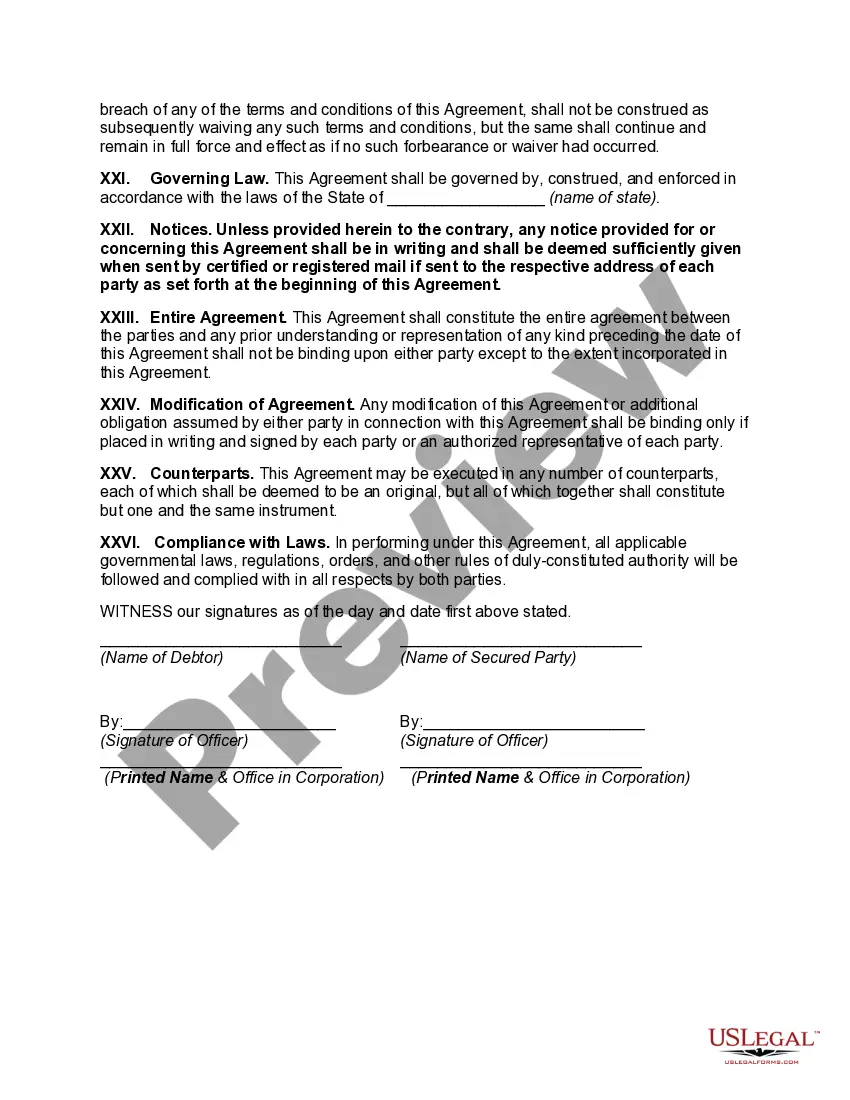

Title: Understanding the Wisconsin Security Agreement between Dealer and Distributor in Detail Introduction: Wisconsin Security Agreement between Dealer and Distributor is a legally binding contract that outlines the terms and conditions regarding the security interests, rights, and obligations between a dealer and distributor in Wisconsin. This agreement ensures the protection of each party's assets and interests in the event of default or non-performance of the contract. Key Elements of a Wisconsin Security Agreement between Dealer and Distributor: 1. Security Interest: The agreement defines the assets or collateral that secure the obligations of the dealer under the contract. It may include inventory, accounts receivable, equipment, real estate, intellectual property, and other tangible or intangible assets owned by the dealer. 2. Obligations: This section outlines the specific obligations of the dealer, such as timely payment of invoices, maintenance of inventory levels, adherence to pricing policies, marketing requirements, and compliance with relevant laws and regulations. 3. Grant of Security Interest: The dealer grants a security interest in the designated collateral to the distributor as collateral for the dealer's performance and obligations under the agreement. 4. Perfection of Security Interest: The agreement ensures that the distributor's security interest is adequately perfected by complying with the relevant provisions of the Uniform Commercial Code (UCC), such as filing UCC financing statements or obtaining control over certain types of collateral. 5. Default and Remedies: It establishes the conditions under which default occurs, such as non-payment, breach of obligations, insolvency, or bankruptcy. The agreement specifies the remedies available to the distributor, including the right to seize and sell the collateral to satisfy the dealer's outstanding obligations. Types of Wisconsin Security Agreement between Dealer and Distributor: 1. Inventory Financing Agreement: This agreement focuses on inventory as collateral and provides funds to the dealer for purchasing and maintaining inventory. The distributor may advance funds to the dealer based on the value of inventory and can repossess or liquidate the inventory in case of default. 2. Accounts Receivable Financing Agreement: In this type of agreement, the distributor extends credit to the dealer based on their accounts receivable. The distributor may collect payments directly from customers or acquire the dealer's accounts receivable, providing the dealer with immediate cash flow. 3. Equipment Financing Agreement: This agreement focuses on financing the purchase of specific equipment required by the dealer. The distributor may provide funds to the dealer for the purchase or lease of equipment with the equipment itself serving as collateral. In conclusion, the Wisconsin Security Agreement between Dealer and Distributor is a crucial legal document that safeguards the dealer and distributor's interests and ensures proper fulfillment of obligations. It establishes guidelines for asset-based lending, offering protection to both parties. Understanding the various types of security agreements available helps dealers and distributors choose the one that aligns with their specific requirements.

Wisconsin Security Agreement between Dealer and Distributor

Description

How to fill out Wisconsin Security Agreement Between Dealer And Distributor?

Choosing the best lawful document web template can be quite a have difficulties. Obviously, there are a variety of templates accessible on the Internet, but how would you get the lawful type you require? Make use of the US Legal Forms site. The support gives a huge number of templates, for example the Wisconsin Security Agreement between Dealer and Distributor, that can be used for company and personal requires. All of the kinds are examined by specialists and meet up with federal and state needs.

If you are already registered, log in to your bank account and click on the Download switch to have the Wisconsin Security Agreement between Dealer and Distributor. Make use of your bank account to appear throughout the lawful kinds you possess bought in the past. Check out the My Forms tab of your own bank account and obtain one more duplicate of your document you require.

If you are a fresh user of US Legal Forms, listed here are easy instructions for you to stick to:

- Initial, make certain you have chosen the proper type for the metropolis/area. You can check out the form while using Preview switch and study the form outline to ensure this is the best for you.

- In case the type fails to meet up with your requirements, take advantage of the Seach discipline to discover the appropriate type.

- When you are sure that the form is acceptable, click the Buy now switch to have the type.

- Select the prices strategy you want and enter in the required details. Build your bank account and pay money for your order with your PayPal bank account or charge card.

- Select the file formatting and download the lawful document web template to your gadget.

- Complete, revise and print out and indicator the attained Wisconsin Security Agreement between Dealer and Distributor.

US Legal Forms will be the biggest collection of lawful kinds that you will find different document templates. Make use of the company to download professionally-manufactured papers that stick to state needs.