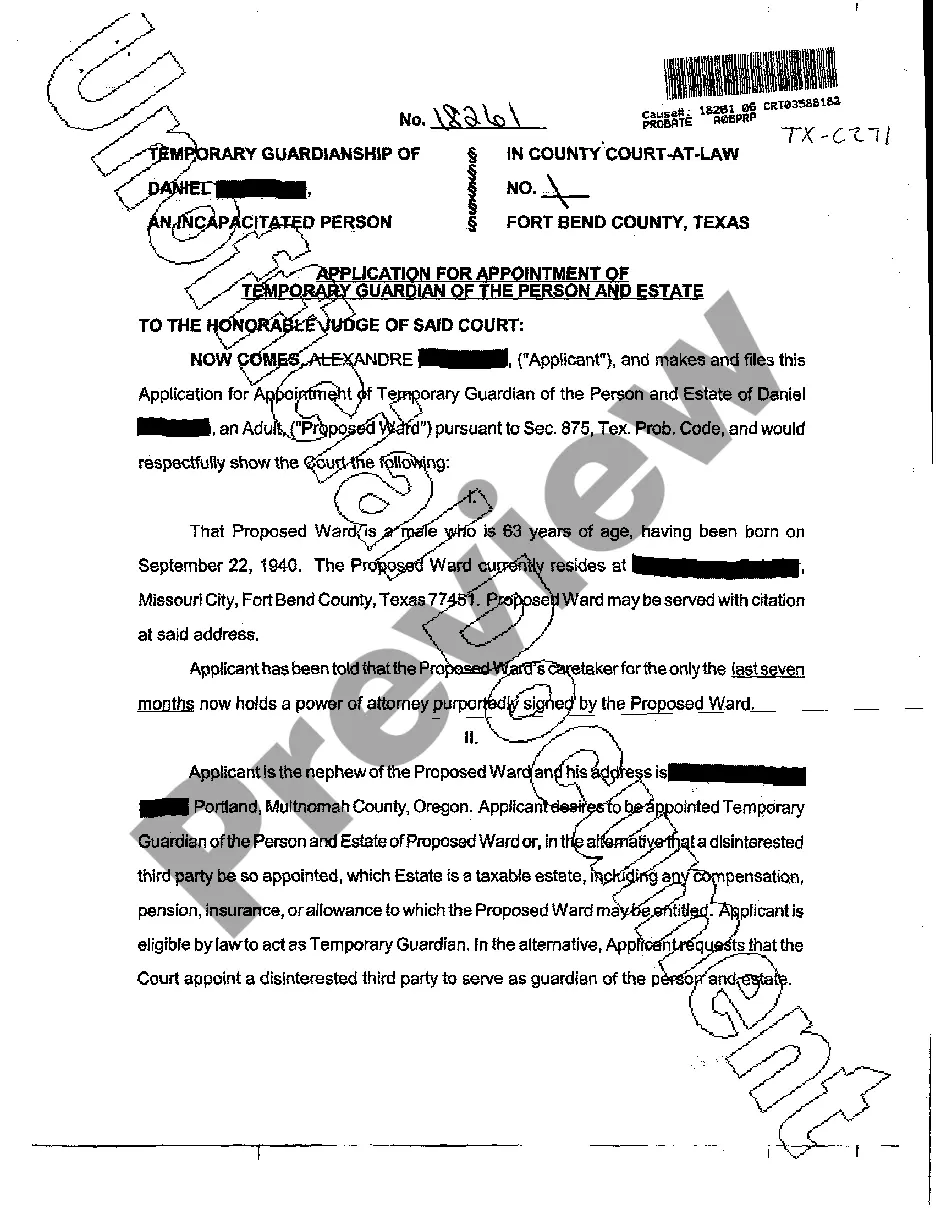

A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions for the appointment of a receiver to manage the affairs and assets of a debtor facing financial distress. This agreement is entered into by the creditors and the debtor, aiming to protect the interests of the creditors while ensuring the orderly management of the debtor's assets and liabilities. Keywords: Wisconsin, agreement, creditors, debtor, appointment, receiver, financial distress, assets, liabilities, interests. There are several types of Wisconsin Agreements between Creditors and Debtor for Appointment of Receiver, including: 1. Voluntary Agreement: This type of agreement is entered into voluntarily by the debtor and the majority of creditors. It allows for the appointment of a receiver to facilitate the orderly liquidation or restructuring of the debtor's assets. 2. Involuntary Agreement: In cases where the debtor fails to meet their financial obligations and multiple creditors seek to protect their interests, an involuntary agreement may be sought. This agreement requires court intervention to appoint a receiver. 3. Interim Agreement: An interim agreement may be used to appoint a receiver on a temporary or emergency basis to manage the debtor's assets until a more permanent solution or agreement is reached. 4. Pre-Packaged Agreement: In certain situations, the debtor may work in collaboration with key creditors to develop a pre-packaged agreement for the appointment of a receiver. This agreement outlines the terms and conditions in advance, allowing for a faster and more efficient process. Regardless of the specific type of agreement, the primary goal is to appoint a receiver who acts as a neutral third party, responsible for safeguarding the assets, determining their value, and distributing the proceeds to the creditors in accordance with their priority claims. It is important to note that the terms and conditions of a Wisconsin Agreement between Creditors and Debtor for Appointment of Receiver may vary based on the specific circumstances and the preferences of the parties involved. Legal advice is crucial when drafting or entering into such an agreement to ensure compliance with Wisconsin law and protection of all parties' interests.