Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws refers to a legal process wherein a corporation in the state of Wisconsin can sell its assets without having to comply with bulk sales laws. This allows for a streamlined and expedited sale of assets, offering certain advantages to both buyer and seller. In Wisconsin, bulk sales laws typically require the seller to provide notice to all creditors and comply with specific procedures aimed at protecting the rights of creditors. However, certain transactions are exempt from these requirements, such as the sale of assets by a corporation. This exemption is particularly applicable when a corporation is liquidating its assets or going through a dissolution process. The sale of assets of a corporation in Wisconsin without the need to comply with bulk sales laws is a highly specialized area, often requiring the expertise of legal professionals with knowledge of the state's corporate and commercial laws. By utilizing this exemption, corporations can proceed with asset sales in a more efficient and time-effective manner. It is important to note that while the exemption allows for a simplified process, it does not absolve the corporation from its obligations to creditors. Existing liens and claims against the corporation's assets will remain valid and enforceable, unless specifically addressed in the sale agreement. Key considerations in a Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws include: 1. Asset Valuation: The fair market value of the assets being sold should be determined through thorough appraisal processes to ensure a fair transaction. 2. Asset Sale Agreement: A comprehensive agreement should be drafted, outlining the terms and conditions of the sale, including details on transfer of ownership, purchase price, and any relevant warranties or representations. 3. Creditor Notifications: While not required by bulk sales laws, it is essential to notify creditors of the asset sale to ensure transparency and facilitate resolution of any outstanding obligations. 4. Liabilities and Duties: The asset sale should clearly define the distinction between assumed and non-assumed liabilities of the corporation, protecting both the buyer and seller from potential disputes or claims arising post-sale. Types of Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws may include: 1. Voluntary Corporate Dissolution: When a corporation decides to dissolve voluntarily, it may opt to sell its assets without having to comply with bulk sales laws. 2. Corporate Liquidation: In cases where a corporation is being liquidated, such as during bankruptcy or financial distress, the sale of assets can proceed under this exemption. In conclusion, the Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws offers corporations a more streamlined process for selling their assets. This exemption allows for a simplified transaction, benefiting both buyers and sellers; however, it is imperative to navigate this process with guidance from experienced legal professionals to ensure compliance with all relevant laws and to protect the rights of all parties involved.

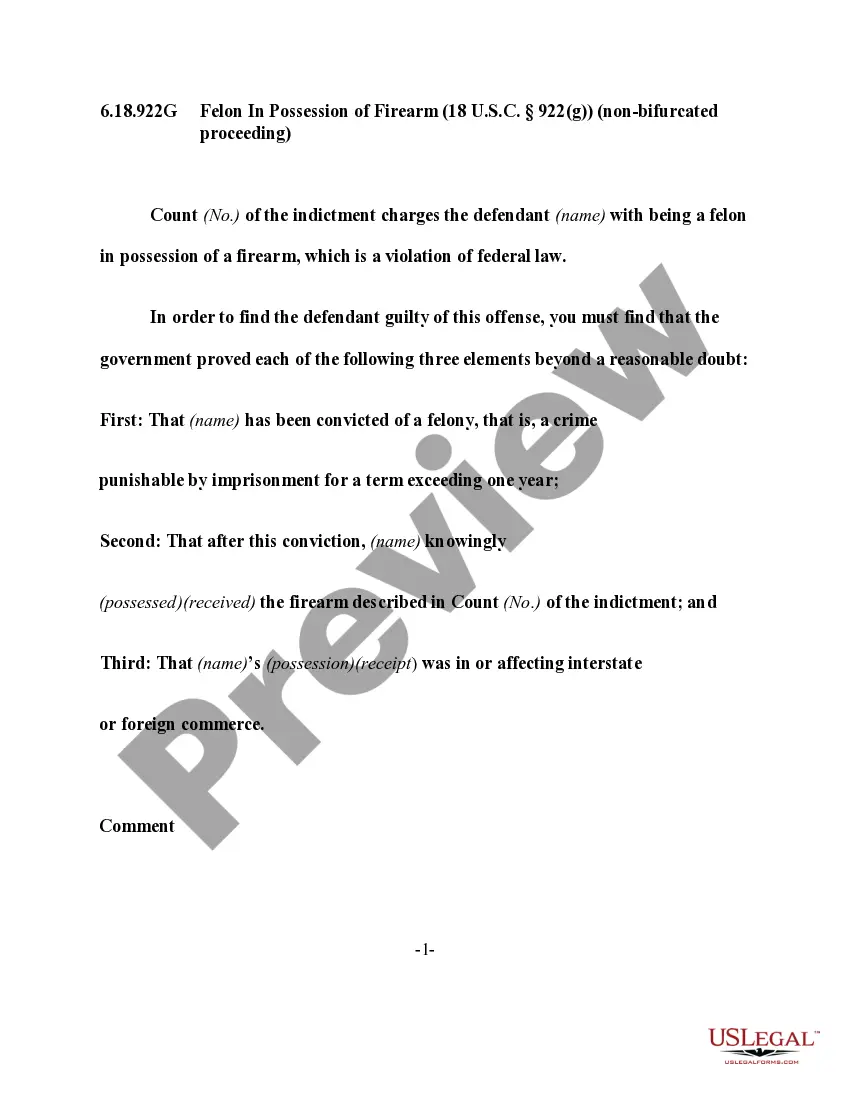

Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Wisconsin Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

Choosing the right legal record template can be a battle. Needless to say, there are a lot of layouts accessible on the Internet, but how will you find the legal kind you need? Use the US Legal Forms website. The support offers a huge number of layouts, for example the Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, that can be used for organization and personal requirements. All the kinds are checked out by professionals and satisfy federal and state needs.

When you are currently registered, log in in your profile and click the Acquire button to get the Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws. Make use of profile to check from the legal kinds you may have bought formerly. Proceed to the My Forms tab of your respective profile and get another copy in the record you need.

When you are a fresh end user of US Legal Forms, listed here are simple directions for you to comply with:

- First, make certain you have selected the correct kind for your city/state. It is possible to look over the shape making use of the Review button and read the shape description to make sure it is the best for you.

- In case the kind does not satisfy your requirements, use the Seach area to discover the right kind.

- When you are positive that the shape is acceptable, select the Get now button to get the kind.

- Select the rates plan you desire and type in the needed information and facts. Design your profile and purchase the order using your PayPal profile or Visa or Mastercard.

- Choose the file format and down load the legal record template in your system.

- Total, modify and print out and indicator the attained Wisconsin Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

US Legal Forms is the biggest collection of legal kinds that you can discover various record layouts. Use the service to down load professionally-created files that comply with condition needs.