Title: Wisconsin Sample Letter for Promotional Letter — Charge Account Keywords: Wisconsin, sample letter, promotional letter, charge account, types, credit, benefits, application process, eligibility, terms, conditions. Introduction: Welcome to Wisconsin's Sample Letter for Promotional Letter — Charge Account! This detailed description will provide you with essential information regarding the types, benefits, and application process of a charge account in Wisconsin. Types of Wisconsin Charge Accounts: 1. Retail Store Charge Account: This type of charge account is offered by retail stores across Wisconsin, enabling customers to make purchases on credit and enjoy special discounts, loyalty rewards, and exclusive offers. 2. Credit Card Charge Account: With a credit card charge account, issued by various financial institutions in Wisconsin, customers can make purchases both online and offline, avail credit facilities, and earn reward points that can be redeemed for various benefits. Benefits of a Wisconsin Charge Account: — Convenient Purchasing: A charge account provides easy access to credit, allowing you to make purchases without immediate payment, ensuring convenience and flexibility. — Exclusive Discounts: Charge accounts often come with special promotions, discounts, and exclusive offers tailored specifically for account holders, helping you save money on your purchases. — Extra Perks: Some charge accounts offer additional benefits such as extended warranties, purchase protection, and travel insurance, enhancing your overall shopping experience. — Building Credit History: By responsibly using a charge account and making regular payments, you can establish or improve your credit history, leading to better financial opportunities in the future. Application Process for a Wisconsin Charge Account: — Research: Begin by researching various accounts offered by retail stores or financial institutions in Wisconsin, comparing factors such as annual fees, interest rates, and rewards programs. — Eligibility Criteria: Determine if you meet the eligibility requirements, which usually involve factors such as age, income, employment status, and credit history. — Gather Required Documents: Gather necessary documents such as identification proof, income details, and any additional information required by the specific institution. — Complete Application: Fill out the application form accurately, ensuring that all provided information is correct and up to date. — Review Terms and Conditions: Carefully read and understand the terms and conditions associated with the charge account, including the interest rates, repayment terms, and any fees associated. — Submit Application: Submit your completed application, along with the required documents, to the relevant institution. — Await Approval: Wait for the institution to review your application and inform you of their decision, which may include a credit limit and the terms associated with your new charge account. Conclusion: Having a charge account in Wisconsin can provide numerous benefits, including access to credit, exclusive discounts, and the ability to establish or improve your credit history. By exploring the different types of charge accounts available, understanding their benefits, and following the application process, you can make informed decisions about obtaining a charge account that suits your needs and financial goals.

Wisconsin Sample Letter for Promotional Letter - Charge Account

Description

How to fill out Wisconsin Sample Letter For Promotional Letter - Charge Account?

US Legal Forms - one of the biggest libraries of lawful forms in the USA - gives an array of lawful file templates it is possible to down load or printing. Using the site, you can find 1000s of forms for business and individual uses, categorized by classes, says, or keywords and phrases.You will find the most recent versions of forms much like the Wisconsin Sample Letter for Promotional Letter - Charge Account in seconds.

If you already possess a subscription, log in and down load Wisconsin Sample Letter for Promotional Letter - Charge Account in the US Legal Forms collection. The Down load switch can look on each and every type you perspective. You get access to all previously saved forms in the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, allow me to share simple recommendations to get you began:

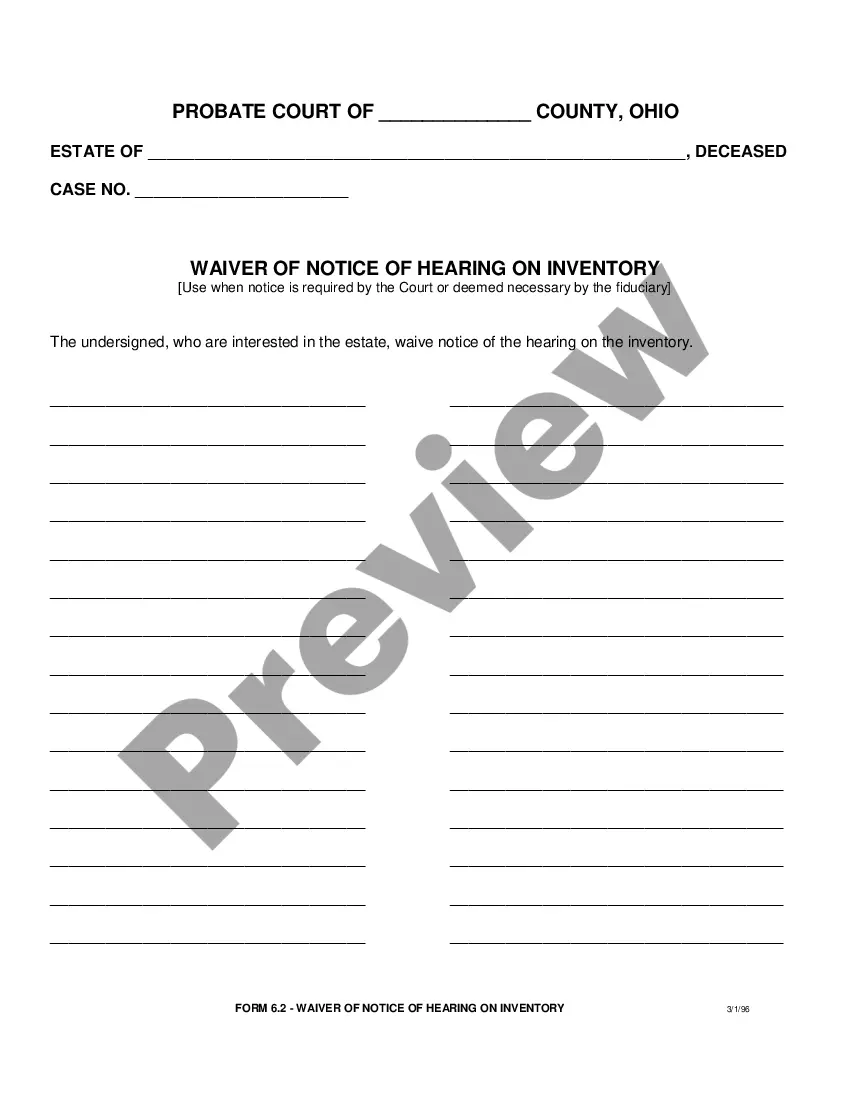

- Ensure you have picked the correct type to your town/area. Go through the Review switch to review the form`s content material. See the type description to actually have selected the correct type.

- In the event the type does not match your requirements, take advantage of the Research industry towards the top of the screen to find the the one that does.

- Should you be happy with the shape, verify your choice by simply clicking the Purchase now switch. Then, choose the costs prepare you like and provide your qualifications to sign up to have an bank account.

- Procedure the financial transaction. Use your credit card or PayPal bank account to perform the financial transaction.

- Pick the file format and down load the shape on your gadget.

- Make changes. Fill up, modify and printing and sign the saved Wisconsin Sample Letter for Promotional Letter - Charge Account.

Every format you included with your account lacks an expiration time and is your own permanently. So, if you would like down load or printing an additional version, just proceed to the My Forms section and then click on the type you want.

Gain access to the Wisconsin Sample Letter for Promotional Letter - Charge Account with US Legal Forms, one of the most comprehensive collection of lawful file templates. Use 1000s of specialist and status-particular templates that meet up with your business or individual requirements and requirements.