Wisconsin Blocked Account Agreement: Understanding the Basics In Wisconsin, a Blocked Account Agreement refers to a legal financial arrangement designed to manage and safeguard funds. It is typically established when an individual wishes to hold or manage another person's funds, ensuring they remain secure and inaccessible unless specific conditions are met. The account is "blocked" to prevent unauthorized withdrawals. A Wisconsin Blocked Account Agreement offers various types to cater to specific needs and situations. Here are a few common variations: 1. Minor's Blocked Account Agreement: This agreement is created on behalf of a minor, allowing a designated adult, usually a parent or guardian, to manage and protect the minor's funds until they reach adulthood. The funds held in the account cannot be accessed without a court order or when the minor reaches the age of majority. 2. Court-Ordered Blocked Account Agreement: In certain cases, such as a legal dispute or when funds are awarded as part of a settlement, a court may mandate the establishment of a blocked account. This agreement ensures that the funds are safeguarded until a specific event or condition is met, as determined by the court. 3. Trustee-Managed Blocked Account Agreement: When an individual wants to entrust their funds to a trustee who will manage and administer them according to specified terms and conditions, a trustee-managed blocked account agreement is established. This arrangement ensures that the funds are handled responsibly and in line with the granter's wishes. 4. Blocked Account Agreement for Non-Residents: Wisconsin offers a specific type of blocked account agreement for non-residents. This agreement assists non-residents in managing their funds within the state's jurisdiction, providing a secure and regulated environment for financial transactions while they reside in Wisconsin. The Wisconsin Blocked Account Agreement includes several essential provisions and components. These typically encompass details such as the account holder's identification information, the purpose and intent of the agreement, the specific conditions under which the funds may be accessed or released, the appointment of a designated custodian or trustee, and any relevant legal or procedural requirements. It's important to note that a Wisconsin Blocked Account Agreement is a legally binding contract, and all parties involved must understand and comply with its terms and conditions. Seeking professional legal advice or consulting with a financial professional is recommended to ensure the agreement accurately reflects the individual's intentions and adheres to Wisconsin's legal framework. In summary, a Wisconsin Blocked Account Agreement is an arrangement used to protect and manage funds, with various types catering to specific situations such as minors, court-ordered circumstances, non-residents, and trustee-managed accounts. It provides security, transparency, and legal compliance when handling money in accordance with Wisconsin's regulations.

Wisconsin Blocked Account Agreement

Description

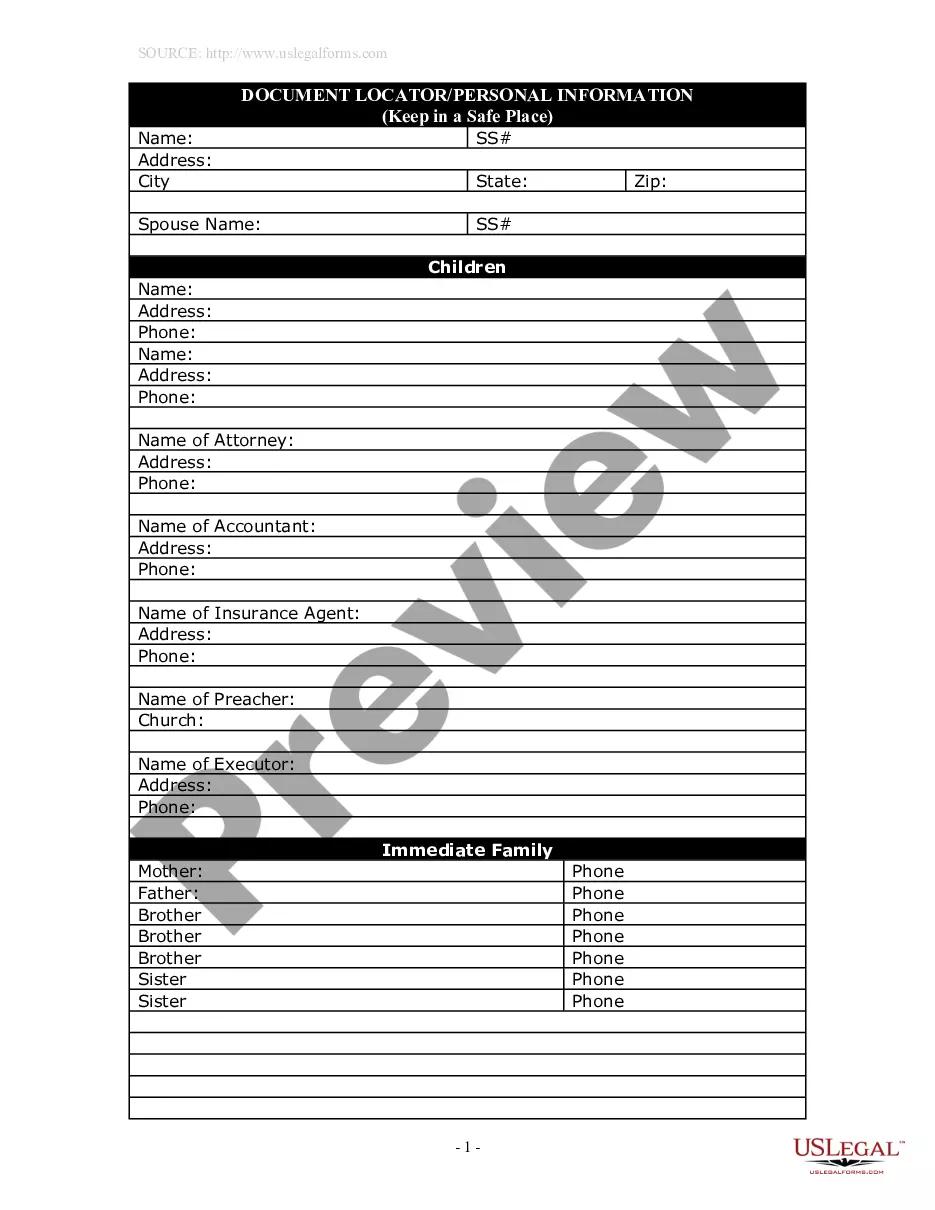

How to fill out Wisconsin Blocked Account Agreement?

If you have to total, download, or print authorized record web templates, use US Legal Forms, the biggest assortment of authorized types, which can be found on-line. Make use of the site`s simple and hassle-free search to obtain the papers you want. A variety of web templates for company and person functions are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Wisconsin Blocked Account Agreement in a few clicks.

In case you are currently a US Legal Forms buyer, log in to your profile and click on the Acquire switch to get the Wisconsin Blocked Account Agreement. You can even entry types you formerly delivered electronically inside the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for that appropriate area/region.

- Step 2. Take advantage of the Preview choice to check out the form`s information. Don`t forget about to read the description.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Lookup industry near the top of the monitor to find other versions of the authorized type web template.

- Step 4. Once you have located the form you want, select the Acquire now switch. Pick the pricing prepare you choose and add your accreditations to sign up for an profile.

- Step 5. Method the financial transaction. You can utilize your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the file format of the authorized type and download it on your device.

- Step 7. Total, revise and print or indication the Wisconsin Blocked Account Agreement.

Every single authorized record web template you purchase is yours for a long time. You might have acces to every single type you delivered electronically within your acccount. Click the My Forms segment and decide on a type to print or download once more.

Compete and download, and print the Wisconsin Blocked Account Agreement with US Legal Forms. There are many specialist and state-particular types you can utilize for your company or person demands.

Form popularity

FAQ

Blocked Account Agreement means an agreement among the Borrower, the Agent and a Clearing Bank, in form and substance reasonably satisfactory to the Agent, concerning the collection of payments which represent the proceeds of Accounts or of any other Collateral.

You have entered Belgium with a student visa type D. You will (re-)apply for a residence permit: for 1 semester (Nov-Feb) or 1 academic year. You 're almost graduating and will apply for an orientation/search year. For an orientation year it is compulsory to apply for a blocked account for one year/12 months.

If an account is blocked then access is denied and you will not be able to access the money until the block is released. You could open another account at a different bank, but you will not be able to transfer any money into from the blocked account.

A court must approve and order any withdrawal of funds from a blocked account. The most common reason to petition a court to withdraw funds from a blocked account is to access a blocked account because the account was created for a minor who has subsequently turned 18.

Blocked accounts are frequently created to protect judgments awarded to minors, or to protect the money of adults who cannot manage their own finances and have therefore had conservators appointed to manage their assets (?conserved adults?). A court must approve and order any withdrawal of funds from a blocked account.

If the borrower defaults on the loan, the lender can assume control over the account and instruct the bank to revoke the borrower's ability to make transactions using funds in the account. Active DACAs, or blocked account control agreements (BACA): Only the lender, not the borrower, can make transactions.

Your bank account can be frozen if a creditor or debt collector has a court judgment against you. It can also be frozen if the bank suspects unauthorized, irregular, or unlawful activities, such as those involved with money laundering, identity theft, counterfeit or stolen checks, or other financial crimes.

Blocked accounts restrict account owners from unlimited and unrestricted use of their funds in that account. Accounts may be blocked or limited for a variety of reasons, including internal bank policies, external regulations, or via a court order or legal decision.