Title: Wisconsin Financial Record Storage Chart: Comprehensive Guide and Types Introduction: In the state of Wisconsin, managing financial records is crucial for businesses, organizations, and individuals alike. To ensure efficient record keeping and compliance with legal requirements, the Wisconsin Financial Record Storage Chart provides a valuable resource. This detailed description will explore the purpose, benefits, and types of Wisconsin Financial Record Storage Chart. Keywords: Wisconsin, financial record storage, chart, management, compliance, organizations, businesses, legal requirements. I. Purpose and Benefits of the Wisconsin Financial Record Storage Chart: 1. Efficiency and Organization: The Wisconsin Financial Record Storage Chart serves as a systematic framework to streamline and organize financial records, ensuring that they are easily accessible when needed. It offers a standardized approach for categorizing and archiving diverse financial documents. 2. Compliance with Legal Requirements: Wisconsin Financial Record Storage Chart helps individuals and organizations remain compliant with state and federal regulations regarding record retention and disposal. This chart ensures that records are retained for the necessary periods, helping to prevent legal issues and facilitating audits. 3. Protection against Data Loss: By employing the Wisconsin Financial Record Storage Chart, individuals and businesses can safeguard important financial data against loss, damage, or unauthorized access. It establishes protocols for secure storage, backups, and digital preservation mechanisms. II. Types of Wisconsin Financial Record Storage Chart: 1. Personal Financial Record Storage Chart: This type of chart is specifically designed to assist individuals in managing personal financial records. It includes documents such as bank statements, tax returns, investment records, insurance policies, loan agreements, and other relevant personal financial records. 2. Small Business Financial Record Storage Chart: Designed for small businesses and startups, this chart provides a structured framework for managing financial records relating to business operations. It encompasses financial statements, receipts, invoices, purchase orders, payroll records, contracts, licenses, and permits. 3. Nonprofit Financial Record Storage Chart: Catered to nonprofit organizations, this chart aids in maintaining financial records required for transparency, accountability, and grant compliance. It covers documents related to donations, grants, expenses, budgets, fundraising, and board meeting minutes. 4. Real Estate Financial Record Storage Chart: Targeting individuals and businesses involved in real estate transactions, this chart focuses on managing financial records specific to property ownership, rentals, mortgages, leases, property taxes, and HOA expenses. 5. Government Financial Record Storage Chart: This chart variant serves governmental agencies, providing guidelines for the retention and management of financial records required for transparency, accountability, and audits. It covers budgets, contracts, payroll, tax records, procurement documents, and financial reports. Conclusion: The Wisconsin Financial Record Storage Chart offers a comprehensive approach to managing financial records efficiently, ensuring compliance, and protecting vital information. Tailored to various sectors, such as personal finance, small businesses, nonprofits, real estate, and government agencies, this chart enables individuals and organizations to keep their financial affairs in order while minimizing risks and optimizing record retrieval.

Wisconsin Financial Record Storage Chart

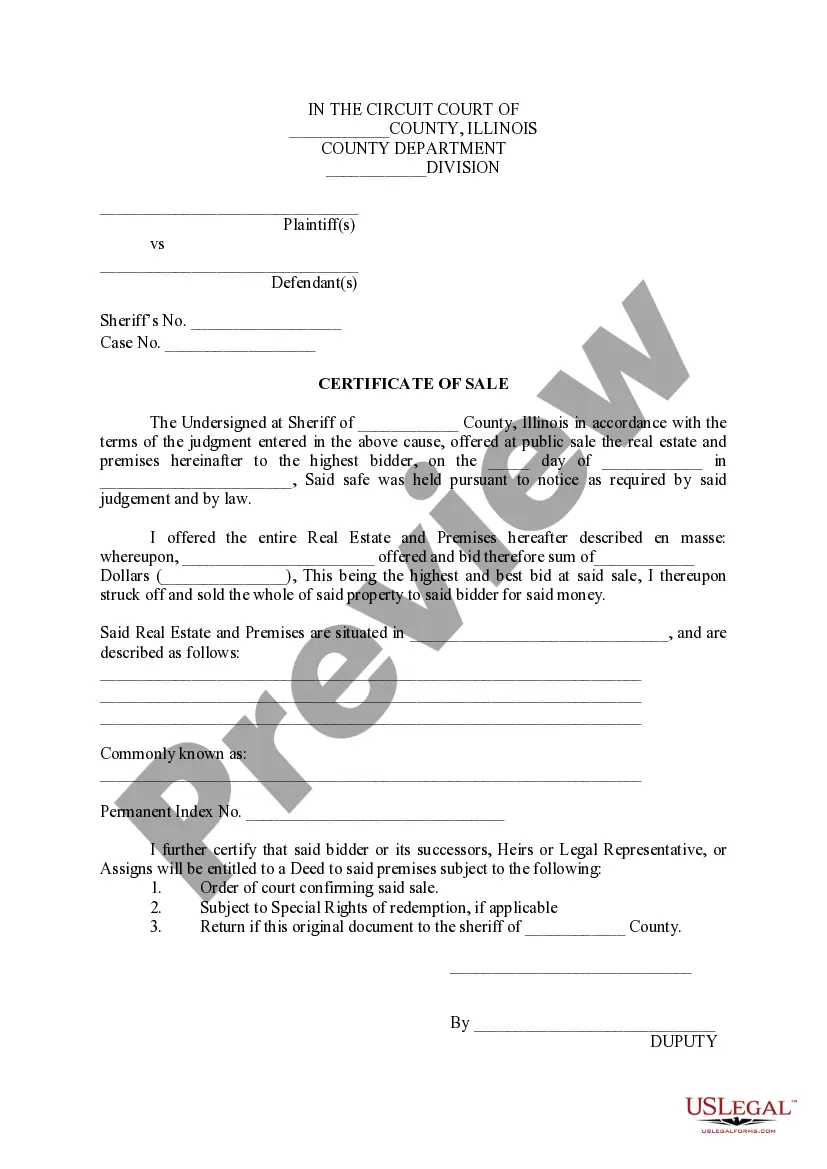

Description

How to fill out Wisconsin Financial Record Storage Chart?

If you have to full, obtain, or printing authorized record layouts, use US Legal Forms, the largest selection of authorized forms, that can be found on the Internet. Use the site`s easy and handy lookup to get the paperwork you will need. Different layouts for company and person reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to get the Wisconsin Financial Record Storage Chart in just a handful of clicks.

Should you be presently a US Legal Forms buyer, log in for your accounts and then click the Acquire button to find the Wisconsin Financial Record Storage Chart. You can even entry forms you formerly downloaded from the My Forms tab of your own accounts.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for your right town/country.

- Step 2. Make use of the Review choice to examine the form`s content material. Never forget to learn the information.

- Step 3. Should you be unsatisfied together with the develop, utilize the Search industry towards the top of the screen to discover other versions of your authorized develop template.

- Step 4. When you have found the shape you will need, click on the Buy now button. Select the costs plan you like and add your credentials to register for an accounts.

- Step 5. Approach the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Select the file format of your authorized develop and obtain it on the device.

- Step 7. Complete, modify and printing or indication the Wisconsin Financial Record Storage Chart.

Each and every authorized record template you purchase is the one you have eternally. You might have acces to each and every develop you downloaded inside your acccount. Go through the My Forms segment and select a develop to printing or obtain once more.

Remain competitive and obtain, and printing the Wisconsin Financial Record Storage Chart with US Legal Forms. There are millions of professional and express-distinct forms you can utilize for the company or person needs.