Wisconsin Reorganization of Partnership by Modification of Partnership Agreement

Description

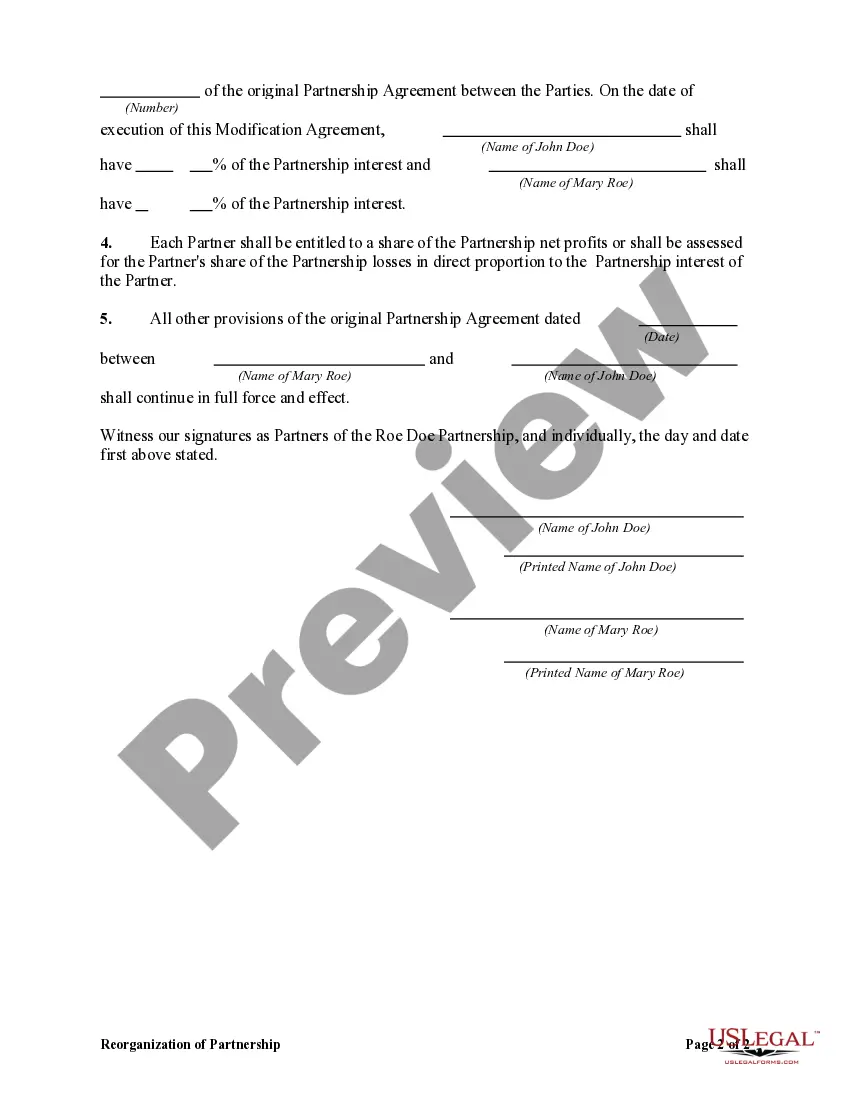

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

It is feasible to spend hours online trying to locate the valid document template that aligns with the federal and state regulations you require.

US Legal Forms offers a vast collection of valid forms that can be evaluated by experts.

You can obtain or print the Wisconsin Reorganization of Partnership by Modification of Partnership Agreement from our service.

First, ensure that you have selected the correct document template for the county/city of your choice. Read the form description to verify you have chosen the right form. If available, use the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can complete, modify, print, or sign the Wisconsin Reorganization of Partnership by Modification of Partnership Agreement.

- Each valid document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the applicable option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Yes, you can file articles of organization online in Wisconsin, which makes the process quick and efficient. The Wisconsin Department of Financial Institutions provides an online portal where you can complete and submit your forms. By taking advantage of this service, you can initiate your Wisconsin Reorganization of Partnership by Modification of Partnership Agreement without unnecessary delays.

To obtain a new article of organization, you generally need to file a new application with the Wisconsin Department of Financial Institutions. If your previous articles no longer serve your needs, this process ensures you have updated and relevant documentation. A new article may be necessary as part of your Wisconsin Reorganization of Partnership by Modification of Partnership Agreement, and tools like US Legal Forms can facilitate your filing.

Yes, articles of organization can be changed through a formal amendment process. This involves filing specific forms with the state and paying any associated fees. Changes might be necessary for various reasons, such as adjustments in the partnership structure or business activities. For effective management of your Wisconsin Reorganization of Partnership by Modification of Partnership Agreement, ensure you follow all legal requirements.

The time it takes to amend articles of organization varies, but it's generally a straightforward process. After submitting your amendment to the Wisconsin Department of Financial Institutions, it typically takes a few business days for processing. However, if your amendment requires further review, it may take longer. To streamline your Wisconsin Reorganization of Partnership by Modification of Partnership Agreement, ensure that all paperwork is complete and accurate.

Changing a partnership typically involves modifying the partnership agreement. You and your partners should discuss the necessary changes and reach a consensus. Then, you will need to draft and formally sign the amended agreement to ensure it reflects the updated terms. For a seamless Wisconsin Reorganization of Partnership by Modification of Partnership Agreement, consider using resources like US Legal Forms to guide you through the process.

Yes, you can amend a partnership agreement. This process usually involves all partners agreeing to the changes and documenting the amendment properly. The Wisconsin Reorganization of Partnership by Modification of Partnership Agreement allows for flexible updates to your agreement. Engaging legal counsel can help ensure the amendments adhere to current laws and protect everyone's interests.

To change the terms of a partnership agreement, partners must agree on modifications and document those changes officially. This is often carried out through a Wisconsin Reorganization of Partnership by Modification of Partnership Agreement. It’s crucial that all partners are involved in discussions and approvals to maintain harmony and transparency. Legal advice can guide you in making these adjustments correctly.

Changing your address with your LLC in Wisconsin requires filing a form with the state. Typically, you would submit the appropriate paperwork to the Wisconsin Department of Financial Institutions. This process ensures that your official records are updated, which is necessary for legal notifications and compliance. Keeping your contact information current helps avoid potential legal issues.

Absolutely, a partnership agreement can be modified or changed as needed. This is typically done through a Wisconsin Reorganization of Partnership by Modification of Partnership Agreement, allowing partners to adjust terms and conditions. It's advisable to document any changes in writing to maintain clarity and avoid disputes. Legal assistance can ensure your changes meet all legal standards.

Wisconsin Form 3 is a document used for specific tax filings for partnerships in the state. It is critical for reporting income, deductions, and credits, ensuring compliance with state tax requirements. Completing this form accurately is crucial for maintaining your partnership's good standing with the state. You can find this form through the Wisconsin Department of Revenue.