Wisconsin Jury Instruction - 10.10.2 Debt vs. Equity

Description

How to fill out Jury Instruction - 10.10.2 Debt Vs. Equity?

You may devote hrs on the web looking for the legal document format which fits the federal and state needs you need. US Legal Forms gives thousands of legal types which can be analyzed by specialists. It is possible to obtain or print the Wisconsin Jury Instruction - 10.10.2 Debt vs. Equity from my assistance.

If you have a US Legal Forms accounts, it is possible to log in and then click the Acquire option. Afterward, it is possible to full, change, print, or sign the Wisconsin Jury Instruction - 10.10.2 Debt vs. Equity. Every single legal document format you purchase is yours permanently. To acquire one more duplicate for any bought develop, proceed to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms site for the first time, follow the basic guidelines under:

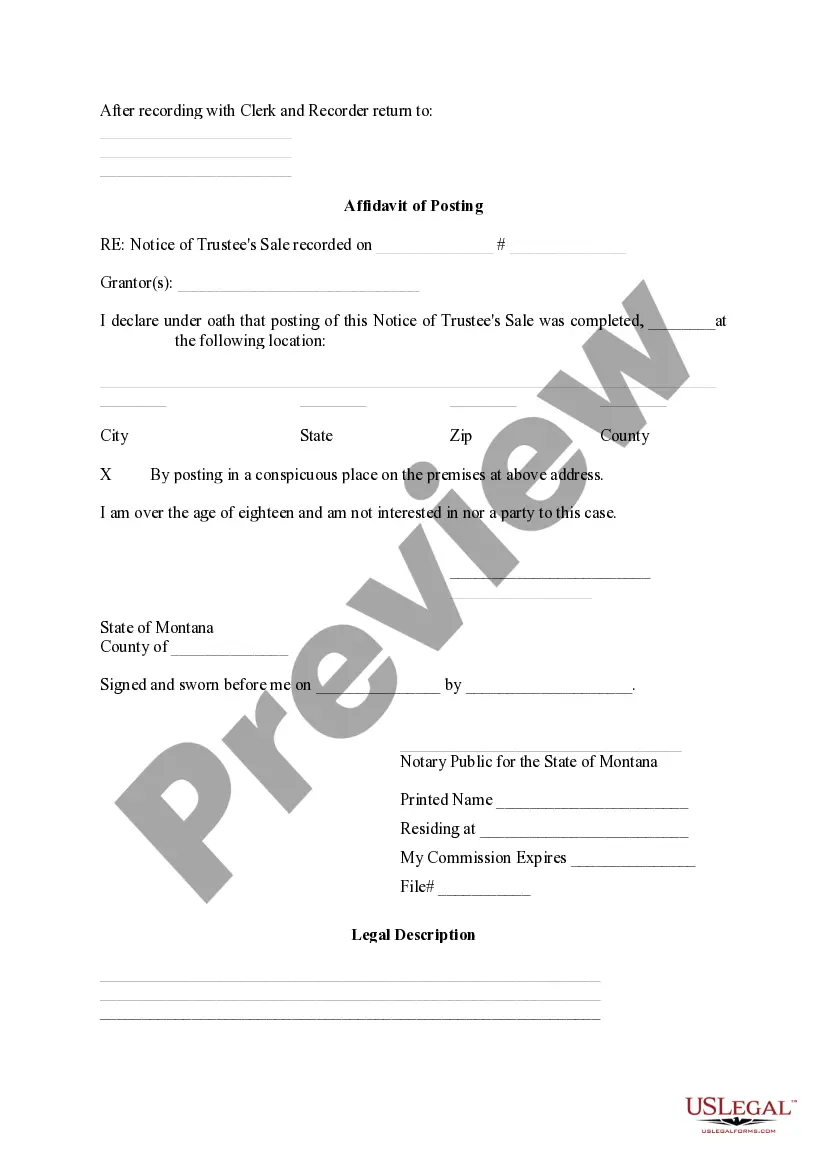

- Very first, ensure that you have chosen the proper document format for that county/city of your choosing. Read the develop description to make sure you have selected the appropriate develop. If available, utilize the Review option to appear through the document format at the same time.

- In order to locate one more variation of your develop, utilize the Search area to find the format that suits you and needs.

- Upon having identified the format you desire, just click Acquire now to carry on.

- Find the costs strategy you desire, enter your qualifications, and register for an account on US Legal Forms.

- Comprehensive the purchase. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legal develop.

- Find the structure of your document and obtain it to the product.

- Make adjustments to the document if required. You may full, change and sign and print Wisconsin Jury Instruction - 10.10.2 Debt vs. Equity.

Acquire and print thousands of document themes making use of the US Legal Forms website, which provides the greatest collection of legal types. Use skilled and condition-certain themes to handle your small business or individual needs.