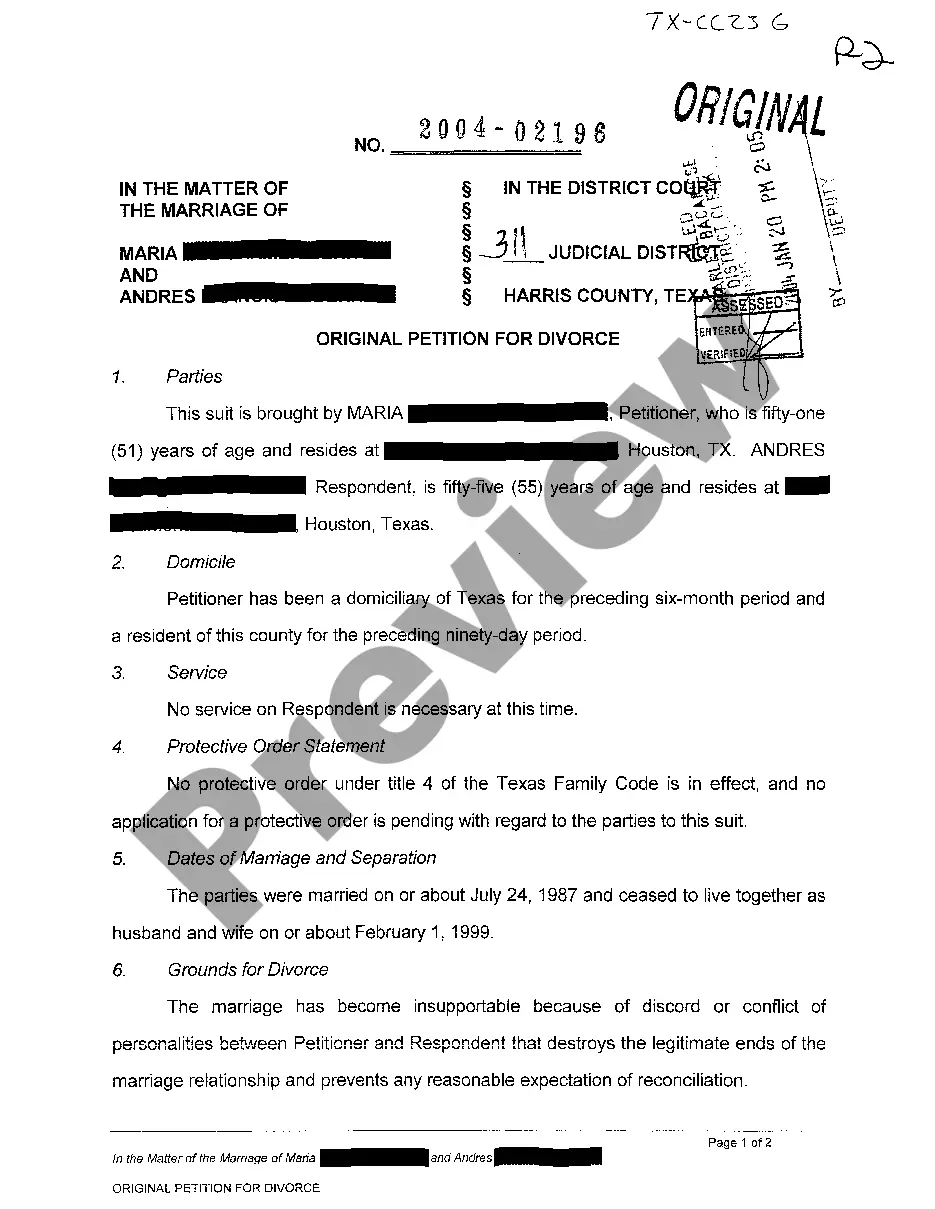

The Wisconsin Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law is a legal document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer. It is designed to comply with the Bulk Sales Law in Wisconsin, which ensures that all creditors are properly notified and reimbursed in case of a sale. This agreement is used specifically when a sole proprietorship is being sold and the closing is to be held in escrow. By opting for an escrow closing, the funds and assets involved in the sale are held by a neutral third party until all conditions of the agreement are met and the transaction is finalized. This safeguards the interests of both the seller and the buyer. The Wisconsin Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law covers various aspects of the transaction, including: 1. Parties involved: Identifies both the seller (sole proprietor) and the buyer, along with their legal names and contact information. 2. Business details: Provides a comprehensive description of the sole proprietorship being sold, including its name, address, assets, liabilities, and any intellectual property rights involved. 3. Purchase price and payment terms: Specifies the agreed-upon purchase price for the business, including any down payment, financing arrangements, and the schedule for releasing funds from escrow. 4. Representations and warranties: Outlines the seller's guarantees about the accuracy of the information provided, the condition of the business, and any ongoing obligations that will be assumed by the buyer. 5. Bulk Sales Law compliance: Includes provisions that ensure compliance with the Bulk Sales Law in Wisconsin, such as notifying creditors and addressing any outstanding liabilities or claims. 6. Closing and escrow process: Details the steps and timelines for the closing, including the requirement for an escrow agent to hold funds and facilitate the transfer of assets and ownership. 7. Dispute resolution: Specifies the methods for resolving any disputes that may arise during or after the sale, such as through mediation or arbitration. 8. Governing law: States that the agreement shall be governed by the laws of Wisconsin, ensuring that any legal action related to the sale will be handled under the state's jurisdiction. Different types of Wisconsin Agreements for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law may exist, depending on specific requirements or modifications desired by the parties involved. However, the basic structure and content discussed above generally remain consistent throughout these variations.

Wisconsin Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Closing In Escrow To Comply With Bulk Sales Law?

Are you currently in a role where you need documents for either professional or personal purposes nearly every day? There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Wisconsin Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Meet Bulk Sales Law, which are designed to satisfy federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Wisconsin Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Meet Bulk Sales Law template.

Access all the document templates you have purchased from the My documents menu. You can retrieve another copy of the Wisconsin Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Meet Bulk Sales Law at any time if necessary. Just select the required form to download or print the document template.

Utilize US Legal Forms, one of the most extensive compilations of legal forms, to save time and avoid errors. The service provides accurately crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

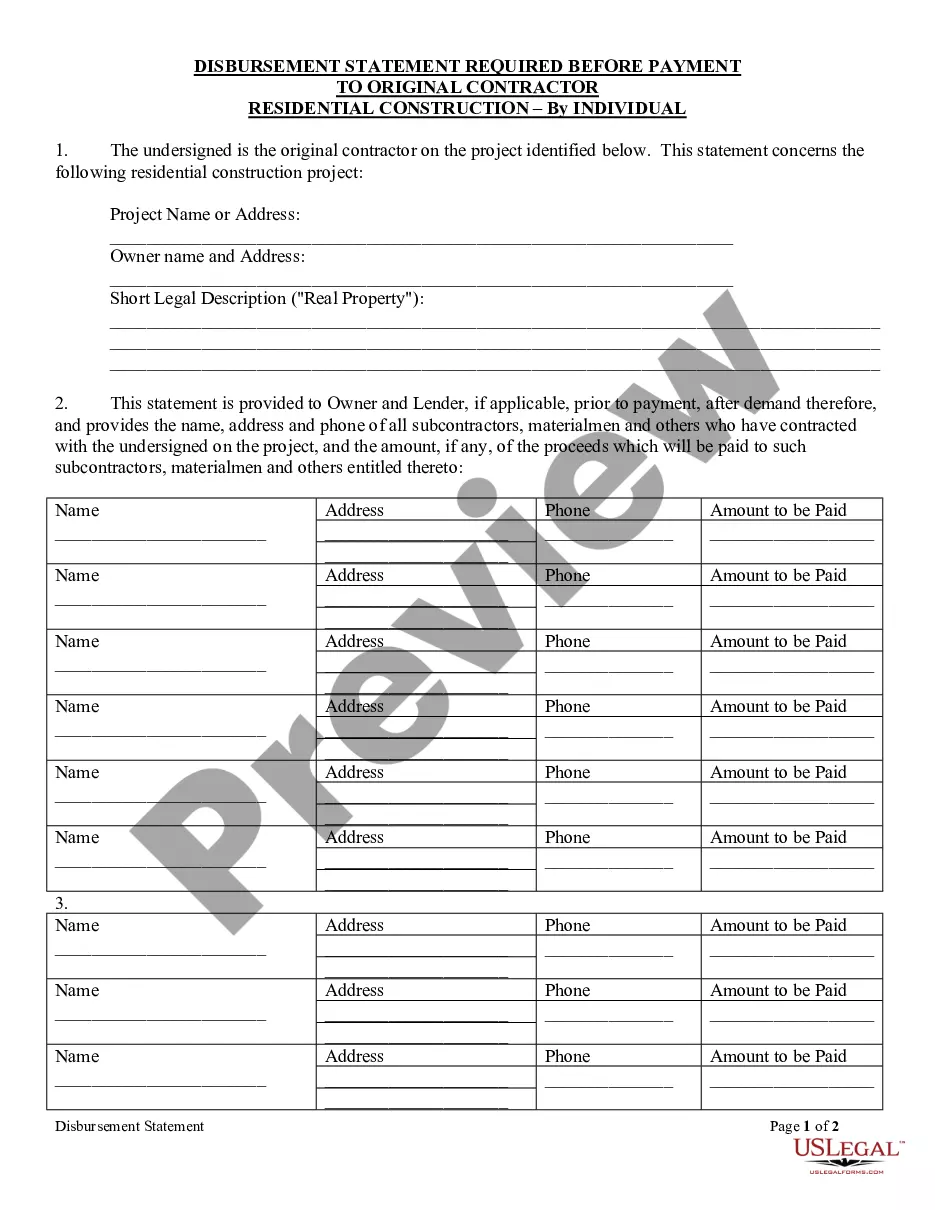

- Locate the form you need and ensure it corresponds to the correct city/county.

- Utilize the Review button to examine the form.

- Verify the details to confirm you have selected the appropriate form.

- If the form is not what you're looking for, use the Search field to find the form that matches your needs and requirements.

- Once you find the right form, click Get now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient format and download your version.

Form popularity

FAQ

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

So the answer to "Can a seller back out on a deal?" is simple: Yes; but without fault on the buyer's part, that breach of contract is going to cost the seller dearly.

Can you back out of an accepted offer? The short answer: yes. When you sign a purchase agreement for real estate, you're legally bound to the contract terms, and you'll give the seller an upfront deposit called earnest money.

Therefore, if you want to cancel a sales contract, you should find a way to legally do so to avoid legal liability.Ask for a mutual rescission. Once you form a valid contract, the contract binds you to its terms.Find a way to unilaterally rescind the contract.Modify a service contract.Modify a sales contract.

Because it's a binding legal document, there may be repercussions if you want to back out of a purchase offer that the seller has already accepted. When you enter into this type of agreement, you are typically required to put down a deposit to demonstrate that you plan to follow through.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

Bulk Sales Law is designed to protect Buyers and Creditors. It was written to prevent owners from (1) selling businesses to good faith Buyers and vanishing with the proceeds, or (2) selling under market value (sweetheart deals) to avoid paying Creditors the full amount owed.

Under Pennsylvania tax law, a Bulk Sales Transfer occurs when 51 % or more of any goods, wares, merchandise, fixtures, machinery, equipment, buildings or real estate of a business are sold.

Bulk sales escrow is an escrow arrangement where the proceeds from the sale of a company or its inventory are placed into a special account, which the seller is forbidden from accessing, to make sure any associated unsecured creditors get their due cash.