Wisconsin Sample Letter for Written Acknowledgment of Bankruptcy Information

Description

How to fill out Sample Letter For Written Acknowledgment Of Bankruptcy Information?

Are you in the situation where you need to have documents for both business or individual uses almost every day? There are a variety of legal document templates available on the net, but locating ones you can depend on is not simple. US Legal Forms delivers a large number of kind templates, such as the Wisconsin Sample Letter for Written Acknowledgment of Bankruptcy Information, that are written to satisfy state and federal demands.

When you are presently informed about US Legal Forms internet site and get an account, merely log in. After that, you may down load the Wisconsin Sample Letter for Written Acknowledgment of Bankruptcy Information web template.

Unless you offer an account and would like to start using US Legal Forms, follow these steps:

- Get the kind you want and ensure it is to the proper area/region.

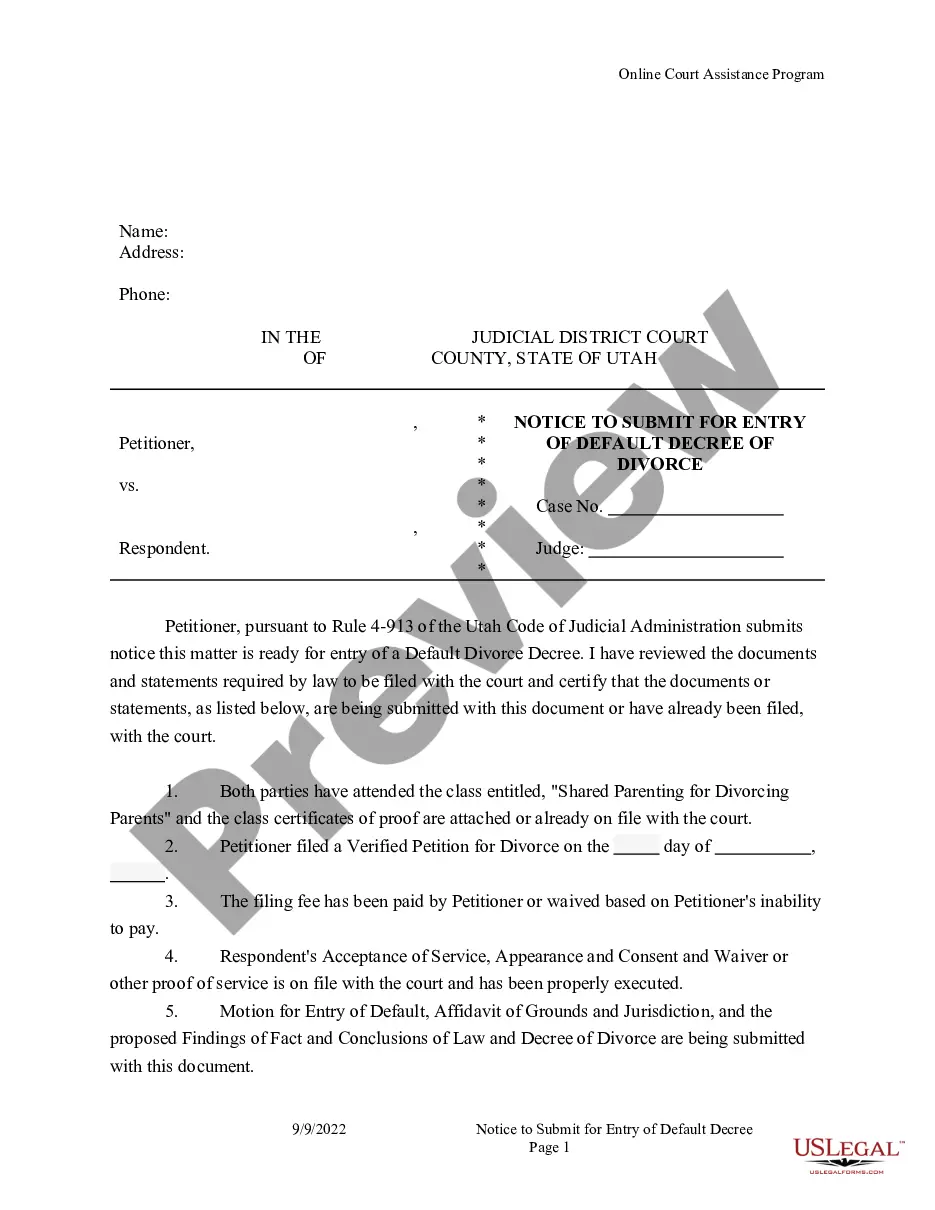

- Use the Review button to analyze the form.

- See the information to actually have selected the proper kind.

- In case the kind is not what you`re trying to find, take advantage of the Research field to discover the kind that meets your needs and demands.

- If you find the proper kind, simply click Purchase now.

- Choose the rates program you want, submit the desired details to generate your bank account, and pay for the order making use of your PayPal or charge card.

- Choose a handy paper file format and down load your copy.

Locate every one of the document templates you have purchased in the My Forms food list. You may get a extra copy of Wisconsin Sample Letter for Written Acknowledgment of Bankruptcy Information at any time, if needed. Just click on the required kind to down load or printing the document web template.

Use US Legal Forms, the most substantial selection of legal forms, to save efforts and prevent blunders. The assistance delivers appropriately created legal document templates that you can use for a variety of uses. Make an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Send a written dispute letter to the credit reporting agencies. Tell them that you filed for bankruptcy, and give them the bankruptcy court case number. List the specific accounts and account numbers which were discharged. Send your letter via certified mail, with a return receipt requested.

In general, a 609 letter is not a legal loophole that consumers can use to remove accurate information from their credit reports. This means they can't relieve you of any verifiable debt. If a credit bureau is able to verify your debt, it will stay on your report.

A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed.

What Is A Letter Of Explanation? A letter of explanation is a brief document you can use to explain something, like a previous bankruptcy, in your financial or employment history that might give an underwriter pause about your ability to repay a loan.

You can dispute a bankruptcy on your credit report for free online, by phone or via letter. If you need help with the dispute process, you could hire a credit repair company to handle the dispute with you. Pricing may vary depending on the company you decide to partner with.