A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Wisconsin Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

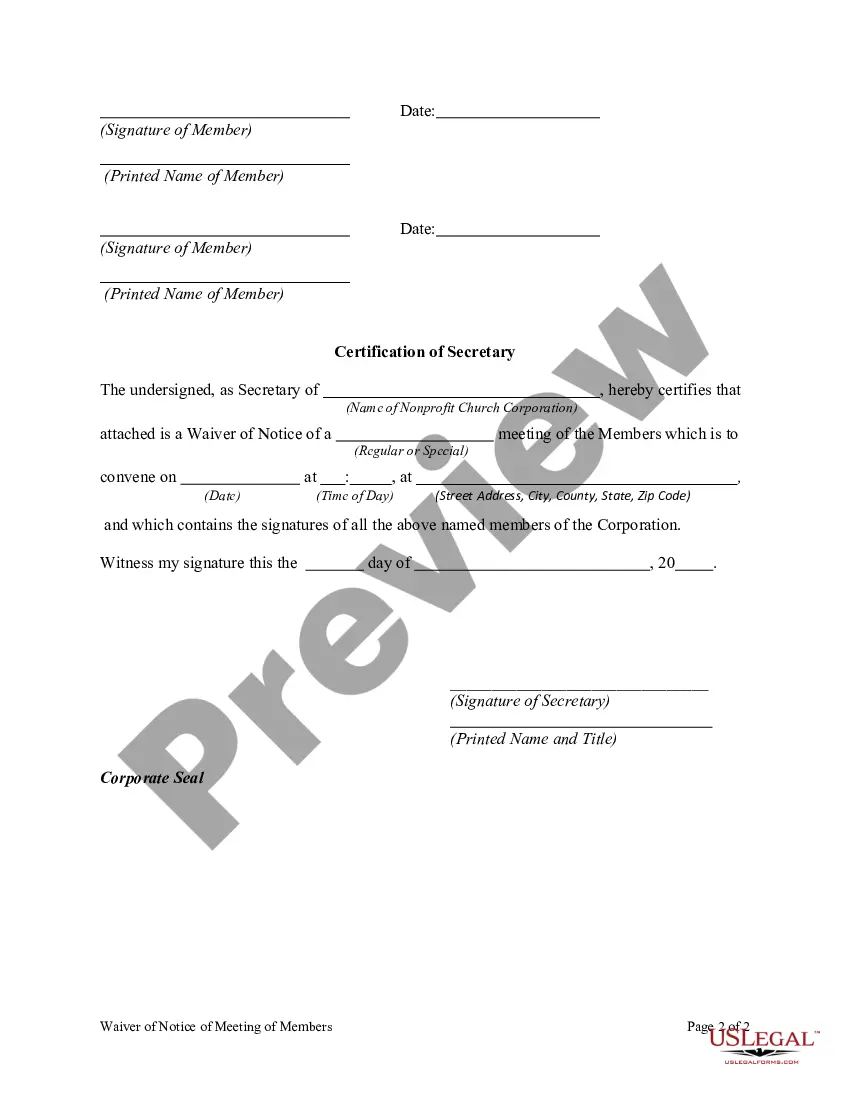

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

Are you presently in a location where you often require documentation for either business or personal purposes.

Numerous sanctioned document templates are available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Wisconsin Waiver of Notice of Meeting of members of a Nonprofit Church Corporation, designed to comply with federal and state regulations.

Once you locate the right form, click Get now.

Choose the payment plan you prefer, enter the necessary information to create your account, and complete the transaction using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Waiver of Notice of Meeting of members of a Nonprofit Church Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/state.

- Use the Preview feature to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you need, use the Search area to find the form that fits your criteria.

Form popularity

FAQ

It can receive grants and donations, and can have activities that generate income, so long as these dollars eventually are used for the group's tax-exempt purposes. If there is money left over at the end of a year, it can be set-aside as a reserve to cover expenses in the next year or beyond.

Bylaws should include, at a minimum, the following:Governance Structure.Control provisions.Director's terms.Officers.Voting procedures.Committees.Conflicts of Interest.Amendments.More items...?

A 501(c)(3) eligible nonprofit board of directors in Wisconsin MUST: Have at least three board members that are not related to each other. Elect the following members: president, treasurer, and secretary.

What to include in nonprofit bylawsGeneral information. This section should outline some basic information about your nonprofit, including your nonprofit's name and your location.Statements of purpose.Leadership.Membership.Meeting and voting procedures.Conflict of interest policy.Committees.The dissolution process.More items...?1 June 2021

Make a draft bylaw Some of the most essential elements that need to be included in a draft bylaw are your organization's name and purpose, information about memberships, the roles and duties of board members, how to handle financial information, and an outline of how to keep the bylaws up to date or amended.

Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

Winding Up In turn, after paying off debts, a dissolving 501(c)(3) organization must distribute its remaining assets for tax-exempt purposes. In practice, this usually means distributing assets to one or more other 501(c)(3) organizations.

With the resolution in hand, California law provides for voluntary dissolution in one of three ways:by majority approval of your nonprofit's members.by action of your directors followed by a vote or other consent of the members; or.if your nonprofit does not have members, by a vote of the directors.

Write a first draft of your bylawsArticle I. Name and purpose of the organization.Article II. Membership.Article III. Officers and decision-making.Article IV. General, special, and annual meetings.Article V. Board of Directors.

Nonprofit Financial ReportingNot only can a charity sell its assets, but it also must put into place adequate procedures to record the sales and publish accurate financial reports. This publication must conform to generally accepted government accounting standards.