The Wisconsin Membership Certificate of a Nonprofit or Non-Stock Corporation is an official document that confirms an individual or organization's membership in a nonprofit or non-stock corporation registered in the state of Wisconsin. This certificate serves as tangible proof of an individual or entity's involvement in and support of the organization. Keywords: Wisconsin, Membership Certificate, Nonprofit, Non-Stock Corporation, corporation, document, state, organization, involvement, support. There are several types of Wisconsin Membership Certificates available depending on the specific characteristics and requirements of the nonprofit or non-stock corporation. These types may include: 1. Individual Membership Certificate: Issued to an individual who has become a member of the nonprofit or non-stock corporation. The certificate reflects the personal commitment of the individual towards the organization. 2. Organizational Membership Certificate: Provided to companies, associations, or other organized groups that have joined as members of the nonprofit or non-stock corporation. This certificate signifies the support and collaboration of the entire organization with the nonprofit entity. 3. Life Membership Certificate: Awarded to individuals who have displayed exceptional dedication and commitment to the nonprofit or non-stock corporation over an extended period. This certificate serves as an extraordinary recognition of their contributions and support. 4. Honorary Membership Certificate: Given to individuals who are not necessarily members but have made significant contributions or have been recognized for their exceptional achievement in the field related to the nonprofit or non-stock corporation's mission. This certificate acknowledges the honorary status and distinct relationship they hold with the organization. 5. Founding Membership Certificate: Reserved for individuals or organizations who were part of the initial formation and establishment of the nonprofit or non-stock corporation. This certificate honors their instrumental role in setting up the organization and commemorates their significant contribution. Each type of Wisconsin Membership Certificate holds its own significance, symbolizing the diverse ways individuals and entities can engage with a nonprofit or non-stock corporation in Wisconsin.

Wisconsin Membership Certificate of Nonprofit or Non Stock Corporation

Description

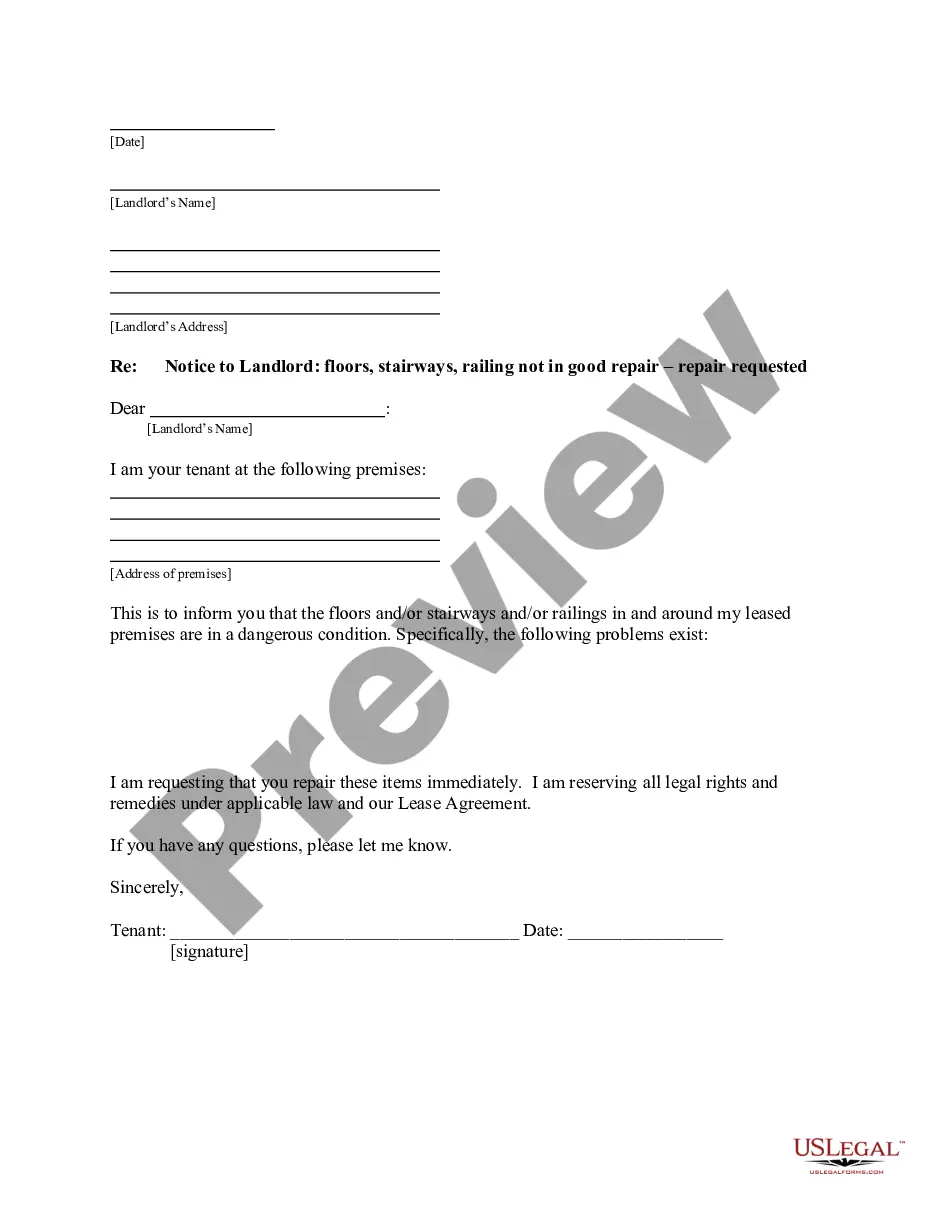

How to fill out Wisconsin Membership Certificate Of Nonprofit Or Non Stock Corporation?

US Legal Forms - one of several biggest libraries of lawful types in the USA - gives a variety of lawful record web templates you are able to acquire or print out. Using the web site, you can find a large number of types for enterprise and personal functions, sorted by types, claims, or key phrases.You can find the most recent types of types like the Wisconsin Membership Certificate of Nonprofit or Non Stock Corporation in seconds.

If you have a registration, log in and acquire Wisconsin Membership Certificate of Nonprofit or Non Stock Corporation from your US Legal Forms local library. The Acquire switch will show up on every single type you look at. You gain access to all previously acquired types within the My Forms tab of the profile.

If you wish to use US Legal Forms initially, here are basic recommendations to help you started out:

- Be sure to have selected the proper type for your metropolis/county. Go through the Review switch to check the form`s content material. See the type explanation to actually have selected the proper type.

- When the type does not suit your demands, utilize the Lookup field at the top of the display screen to discover the one who does.

- In case you are content with the shape, verify your selection by clicking on the Get now switch. Then, choose the pricing program you favor and supply your qualifications to register for the profile.

- Process the deal. Make use of your credit card or PayPal profile to perform the deal.

- Pick the structure and acquire the shape on your gadget.

- Make changes. Fill up, modify and print out and indicator the acquired Wisconsin Membership Certificate of Nonprofit or Non Stock Corporation.

Each design you included in your money lacks an expiry date and it is the one you have permanently. So, if you want to acquire or print out an additional duplicate, just check out the My Forms segment and click on the type you will need.

Obtain access to the Wisconsin Membership Certificate of Nonprofit or Non Stock Corporation with US Legal Forms, one of the most substantial local library of lawful record web templates. Use a large number of professional and state-distinct web templates that fulfill your small business or personal demands and demands.

Form popularity

FAQ

Unlike a stock corporation that issues shares of stock to investors who then become "owners" and are entitled to share in the corporation's profits, a nonstock corporation does not have any shareholders or "owners."

There are some instances in which a for-profit corporation remains non-stock: The company is closely held by a few individuals who have no interests in stocks. The company is formed for a short-term, single purpose or transaction, such as building a construction project.

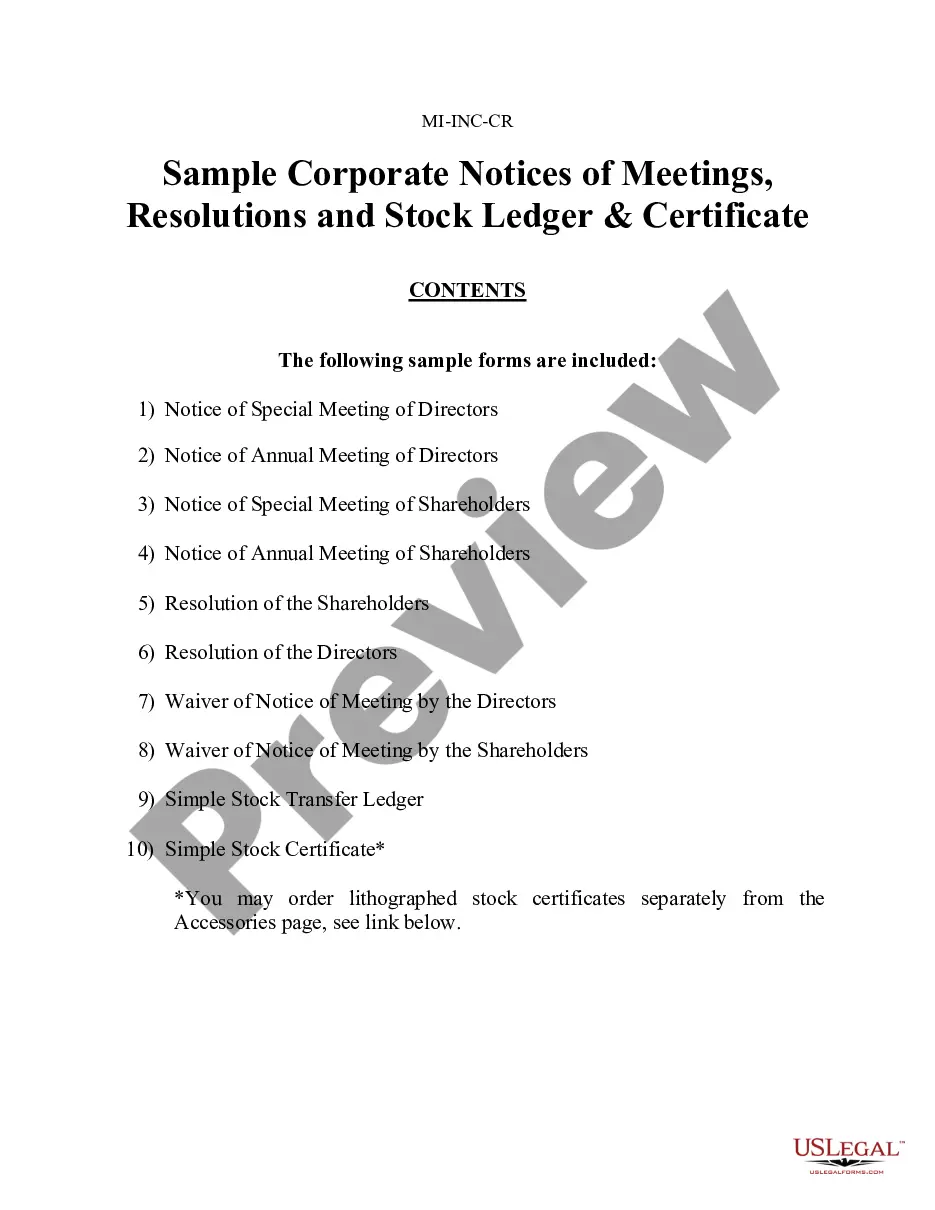

How to Form a Wisconsin Nonprofit Corporation Choose directors for your nonprofit. Choose a name for your nonprofit. Appoint a registered agent. File Wisconsin nonprofit Articles of Incorporation. Prepare nonprofit bylaws. Hold a meeting of your board of directors. Obtain an employer identification number (EIN).

There are some instances in which a for-profit corporation remains non-stock: The company is closely held by a few individuals who have no interests in stocks. The company is formed for a short-term, single purpose or transaction, such as building a construction project.

profit corporation is nonstock by definition, since the purpose of the nonprofit corporation is not to pay shareholder dividends. Nonstock, Nonprofit corporations are without any profit motive and are formed to provide a service to their members.

stock corporation (or nonstock corporation) is a corporation that does not have owners represented by shares of stock, in contrast to a jointstock company. stock corporation typically has members who are the functional equivalent of shareholders in a stock corporation.

Non-stock corporations are separate legal entities that provide limited liability protection for the personal assets of members, directors, and officers. Non-stock corporations are utilized by both non-profit organizations and for-profit enterprises.