Wisconsin Covenant Not to Sue by Widow of Deceased Stockholder

Description

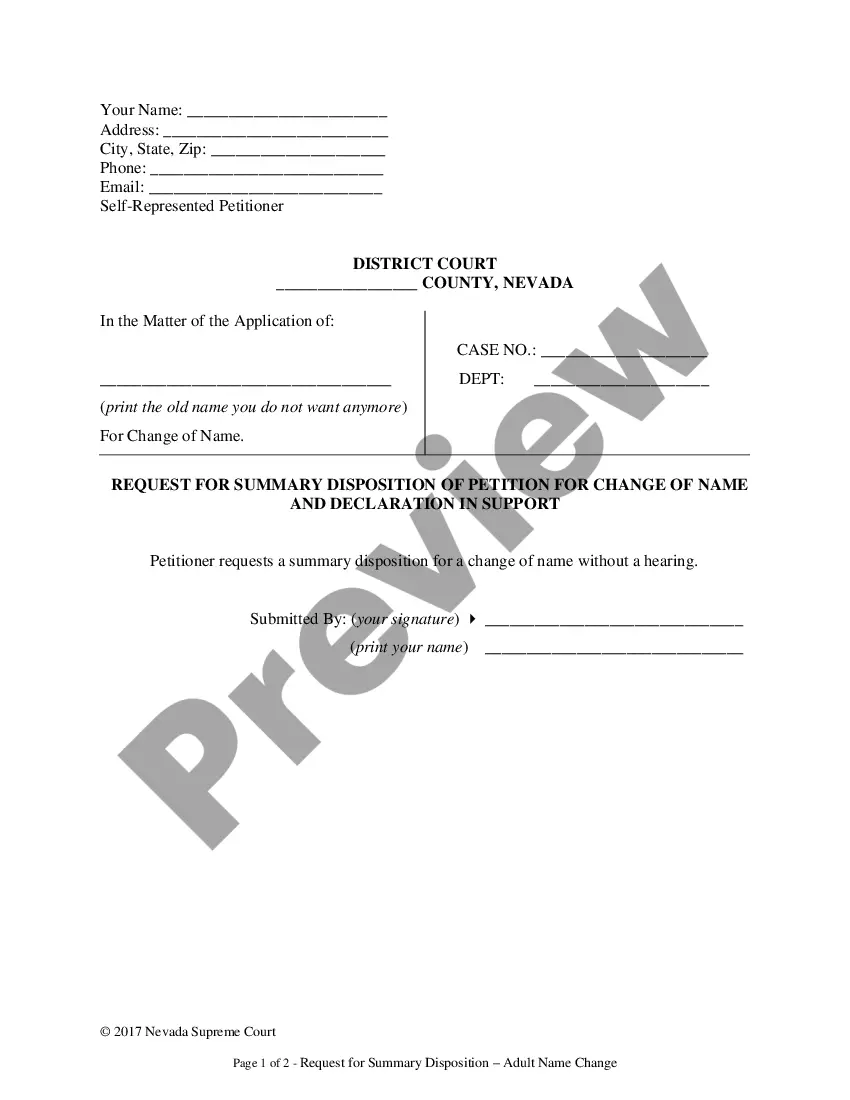

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

US Legal Forms - one of the largest collections of authentic documents in the United States - offers a range of legal document templates you can download or print.

While using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the Wisconsin Covenant Not to Sue by Widow of Deceased Stockholder in just seconds.

Click the Review option to verify the form’s details. Read the form description to ensure you have chosen the correct document.

If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- If you currently possess a subscription, Log In and download the Wisconsin Covenant Not to Sue by Widow of Deceased Stockholder from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these straightforward instructions to get started.

- Ensure you have selected the correct form for your specific region/area.

Form popularity

FAQ

After the death of the grantor, an irrevocable trust continues to exist and is administered according to its terms. The assets within the trust are distributed to the designated beneficiaries without going through probate, providing privacy and efficiency. For instances involving a Wisconsin Covenant Not to Sue by Widow of Deceased Stockholder, understanding the trust's provisions is vital for the surviving spouse's claims.