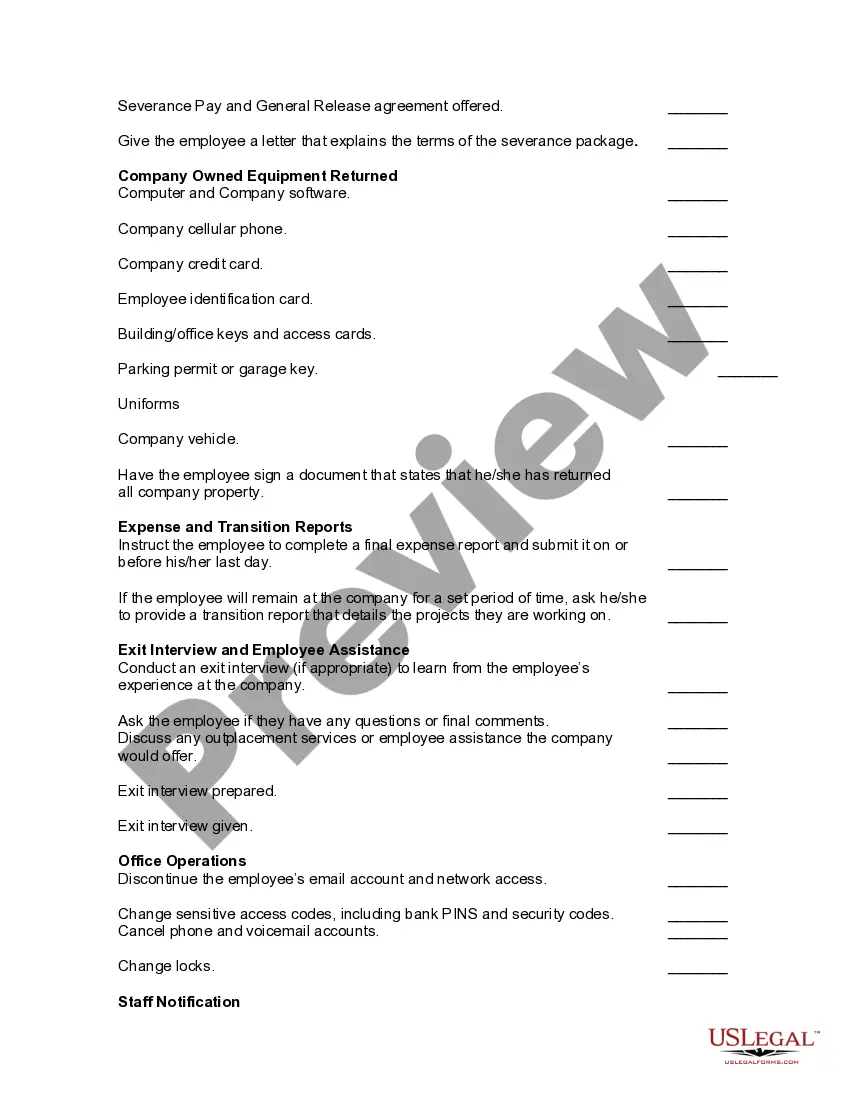

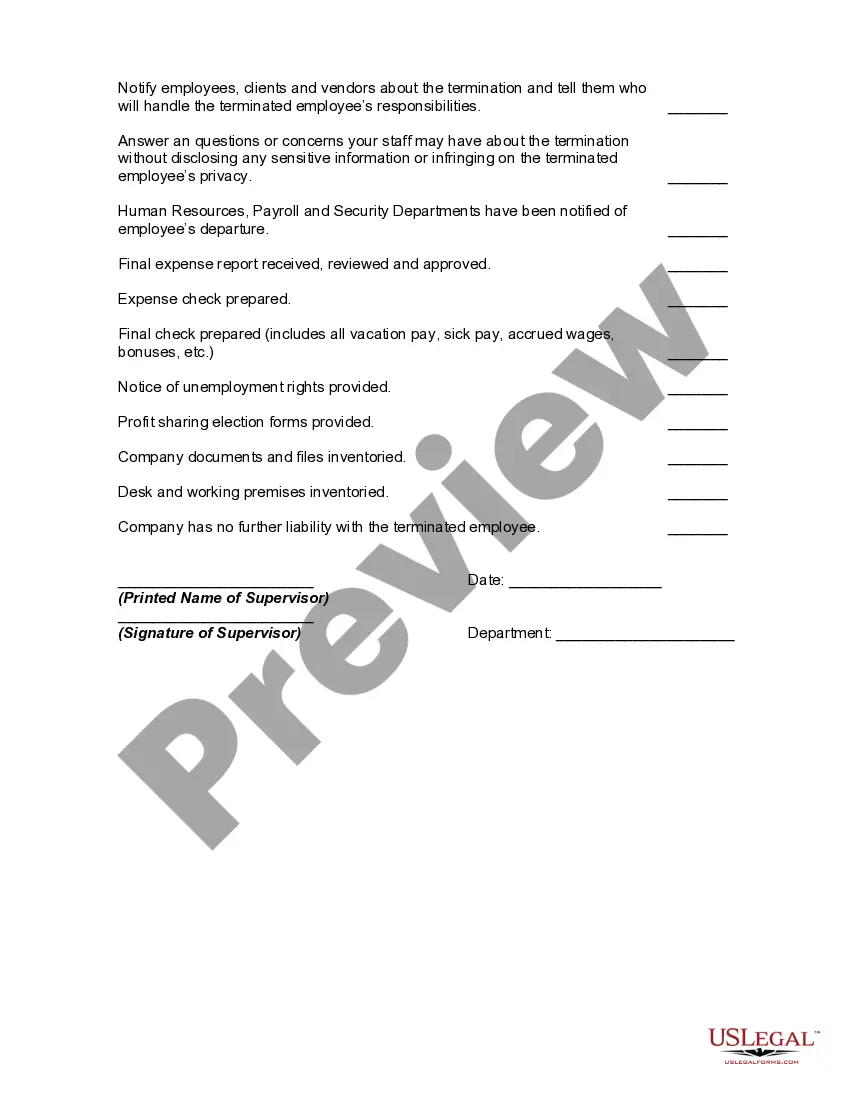

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Wisconsin Worksheet — Termination of Employment is a comprehensive document that outlines the necessary steps and information required when terminating an employee in the state of Wisconsin. This worksheet acts as a guide for employers, ensuring a smooth and legally compliant termination process. The termination of employment can occur in various circumstances, each requiring specific considerations and actions. Here are different types of Wisconsin Worksheets — Termination of Employment: 1. Voluntary Termination: This type occurs when an employee decides to leave a job position and terminate their employment voluntarily. The worksheet helps employers outline the necessary paperwork and procedures for handling this situation, such as providing the employee with forms for voluntary separation, calculating their final paycheck, and collecting company property. 2. Involuntary Termination: In cases where an employer chooses to terminate an employee's contract, the worksheet assists in ensuring that the termination is conducted within the boundaries of state employment laws. It helps employers document the reasons for termination, determine appropriate advance notice requirements, calculate final pay and any accrued benefits, and guide through severance pay considerations. 3. Layoff or Reduction in Force: When an employer needs to lay off employees due to financial constraints or restructuring, this worksheet provides vital resources. It helps employers determine the criteria for selecting employees, such as seniority or job performance, and guides through the process of issuing required notices, conducting meetings, complying with federal and state laws, and arranging appropriate final pay and benefits. 4. Termination for Cause: In situations where an employee's conduct or performance falls below acceptable standards, this worksheet helps employers review the necessary procedures for terminating employment with cause. It ensures documentation of incidents, proper investigations, witness statements, disciplinary measures taken, and adherence to any contractual obligations, ultimately safeguarding against potential legal repercussions. Furthermore, the Wisconsin Worksheet — Termination of Employment encompasses a range of key topics, such as: — Verification of employment eligibility — Final paycheck calculation— - Severance agreements — Unused vacation or paid time off (PTO) balances — COBRA benefitcontinuationio— - Return of company property — Non-disclosure agreements (NDAs) and non-compete clauses — Unemployment insurance eligibility and notices By utilizing the Wisconsin Worksheet — Termination of Employment, employers can effectively navigate the complex legal landscape surrounding termination procedures in Wisconsin. This comprehensive document ensures compliance with state laws, protects both parties' rights, and helps maintain a fair and transparent process throughout the termination of employment.