Wisconsin Collateral Assignment of Trademarks

Description

How to fill out Collateral Assignment Of Trademarks?

Selecting the finest legal document template can be a challenging endeavor. Naturally, there are countless templates available online, but how can you find the legal document you need? Visit the US Legal Forms website. The platform offers a multitude of templates, such as the Wisconsin Collateral Assignment of Trademarks, that you can use for both business and personal purposes. All templates are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Wisconsin Collateral Assignment of Trademarks. Use your account to search through the legal documents you have previously purchased. Navigate to the My documents section of your account to get another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Buy now button to purchase the form.

Utilize the service to download professionally crafted paperwork that adhere to state requirements.

- Select the pricing plan you wish to use and input the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Wisconsin Collateral Assignment of Trademarks.

- US Legal Forms is the largest repository of legal documents where you can find numerous file templates.

Form popularity

FAQ

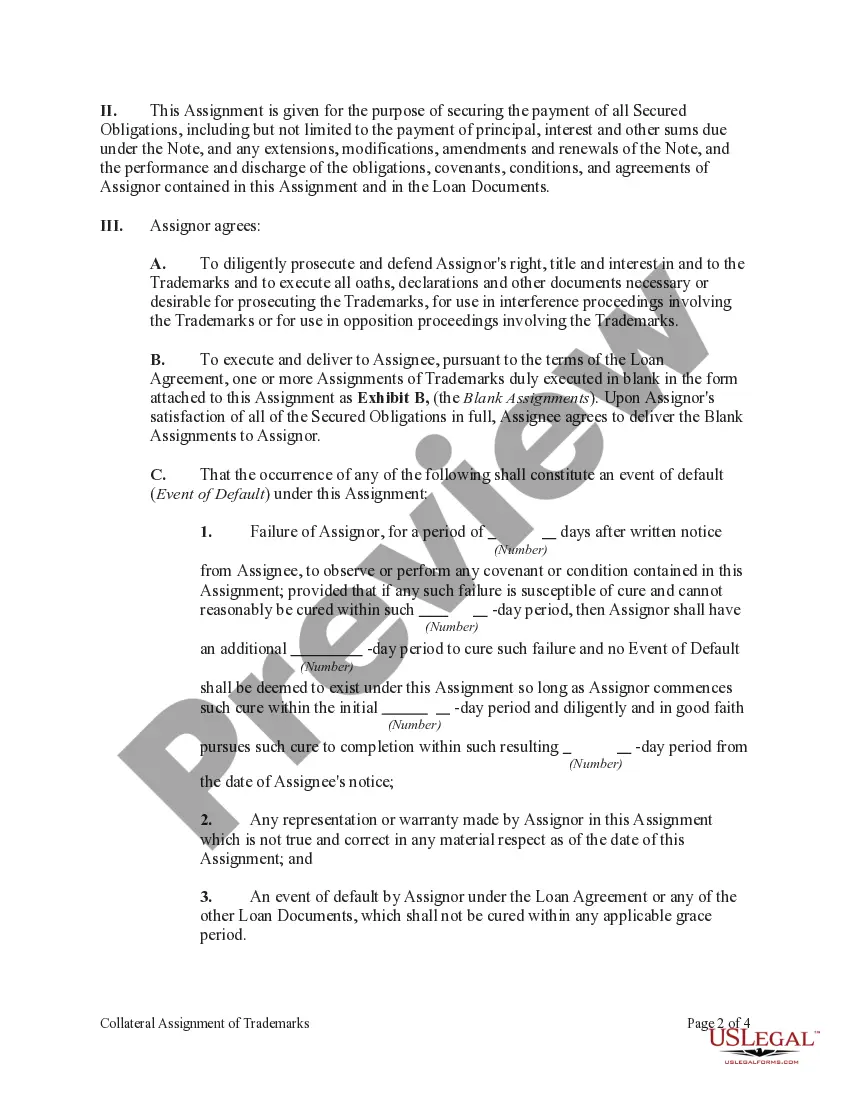

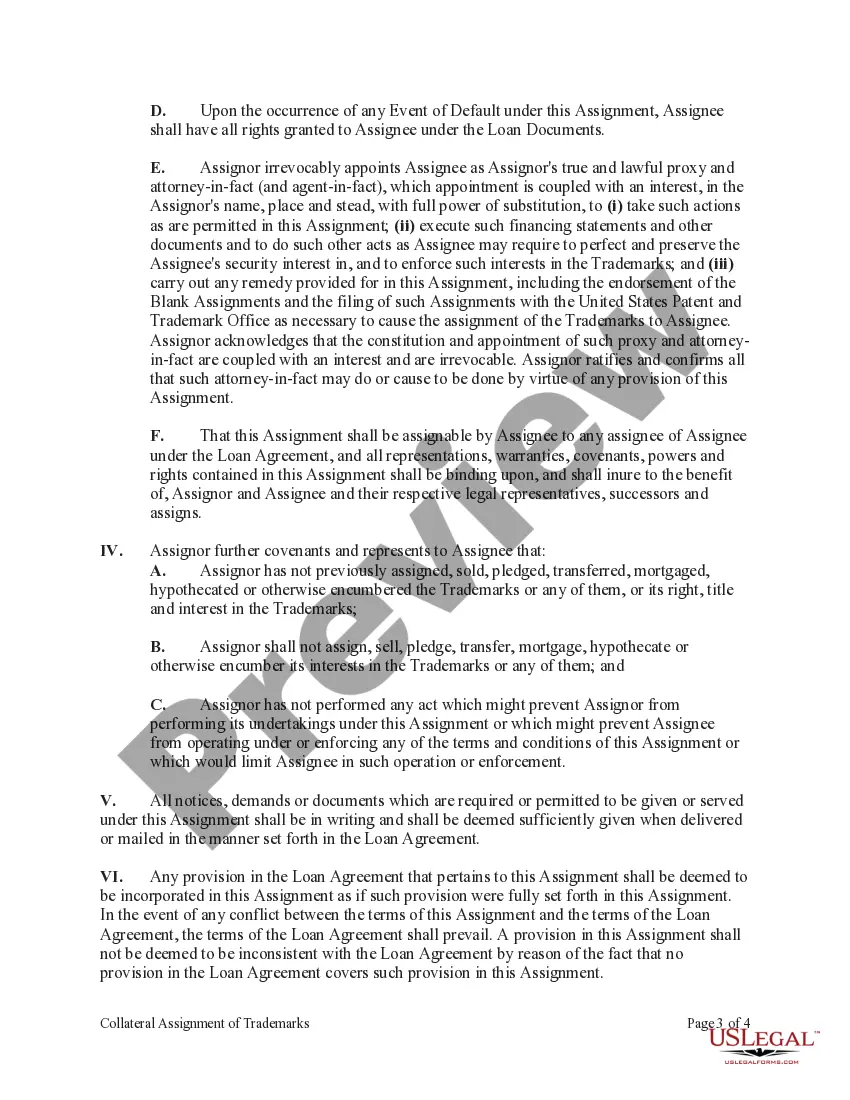

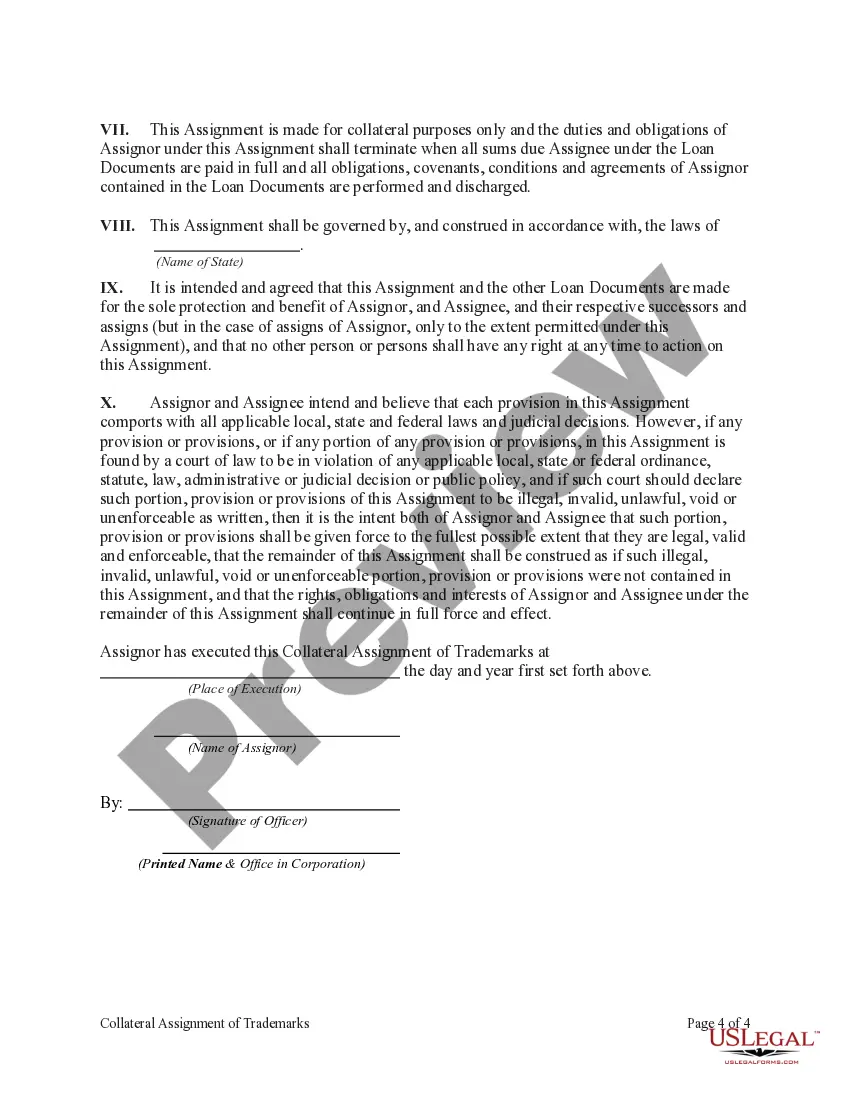

To change the owner of a federal trademark registration or application, a trademark assignment should be signed and recorded with the USPTO. A trademark assignment is a document signed by the original owner (assignor) that transfers ownership of the trademark to a new owner (assignee).

Assignment of a trademark means to transfer the owner's right in a trademark to another person. The transferring party is called the assignor, and the receiving party is called the assignee.

A trademark assignment is the transfer of an owner's property rights in a given mark or marks. Such transfers may occur on their own or as parts of larger asset sales or purchases. Trademark assignment agreements both provide records of ownership and transfer and protect the rights of all parties.

What are the documents required for licensing a trademark assignment ? A valid identity proof of both parties, a copy of the assignment agreement and a filled form TM-P of Trademarks Act 1999 must be produced along with fee payment.

To acquire and maintain trademark rights, it comes down to use of the mark. If the mark is no longer used, no longer used in association with all of the goods/services identified in registration for the mark, or if the mark is used incorrectly, rights in the mark will be lost.

Typically only the party assigning the intellectual property must sign the assignment, and while notarization is strongly preferred it is not strictly required. Once as assignment has been executed, it should be recorded.

Instead, a trademark must be assigned through an Assignment of Rights. That Assignment must transfer not only the trademark and the registration, but must also transfer the goodwill behind the trademark to be valid.

You can claim trademark rights in your unregistered trademark as long as it is distinctive and identifies or distinguishes your products or services. A trade name for your business is not the same as an unregistered trademark and is not given the same protections under federal trademark law.

Assignment of a trademark occurs when the ownership of such mark as such, is transferred from one party to another whether along with or without the goodwill of the business. In case of a registered Trademark, such assignment is required to be recorded in the Register of trade marks.

The Trademark Assignment Should Be in Writing Although an assignment need not be in writing to be effective, it's strongly recommended that it be in the form of a written document signed by both the assignor and the assignee.