Title: Wisconsin Sample Letter for Corrections to Credit Report Introduction: When individuals in Wisconsin encounter errors or discrepancies on their credit reports, it is crucial to take steps to correct them promptly. A well-written and detailed letter can help rectify any mistakes and ensure accurate information on credit reports. This article provides a detailed description of what a Wisconsin Sample Letter for Corrections to Credit Report is and its various types. Key Points: 1. Why write a Wisconsin Sample Letter for Corrections to Credit Report: — Highlight the importance of accurate credit reports for financial stability. — Emphasize the impact errors can have on creditworthiness and the ability to access loans, mortgages, or other financial opportunities. 2. Addressing credit report errors in Wisconsin: — Explain how the Fair Credit Reporting Act (FCRA) grants individuals the right to dispute inaccurate information. — Discuss the three major credit bureaus (Equifax, Experian, and TransUnion) and their obligation to investigate and correct errors. 3. Components of a Wisconsin Sample Letter for Corrections to Credit Report: — Contact information: Include full name, current address, and telephone number(s). — Date of the letter: Be sure to mention the precise date. — Reference: Provide the credit report details (account number, date, and name of the credit bureau). — Statement of dispute: Describe the specific error(s) on the credit report with clarity and accuracy. — Supporting documentation: Encourage attaching any relevant documents that prove the inaccuracy, such as payment receipts, letters, or bank statements. — Request for investigation: Clearly state the expectation for a thorough investigation and resolution of the dispute within the mandated 30-day timeframe. — Complimentary closing: Sign off the letter with regards and full name. 4. Types of Wisconsin Sample Letters for Corrections to Credit Report: — Letter for incorrect personal information: Address discrepancies related to name, address, social security number, or other personal details. — Letter for erroneous account information: Resolve discrepancies concerning account balances, payment history, or incorrect account status. — Letter for identity theft or fraudulent activities: Report any fraudulent accounts or identity theft incidents and request their removal. — Letter for outdated negative information: Dispute outdated negative items, such as late payments or collection accounts that no longer apply. — Letter for mixed credit files: Address the merging of credit information with another person having a similar name. — Letter for errors due to the creditor: Dispute errors made by the creditor in reporting accurate payment information or resolving accounts. — Letter for errors resulting from public records: Dispute inaccuracies in public record information displayed on the credit report, such as bankruptcies or tax liens. Conclusion: By understanding the importance of accurate credit reports and utilizing a Wisconsin Sample Letter for Corrections to Credit Report, individuals can protect their financial reputation, rectify errors, and improve their creditworthiness. Ensure to tailor the letter to the specific error and follow up with the credit bureaus to confirm the completion of the investigation and correction process.

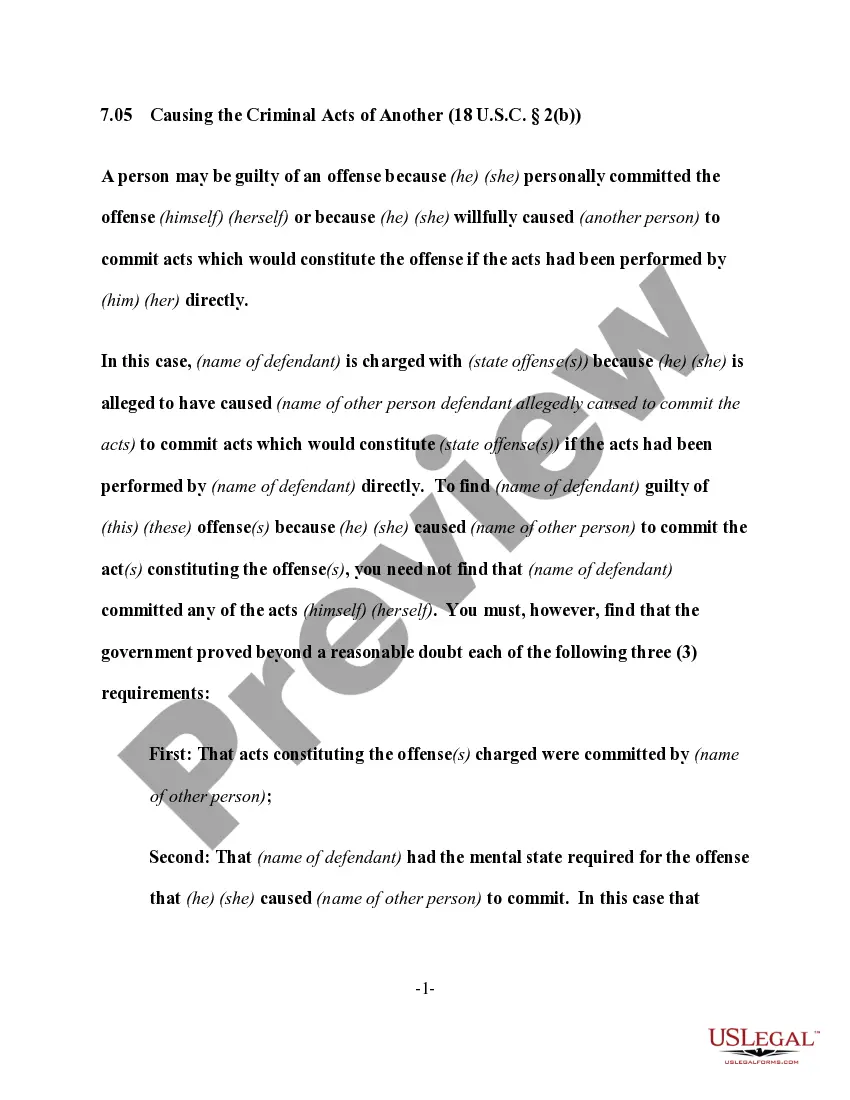

Wisconsin Sample Letter for Corrections to Credit Report

Description

How to fill out Wisconsin Sample Letter For Corrections To Credit Report?

Discovering the right legitimate document design might be a struggle. Naturally, there are a variety of web templates available online, but how can you discover the legitimate develop you require? Use the US Legal Forms web site. The assistance offers 1000s of web templates, including the Wisconsin Sample Letter for Corrections to Credit Report, that you can use for company and personal demands. Each of the forms are checked by specialists and meet up with state and federal requirements.

Should you be presently signed up, log in to the bank account and then click the Acquire key to obtain the Wisconsin Sample Letter for Corrections to Credit Report. Make use of your bank account to search with the legitimate forms you have ordered previously. Go to the My Forms tab of your bank account and obtain an additional duplicate in the document you require.

Should you be a new consumer of US Legal Forms, here are basic directions for you to adhere to:

- First, make certain you have chosen the correct develop for your personal city/county. You can look through the shape utilizing the Preview key and study the shape outline to guarantee it will be the right one for you.

- When the develop fails to meet up with your needs, make use of the Seach field to obtain the right develop.

- When you are sure that the shape would work, go through the Purchase now key to obtain the develop.

- Pick the costs prepare you desire and type in the required information. Make your bank account and purchase the order using your PayPal bank account or bank card.

- Choose the data file format and down load the legitimate document design to the device.

- Total, edit and print and indication the obtained Wisconsin Sample Letter for Corrections to Credit Report.

US Legal Forms may be the biggest local library of legitimate forms that you can find different document web templates. Use the service to down load professionally-manufactured documents that adhere to state requirements.