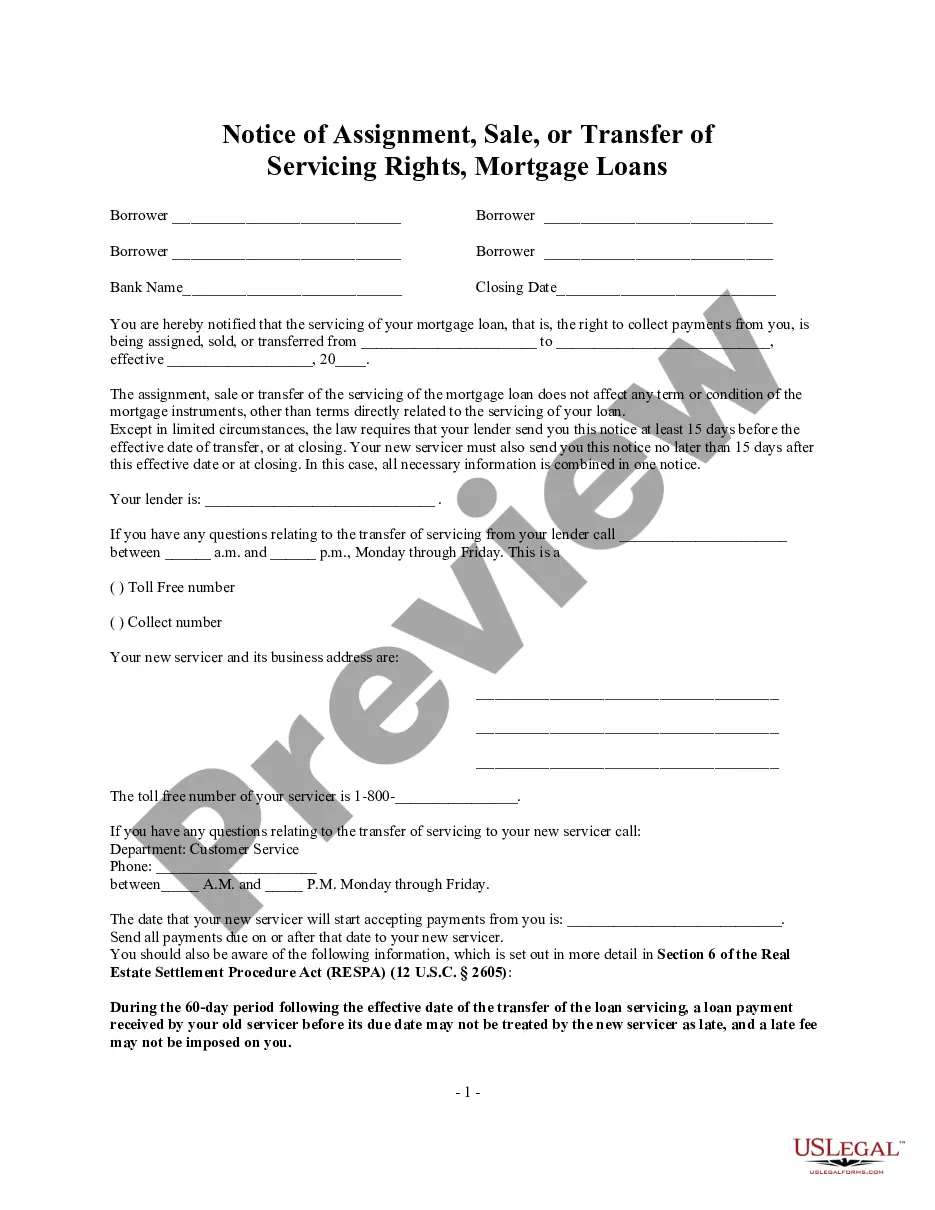

Wisconsin Letter of Notice to Borrower of Assignment of Mortgage

Description

How to fill out Letter Of Notice To Borrower Of Assignment Of Mortgage?

If you wish to full, down load, or produce legitimate papers templates, use US Legal Forms, the most important assortment of legitimate types, which can be found online. Utilize the site`s basic and convenient research to find the paperwork you will need. Different templates for enterprise and person reasons are sorted by groups and states, or key phrases. Use US Legal Forms to find the Wisconsin Letter of Notice to Borrower of Assignment of Mortgage in just a couple of mouse clicks.

Should you be currently a US Legal Forms buyer, log in to your account and then click the Acquire option to get the Wisconsin Letter of Notice to Borrower of Assignment of Mortgage. Also you can access types you previously acquired from the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that right town/country.

- Step 2. Take advantage of the Review option to look over the form`s content material. Don`t forget to read the description.

- Step 3. Should you be unhappy using the form, use the Research industry towards the top of the monitor to locate other variations in the legitimate form web template.

- Step 4. Once you have identified the shape you will need, click the Get now option. Select the rates strategy you like and put your credentials to register to have an account.

- Step 5. Approach the purchase. You should use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the file format in the legitimate form and down load it on your device.

- Step 7. Total, modify and produce or sign the Wisconsin Letter of Notice to Borrower of Assignment of Mortgage.

Each and every legitimate papers web template you get is your own property for a long time. You possess acces to each form you acquired in your acccount. Click the My Forms section and decide on a form to produce or down load once again.

Contend and down load, and produce the Wisconsin Letter of Notice to Borrower of Assignment of Mortgage with US Legal Forms. There are many expert and condition-distinct types you can utilize for the enterprise or person needs.

Form popularity

FAQ

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

A letter of intent, or LOI, is a document that states one party's intent to do business with another. These letters are used in various contexts but are most commonly written in real estate transactions or other large-purchase transactions.

What Does Assignment Of Mortgage Mean? An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

It's best to keep your letter of explanation short and sweet. Include as much detail as needed, but address only the specific information the lender requested. The idea is to make it easy for the underwriter to find the information they need. Your letter of explanation should be businesslike in tone and structure.

Format it as you would a business letter, address it to your lender and plug in the address of the property it's regarding in the subject line. Keep it brief, providing only what the lender requests. It needs to be no more than a single paragraph describing that you'll use the property as your primary home.

Use the seller's full personal or company name, main address, and contact information, and date the letter. Indicate that you are interested in buying the house. Include the property address and any details about what will be included in the purchase, including furnishings, land, or other items.

How To Write A Letter To The Seller When Buying A Home Decide How You Want The Letter To Look. ... Introduce Yourself. ... Share Your Love For The Home. ... Describe How You'd Live In The House. ... Explain Your Offer. ... Express Gratitude. ... Read Over Your Letter. ... Deliver The Letter To The Seller.