Wisconsin Receipt for Loan Funds: A Comprehensive Guide In Wisconsin, a Receipt for Loan Funds is a legal document that serves as evidence of the transfer of loan funds from a lender to a borrower. It outlines the terms and conditions of the loan agreement, including the principal amount, interest rate, repayment schedule, and any associated fees or charges. This receipt is crucial for both parties involved as it ensures transparency, accountability, and legal protection. Key features of a standard Wisconsin Receipt for Loan Funds: 1. Identification of Parties: The receipt should clearly identify both the lender and the borrower. This includes their full names, addresses, contact information, and any relevant identification numbers. 2. Loan Amount and Terms: The receipt must specify the total loan amount provided by the lender and the agreed-upon terms and conditions, such as the interest rate, repayment period, and installment amounts. It should also outline any penalties or fees associated with late payments or defaults. 3. Date and Method of Loan Disbursement: The document should state the exact date when the loan funds were disbursed and the specific method used, such as electronic transfer, check, or cash. This ensures a mutual understanding of when the borrower gained access to the funds. 4. Signatures and Witness: The receipt should include the signatures of both the lender and borrower, as well as the date of signing. Additionally, it is recommended to have a witness present during the signing process to further validate the authenticity of the agreement. Types of Wisconsin Receipt for Loan Funds: 1. Personal Loan Receipt: This type of receipt is commonly used for loans between individuals, such as friends or family members. It outlines the terms agreed upon and ensures proper documentation for personal lending activities. 2. Business Loan Receipt: Specifically designed for loans given to businesses, this receipt encompasses the loan details and terms for commercial purposes. It may also include additional clauses relevant to business transactions, such as collateral requirements or repayment guarantees. 3. Mortgage Loan Receipt: When a loan is granted for purchasing or refinancing real estate, a mortgage loan receipt is generated. It captures the specific loan amount provided and the property details, providing a record of the financial transaction related to the property. 4. Student Loan Receipt: This receipt is used when a lender provides funds to finance a student's education. It outlines the terms and conditions unique to student loans, such as deferment options, grace periods, and repayment plans tailored to educational milestones. In conclusion, a Wisconsin Receipt for Loan Funds is an essential document that ensures transparency and accountability for both lenders and borrowers. By explicitly outlining the loan terms, disbursement details, and signatures of involved parties, this receipt serves as an official record of the loan transaction. It is important to note that seeking legal advice or consulting a financial professional is recommended when entering into any loan agreement to understand all legal implications and obligations.

Wisconsin Receipt for loan Funds

Description

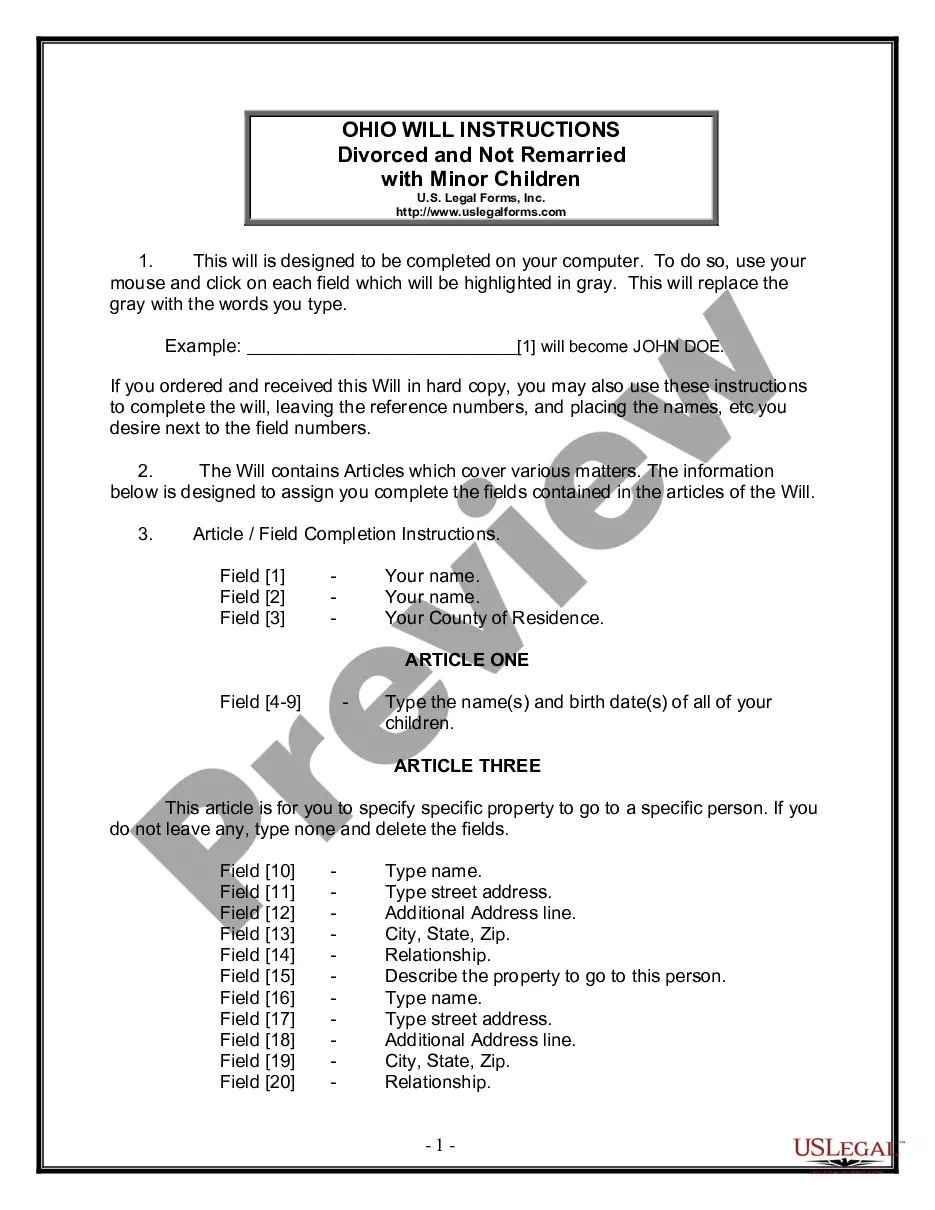

How to fill out Wisconsin Receipt For Loan Funds?

If you need to full, obtain, or print out legal papers layouts, use US Legal Forms, the biggest assortment of legal kinds, that can be found on-line. Utilize the site`s basic and handy look for to get the paperwork you need. Various layouts for business and personal uses are categorized by types and claims, or search phrases. Use US Legal Forms to get the Wisconsin Receipt for loan Funds in just a number of mouse clicks.

In case you are previously a US Legal Forms consumer, log in to your bank account and click the Download option to find the Wisconsin Receipt for loan Funds. You can also entry kinds you in the past delivered electronically from the My Forms tab of your bank account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that correct town/land.

- Step 2. Take advantage of the Review choice to look through the form`s information. Never forget about to see the information.

- Step 3. In case you are not satisfied together with the kind, make use of the Research area at the top of the screen to locate other models of your legal kind web template.

- Step 4. Upon having identified the shape you need, click the Acquire now option. Pick the costs program you favor and put your references to register on an bank account.

- Step 5. Approach the deal. You can use your credit card or PayPal bank account to finish the deal.

- Step 6. Find the formatting of your legal kind and obtain it on your device.

- Step 7. Comprehensive, edit and print out or sign the Wisconsin Receipt for loan Funds.

Each legal papers web template you buy is yours eternally. You have acces to each and every kind you delivered electronically within your acccount. Go through the My Forms segment and decide on a kind to print out or obtain again.

Contend and obtain, and print out the Wisconsin Receipt for loan Funds with US Legal Forms. There are thousands of specialist and status-distinct kinds you may use to your business or personal requires.

Form popularity

FAQ

Leases less than 99 years are not conveyances of real property per state law (sec. 77.21(1), Wis. Stats.). If an original lease of 50 years expires and is then renewed for another 50 years, it is considered to be less than 99 years and is exempt from transfer return and the transfer fee. Real Estate Transfer Fee Common Questions - L wi.gov ? FAQS ? slf-retr-retr-l wi.gov ? FAQS ? slf-retr-retr-l

Key Takeaways. A transfer tax is charged by a state or local government to complete a sale of property from one owner to another. The tax is typically based on the value of the property. A federal or state inheritance tax or estate tax may be considered a type of transfer tax. What Is a Transfer Tax? Definition and How It Works With Inheritances investopedia.com ? terms ? transfertax investopedia.com ? terms ? transfertax

The deed transfer tax is $3.00 per $1000.00 or major fraction thereof of consideration. The seller customarily pays the deed transfer tax. Wisconsin does not have a mortgage, recordation or excise tax. Title insurance premium includes the search and examination fee.

A tax warrant acts as a lien against real property you own in the county in which it is filed, and against your personal property. The warrant is filed with the Clerk of Court and is a public record of the amount you owe. It could affect your ability to obtain credit or sell real estate.

The transfer tax is calculated as a percentage of the sale price or the appraised value of the property. The percentage will vary depending on what the city, county, or state charges. For the most part, the rate is calculated per $100, $500, or $1,000. If the transfer tax is $1.00 per $500, the rate would be 0.2%. A Breakdown of Transfer Tax In Real Estate - UpNest upnest.com ? post ? what-is-a-transfer-tax upnest.com ? post ? what-is-a-transfer-tax

$3.00 per $1,000 The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value. 345 - Real Estate Transfer Fee - Legislative Fiscal Bureau Wisconsin (.gov) ? lfb ? budget Wisconsin (.gov) ? lfb ? budget PDF