Wisconsin Partnership Agreement for Real Estate

Description

How to fill out Partnership Agreement For Real Estate?

Finding the right legal document template can be quite a challenge.

Of course, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Wisconsin Partnership Agreement for Real Estate, which can be used for business and personal purposes.

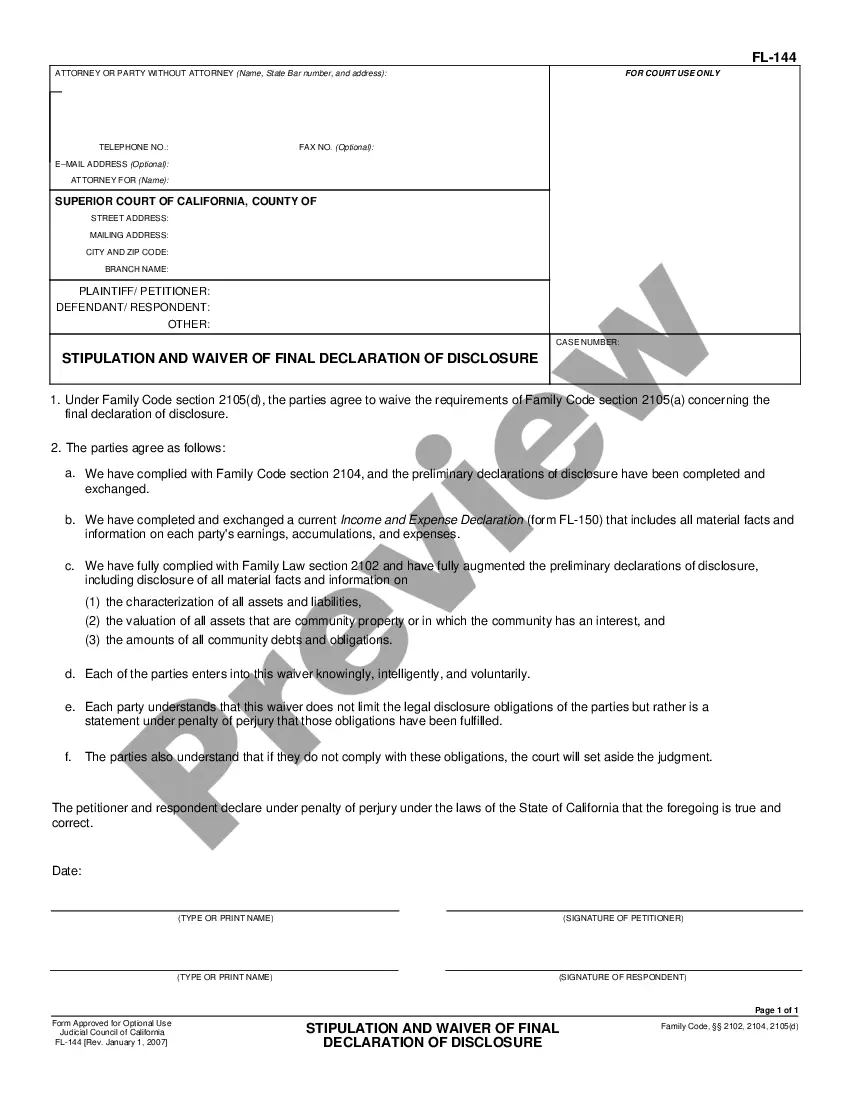

First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm this is the right one for you.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to retrieve the Wisconsin Partnership Agreement for Real Estate.

- Use your account to browse the legal forms you have previously purchased.

- Go to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Illinois generally follows federal guidelines and does accept federal extensions for partnerships. This allows businesses operating under a Wisconsin Partnership Agreement for Real Estate to align their tax filings between states. However, it is wise to check any specific requirements or forms necessary for Illinois to ensure seamless compliance. Always consider consulting with legal experts to navigate these regulations effectively.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

Business Partnership agreement This is a vital document for a partnership. A business partnership agreement sets out what is expected from each of the partners, how key decisions are made, and how profits (and liabilities) are divided.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

Here are the basic steps to forming a partnership: Choose a business name. Register a fictitious business name. Draft and sign a partnership agreement.

To form a partnership in Wisconsin, you should take the following steps:Choose a business name.File a trade name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

These are the four types of partnerships.General partnership. A general partnership is the most basic form of partnership.Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state.Limited liability partnership.Limited liability limited partnership.

It's ultimately up to you and the partners to decide how to create the partnership agreement. It's a legal contract, so it should be worded as such, and signed by all parties. You can choose an online template, create one yourself or speak to an attorney to draw up the contract.