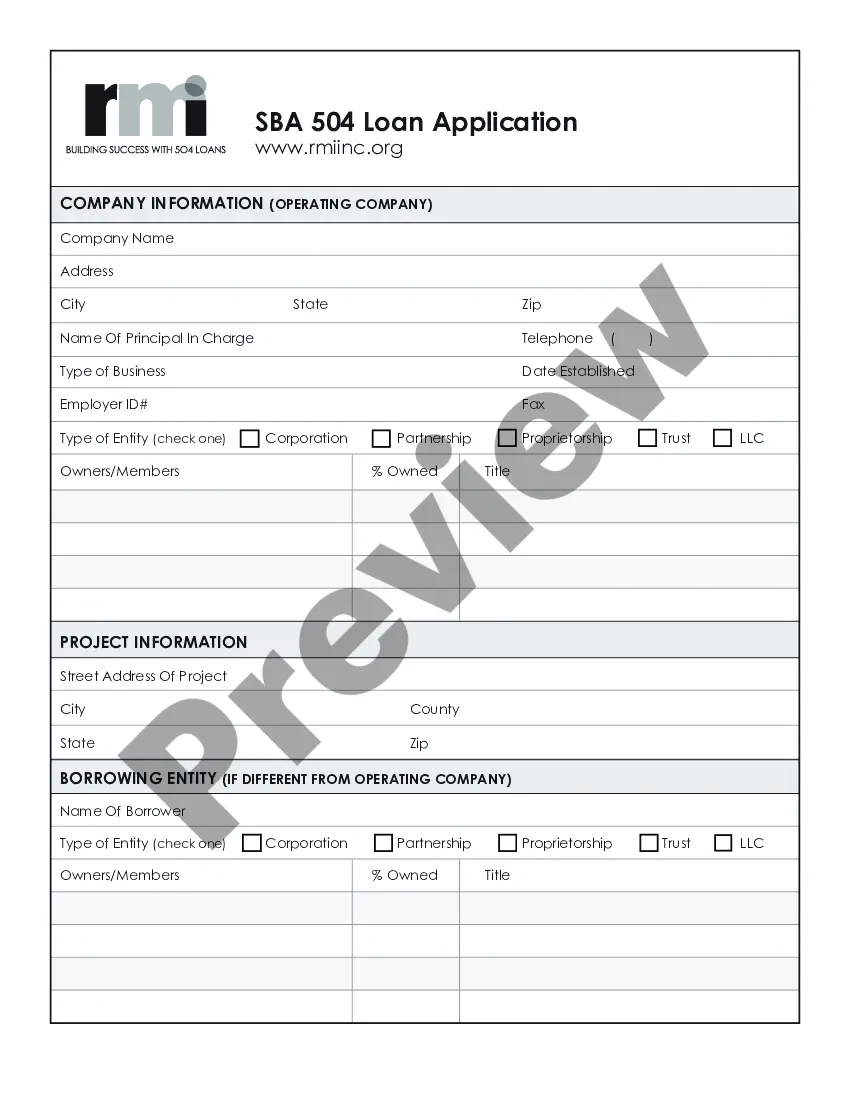

Wisconsin Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

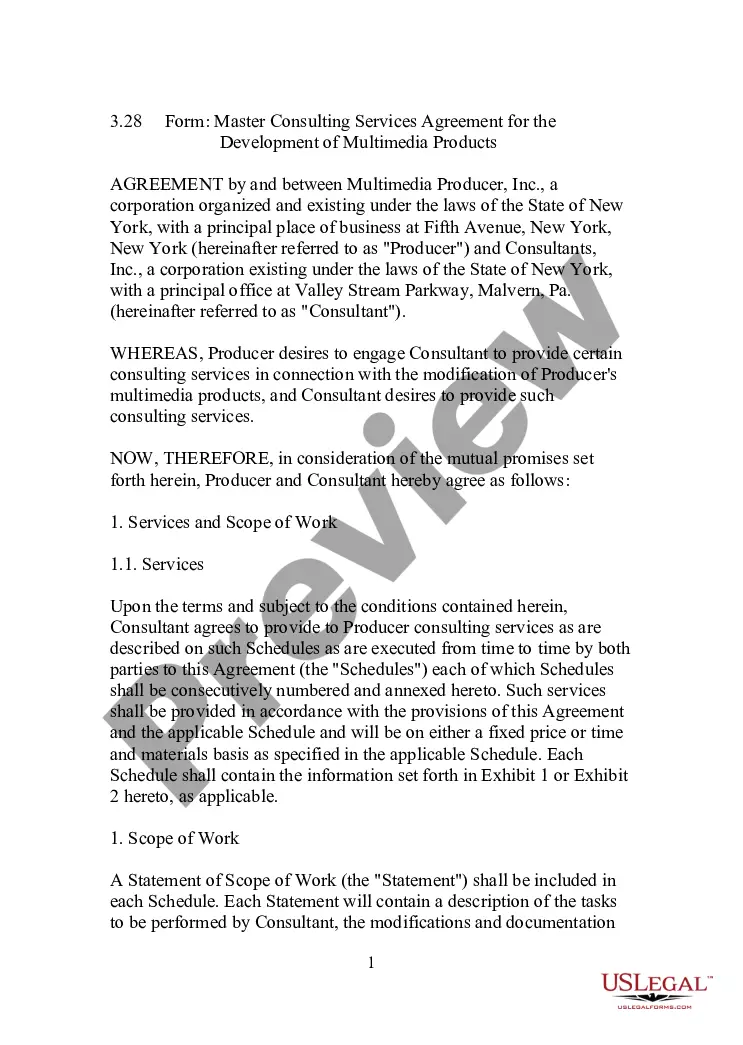

Choosing the best legal document template might be a struggle. Obviously, there are plenty of themes available on the net, but how will you get the legal type you need? Use the US Legal Forms website. The service offers 1000s of themes, for example the Wisconsin Small Business Administration Loan Application Form and Checklist, that can be used for organization and private demands. Every one of the forms are checked by experts and meet state and federal requirements.

Should you be already registered, log in to your accounts and click the Download switch to obtain the Wisconsin Small Business Administration Loan Application Form and Checklist. Make use of accounts to look through the legal forms you possess ordered in the past. Proceed to the My Forms tab of your respective accounts and acquire one more version from the document you need.

Should you be a brand new customer of US Legal Forms, listed below are easy recommendations so that you can adhere to:

- Very first, be sure you have chosen the correct type to your town/area. You can check out the shape making use of the Review switch and look at the shape outline to guarantee this is the best for you.

- If the type fails to meet your preferences, make use of the Seach area to discover the right type.

- When you are certain the shape is suitable, click on the Acquire now switch to obtain the type.

- Opt for the costs program you desire and type in the essential information and facts. Make your accounts and buy your order making use of your PayPal accounts or charge card.

- Select the document file format and down load the legal document template to your product.

- Full, edit and print and indication the attained Wisconsin Small Business Administration Loan Application Form and Checklist.

US Legal Forms may be the most significant local library of legal forms for which you will find numerous document themes. Use the company to down load professionally-produced files that adhere to condition requirements.

Form popularity

FAQ

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.

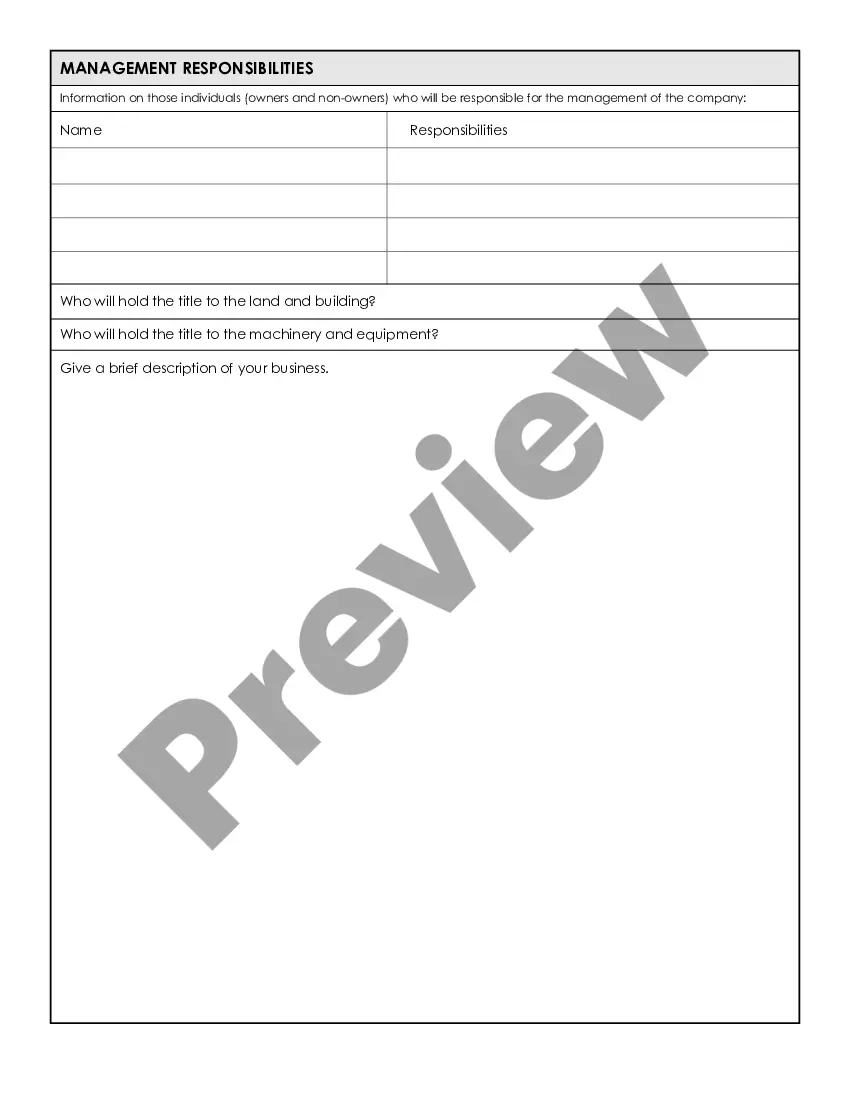

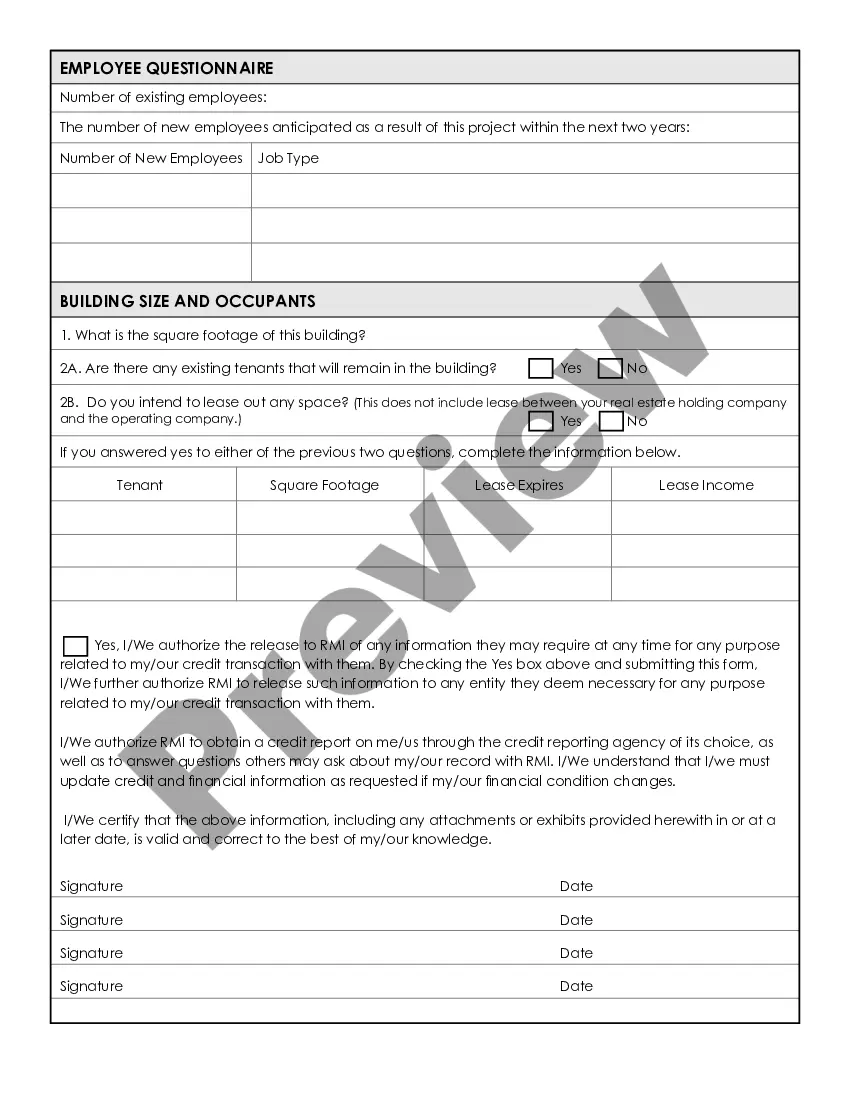

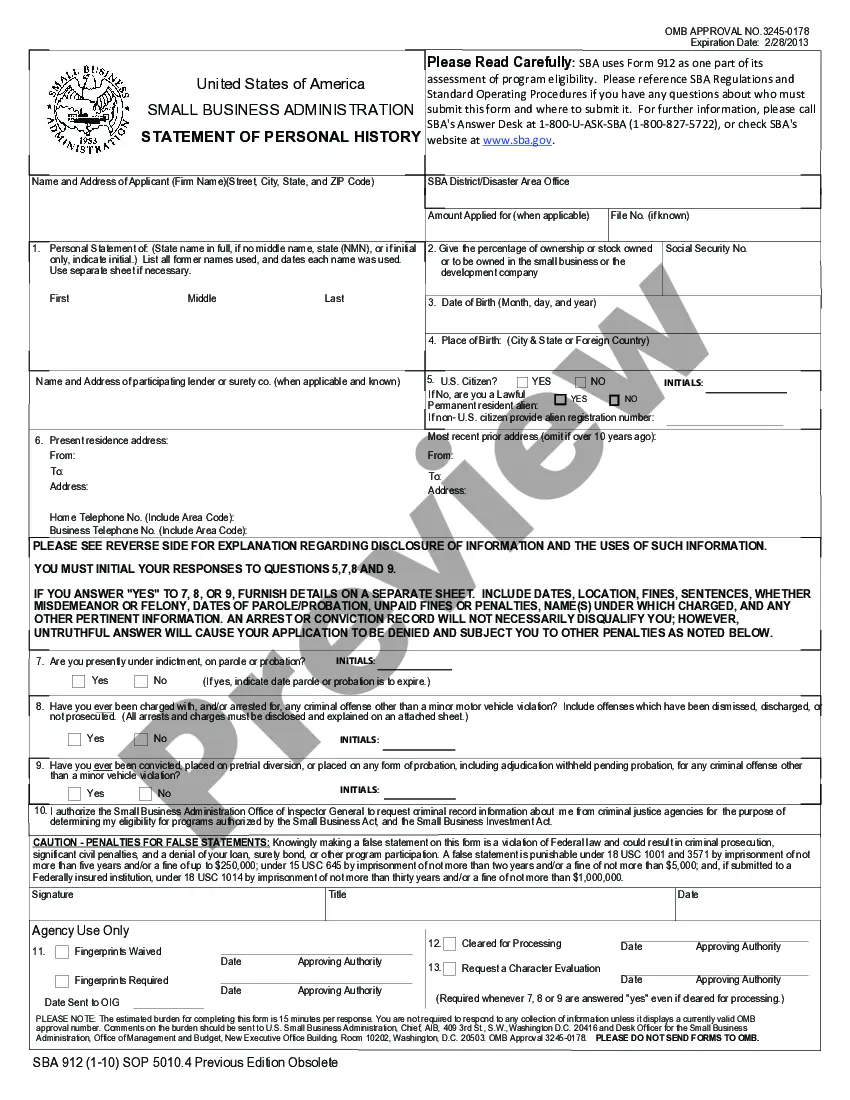

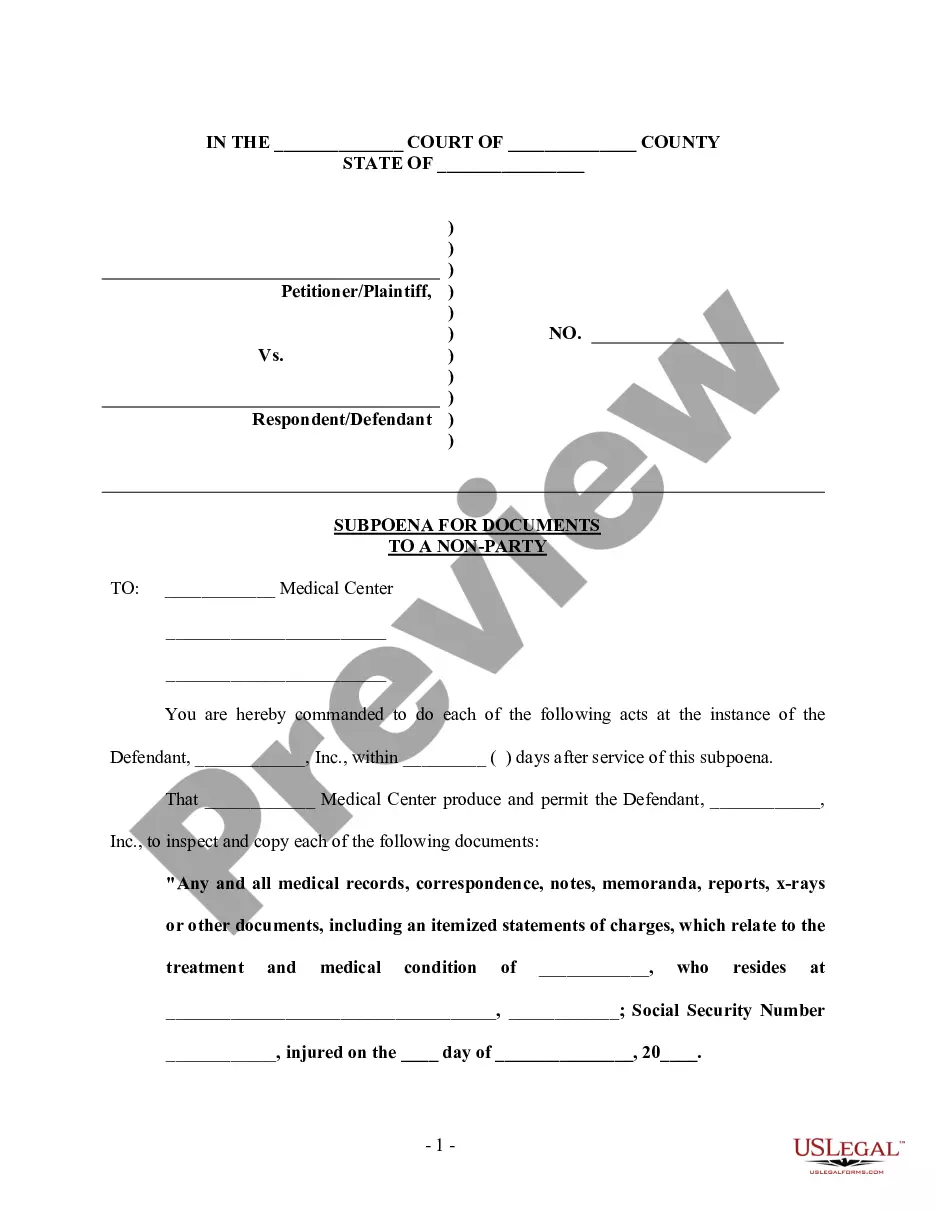

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

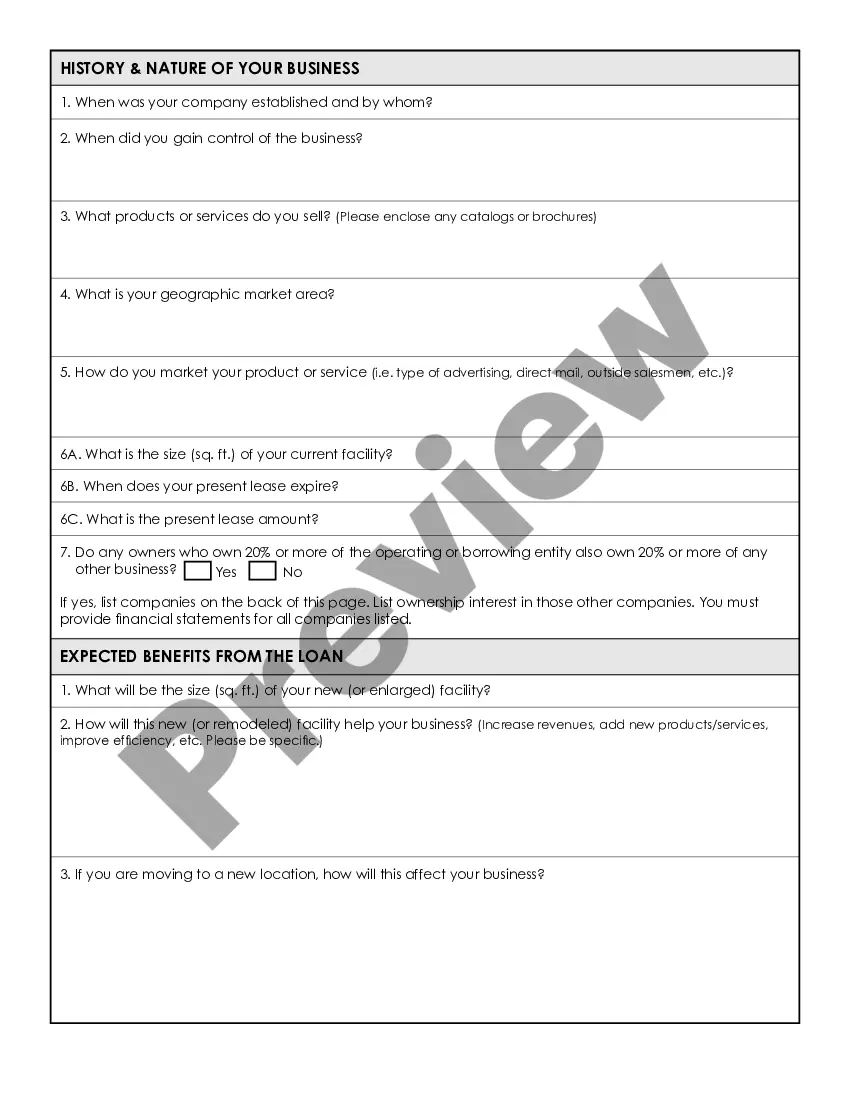

Both your personal and business credit reports, income tax returns and bank statements will be reviewed. You'll also need to provide business financial statements, including a profit and loss statement, cash flow and balance sheet and a complete accounting of all business debt and creditors.

In most cases, SBA loans require at least one owner or stakeholder to sign an unlimited personal guarantee on their loan. However, lenders may ask that other individuals involved in the company's ownership or who have an important say in the business's operations sign a personal guarantee as well.

Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose.

Use this form to document key loan information such as the loan number, the interest rate, the lender, and the borrower.