Title: Wisconsin Checklist — Leasing vs. Purchasing: A Comprehensive Guide for Making the Right Decision Introduction: In Wisconsin, individuals and businesses often have to decide whether to lease or purchase assets such as vehicles, equipment, or property. This detailed checklist aims to help you make an informed decision by highlighting the key factors to consider when comparing leasing and purchasing options in Wisconsin. We will explore the various aspects associated with leasing and purchasing, covering different types of assets like vehicles and real estate. Let's delve into the Wisconsin Checklist — Leasing vs. Purchasing! 1. Understanding Leasing: — Types of Leases: Operating Lease, Finance Lease, and True Lease. — Flexibility and Cost: Evaluate the contract's terms, monthly payments, maintenance responsibilities, and potential tax advantages. — Duration: Assess the lease period's suitability for your needs and whether early termination or renewal options are available. — Mileage and Usage: Determine the allowable mileage and any restrictions on the asset's use. — Return and End of Lease Options: Familiarize yourself with potential return conditions, purchase options, and how lease-end costs may be calculated. 2. Evaluating Purchasing: — Types of Purchase: Outright Purchase, Financing, or Loans. — Budget Considerations: Analyze the upfront costs, down payment requirements, interest rates, maintenance expenses, and possible tax implications. — Depreciation and Ownership: Understand how asset depreciation may affect your investment and assess the longevity of ownership. — Asset Customization: Determine whether the asset's customization is essential and if purchasing allows for modifications. — Resale Value: Research the asset's potential resale value in the market and evaluate the impact on your long-term financial strategy. 3. Vehicle Leasing vs. Purchasing: — Leasing a Vehicle: Benefits of low monthly payments, warranty coverage, easy upgrades, and avoiding depreciation risks. — Purchasing a Vehicle: Advantages of long-term ownership, customization options, unlimited mileage, and building equity. 4. Real Estate Leasing vs. Purchasing: — Leasing Real Estate: Benefits of lower upfront costs, flexibility for changing locations, reduced maintenance responsibilities, and potential tax deductions. — Purchasing Real Estate: Advantages of building equity, potential appreciation, long-term stability, and freedom to customize the property. Conclusion: When deciding between leasing and purchasing in Wisconsin, careful consideration of the checklist's various aspects is crucial. While leasing offers flexibility and lower initial costs, purchasing provides long-term ownership benefits and potential appreciation. Evaluate your specific needs, priorities, available budget, and future goals to make an informed decision that aligns with your circumstances. Remember, consulting with financial advisors or experts is always advisable to ensure an optimal choice for your Wisconsin-based business or personal requirements.

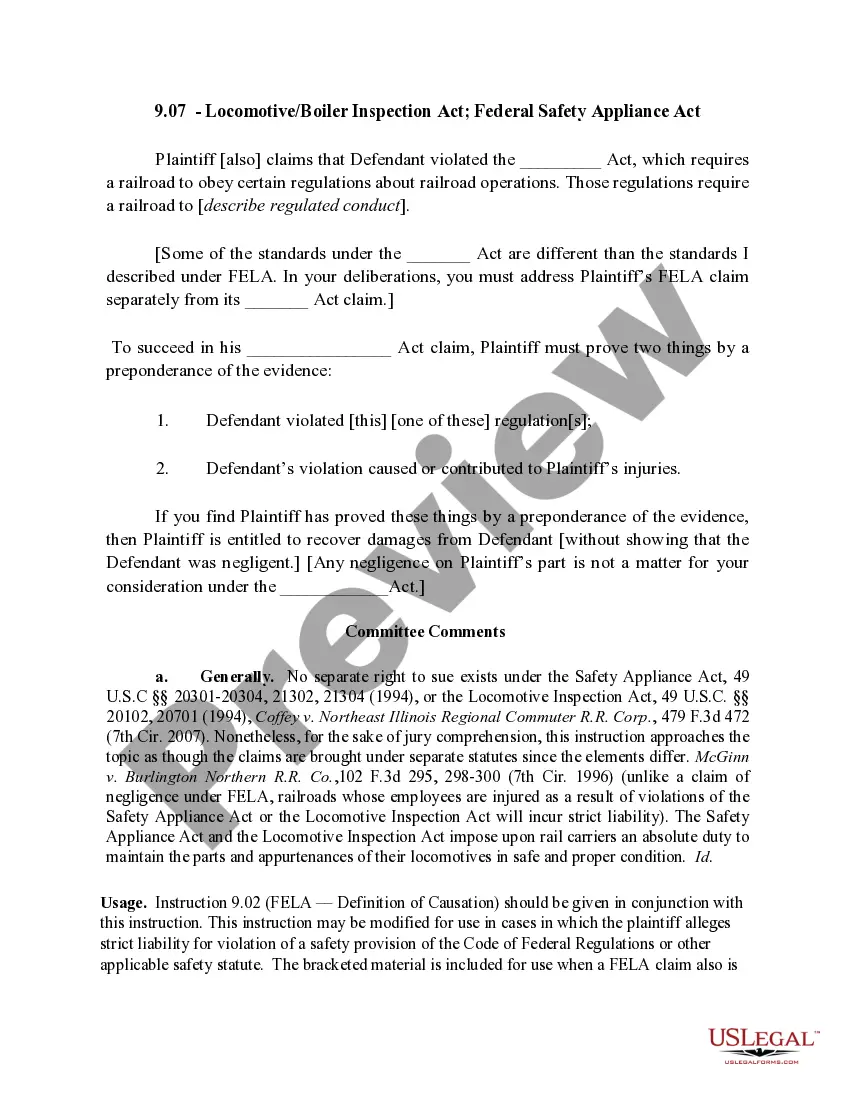

Wisconsin Checklist - Leasing vs. Purchasing

Description

How to fill out Wisconsin Checklist - Leasing Vs. Purchasing?

US Legal Forms - one of several largest libraries of legal kinds in the United States - gives a wide array of legal document web templates you may down load or printing. While using site, you can find a huge number of kinds for business and individual reasons, sorted by types, says, or key phrases.You can find the newest models of kinds just like the Wisconsin Checklist - Leasing vs. Purchasing within minutes.

If you currently have a monthly subscription, log in and down load Wisconsin Checklist - Leasing vs. Purchasing through the US Legal Forms catalogue. The Obtain key can look on each type you view. You gain access to all previously acquired kinds in the My Forms tab of the bank account.

In order to use US Legal Forms for the first time, listed below are straightforward guidelines to obtain began:

- Be sure to have chosen the correct type for your personal town/state. Click on the Preview key to review the form`s information. Look at the type description to ensure that you have chosen the correct type.

- In the event the type doesn`t suit your needs, take advantage of the Lookup industry towards the top of the screen to get the one that does.

- Should you be content with the form, verify your option by visiting the Acquire now key. Then, pick the prices strategy you favor and supply your qualifications to register for an bank account.

- Method the deal. Make use of your credit card or PayPal bank account to accomplish the deal.

- Select the formatting and down load the form on your device.

- Make changes. Fill up, modify and printing and indication the acquired Wisconsin Checklist - Leasing vs. Purchasing.

Each design you put into your money does not have an expiry particular date and is your own for a long time. So, if you wish to down load or printing yet another version, just visit the My Forms area and then click on the type you require.

Gain access to the Wisconsin Checklist - Leasing vs. Purchasing with US Legal Forms, the most extensive catalogue of legal document web templates. Use a huge number of specialist and express-specific web templates that satisfy your organization or individual demands and needs.