Wisconsin Equipment Inventory List

Description

How to fill out Equipment Inventory List?

Finding the appropriate legal document layout can be a challenge.

Certainly, there are numerous formats available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The service offers a wide array of templates, including the Wisconsin Equipment Inventory List, which you can utilize for business and personal purposes.

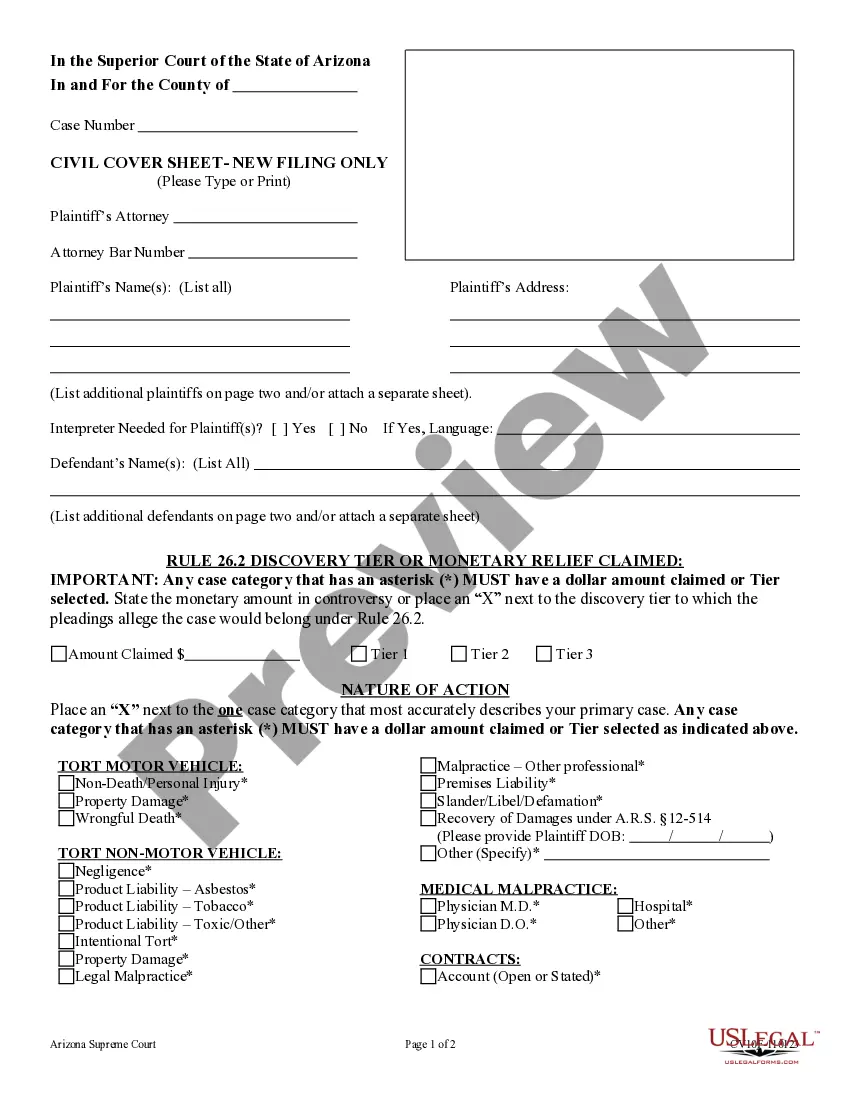

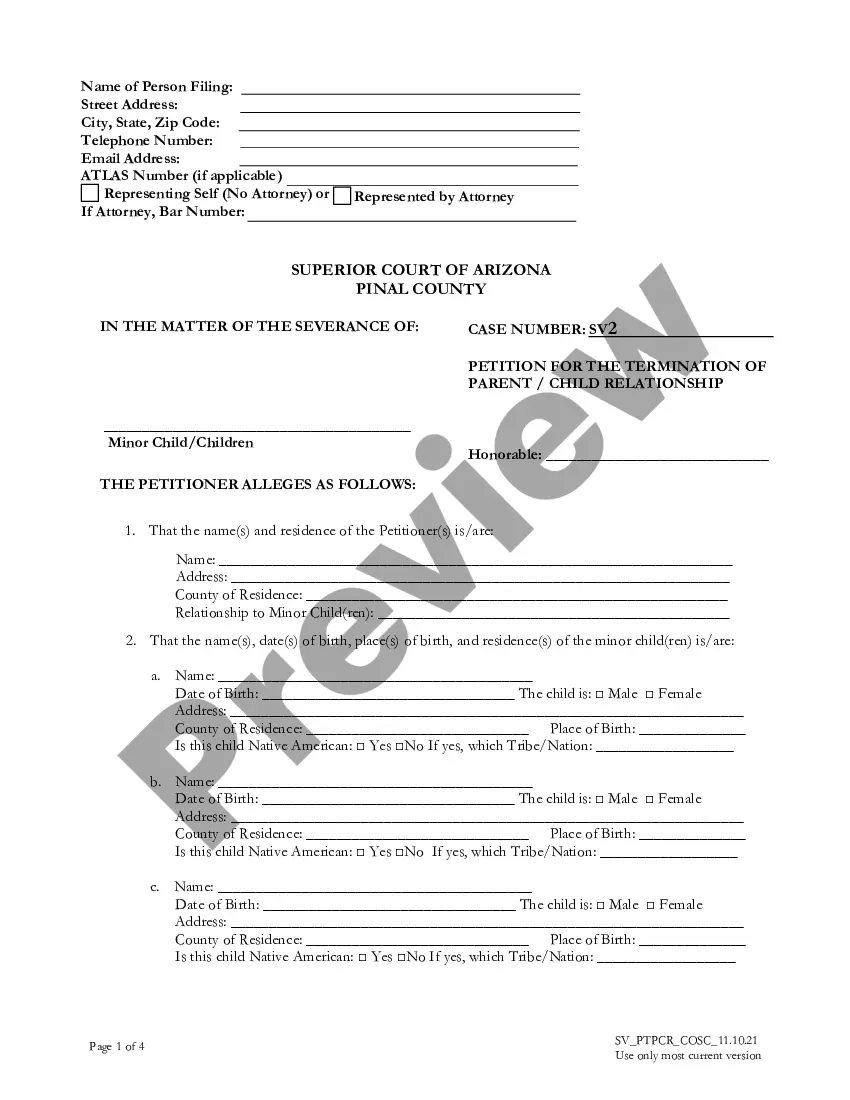

You can preview the form using the Preview button and read the form description to ensure it is the right choice for you.

- All the forms are vetted by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Get button to download the Wisconsin Equipment Inventory List.

- Use your account to search for the legal forms you have obtained previously.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are easy steps for you to follow.

- First, ensure that you have selected the correct form for your area/state.

Form popularity

FAQ

Yes, you can write off inventory under certain conditions, typically when it becomes obsolete or unsellable. Keeping track of your inventory through a Wisconsin Equipment Inventory List can help you identify items that qualify for write-offs. This practice not only reduces taxable income but also provides a clearer picture of your business's financial health. Consult a tax advisor to ensure you're following the correct protocols for write-offs.

Yes, as a business owner, you are generally required to report your inventory on your tax return. This is necessary for assessing your tax obligations accurately and ensuring compliance with tax laws. Utilizing a Wisconsin Equipment Inventory List can simplify this reporting process by organizing your inventory counts and values effectively. An organized approach can improve your overall tax experience.

When reporting taxes, inventory is typically reported as part of your assets on your tax return. For businesses, it may be included on Schedule C or the relevant corporate tax forms. It's crucial to catalog your items in a comprehensive Wisconsin Equipment Inventory List to support your asset reporting. Proper placement of inventory documentation aids in clarity and accountability when filing your taxes.

Yes, tracking inventory for taxes is essential for businesses as it directly affects profit calculations and tax liabilities. A well-maintained Wisconsin Equipment Inventory List helps you stay organized, ensuring accurate reporting and compliance. Moreover, this inventory tracking can also provide insights for operational improvements and informed decision-making. Accurate records contribute to transparency in your financial reports.

Manufacturing equipment is generally taxable in Wisconsin unless it qualifies for specific exemptions. Businesses often benefit from understanding the nuances of these exemptions, which can include certain machinery used directly in production. Keeping a comprehensive Wisconsin Equipment Inventory List can help businesses track taxable and exempt items efficiently. Therefore, it is essential to be aware of these details to avoid tax liability.

To report inventory on your taxes, you must complete Schedule C if you're a sole proprietor or the appropriate forms for your business structure. It's important to determine the value of your inventory at the end of the tax year, and maintain a detailed Wisconsin Equipment Inventory List to assist in this process. Reporting inventory accurately can influence your tax liability, so ensure all values are supported by documentation. Consulting a tax professional may also be wise.

In Wisconsin, certain items are exempt from sales tax, including specific agricultural items, machinery used in manufacturing, and certain prescription drugs. Businesses should maintain a Wisconsin Equipment Inventory List to help identify which items qualify for exemption. This can simplify compliance and ensure that you correctly apply the tax rules. Always consult the Wisconsin Department of Revenue for the most updated information.

To make a simple Wisconsin Equipment Inventory List, focus on the essentials. Start with item names and quantities, then add key details like locations and responsible parties. Keep your list easy to read and update, ensuring it remains a helpful tool for managing your equipment efficiently.

When filling out an inventory sheet for your Wisconsin Equipment Inventory List, start with a clear template that includes all necessary fields. Systematically input the equipment information, ensuring accuracy as you enter details like item condition and location. Regular updates will help maintain the list’s usefulness and reliability.

Creating a Wisconsin Equipment Inventory List in Excel is straightforward. Start by setting up columns for each detail you want to track, such as item name, serial number, and condition. Input your data into each column and use Excel's sorting and filtering features for easy management and quick access to your equipment information.