Wisconsin Finance Lease of Equipment is a legal agreement commonly used by businesses in Wisconsin to obtain essential equipment for their operations. Under this lease arrangement, the lessee (business) acquires the right to use equipment owned by the lessor (leasing company) in exchange for regular lease payments. This alternative financing option allows businesses to conserve capital, enhance their cash flow, and avoid the upfront costs associated with equipment purchase. A Wisconsin Finance Lease of Equipment provides numerous benefits to businesses, including increased flexibility in managing their equipment needs. It allows businesses to acquire a wide range of equipment, including machinery, vehicles, office technology, medical devices, and more. With this leasing option, businesses can access the equipment necessary to streamline their operations and improve productivity without straining their financial resources. One of the significant advantages of a finance lease is the ability to include additional services and maintenance in the lease agreement. Lessors often offer ancillary services such as equipment maintenance, repairs, and insurance coverage, alleviating the lessee's burden and ensuring the equipment remains in optimal condition throughout the lease term. This comprehensive package provides businesses with peace of mind and reduces the risk associated with equipment breakdowns or malfunctions. Wisconsin Finance Lease of Equipment also offers tax benefits to lessees. Since lease payments are often treated as business expenses, they can be deductible, lowering the lessee's taxable income. This tax advantage can significantly reduce the overall cost of acquiring equipment through leasing, making it an attractive option for businesses looking to optimize their financial strategies. Regarding the types of Wisconsin Finance Lease of Equipment, there are generally two classifications worth mentioning: capital leases and operating leases. A capital lease is a financing arrangement structured to transfer ownership of the equipment to the lessee at the end of the lease term. This type of lease allows the lessee to effectively purchase the equipment and typically includes a bargain purchase option or fixed payment duration. On the other hand, an operating lease is a more short-term arrangement, where the lessor retains ownership of the equipment throughout the lease term. Operating leases offer businesses the flexibility to upgrade or replace equipment as needed, making them suitable for rapidly evolving industries. This type of lease often has a shorter duration and may include various end-of-term options, such as equipment return, renewal, or upgrade. In conclusion, Wisconsin Finance Lease of Equipment provides businesses with a valuable opportunity to acquire necessary equipment while minimizing upfront costs and preserving capital. Whether opting for a capital lease or an operating lease, businesses can leverage this financial tool to meet their equipment needs, enhance productivity, and maintain a competitive edge in the Wisconsin marketplace.

Wisconsin Finance Lease of Equipment

Description

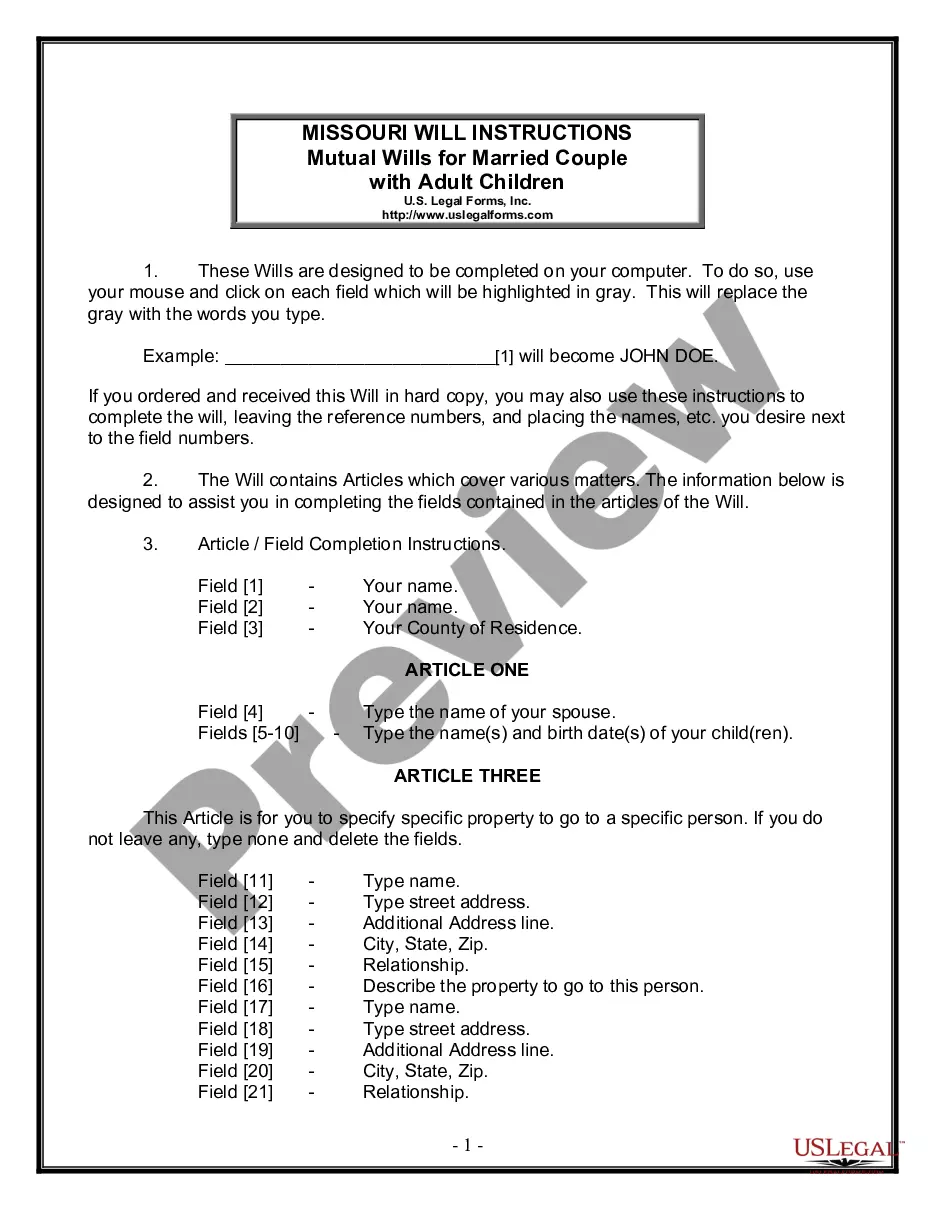

How to fill out Wisconsin Finance Lease Of Equipment?

If you wish to comprehensive, down load, or print legitimate document web templates, use US Legal Forms, the greatest collection of legitimate kinds, that can be found on the Internet. Make use of the site`s simple and easy convenient search to obtain the documents you require. A variety of web templates for organization and specific purposes are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Wisconsin Finance Lease of Equipment in just a couple of mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your profile and click on the Obtain key to obtain the Wisconsin Finance Lease of Equipment. You may also accessibility kinds you previously delivered electronically within the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your appropriate town/land.

- Step 2. Use the Review option to check out the form`s articles. Don`t neglect to read the description.

- Step 3. Should you be not happy with all the kind, take advantage of the Search field on top of the display screen to find other versions of the legitimate kind format.

- Step 4. Upon having discovered the shape you require, click the Purchase now key. Pick the costs strategy you like and add your credentials to sign up for the profile.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal profile to perform the purchase.

- Step 6. Find the format of the legitimate kind and down load it on your own system.

- Step 7. Complete, change and print or indicator the Wisconsin Finance Lease of Equipment.

Each and every legitimate document format you buy is your own for a long time. You have acces to each kind you delivered electronically within your acccount. Click the My Forms area and decide on a kind to print or down load once more.

Be competitive and down load, and print the Wisconsin Finance Lease of Equipment with US Legal Forms. There are thousands of expert and state-particular kinds you can use for the organization or specific needs.

Form popularity

FAQ

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

A finance lease is a contract between a lessor (a funder or finance company) and a lessee (your business), where the lessee requires the use of business equipment, vehicles, or machinery. The lessor provides the use of such equipment in exchange for pre-agreed regular payments.

Key TakeawaysCapital leases transfer ownership to the lessee while operating leases usually keep ownership with the lessor. For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets.

A capital lease (or finance lease) is an agreement where the lessor has agreed that the ownership of the asset will be transferred to the lessee when the lease period is over. It allows the lessee the choice of buying the asset at a bargain price that is lower than the market value at the end of the lease period.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

When you lease equipment, the lessor is effectively putting up a lump sum of money on your behalf, which you will pay off with interest over time. The effective interest rate on a lease can be anywhere from the low single digits to more than 30%, with the average is around 6% to16%.

Step 1: The lessee selects an asset that they require for a business. Step 2: The lessor, usually a finance company, purchases the asset. Step 3: The lessor and lessee enter into a legal contract in which the lessee will have use of the asset during the agreed upon lease.

A finance lease (also known as a capital lease or a sales lease) is a type of lease in which a finance company is typically the legal owner of the asset for the duration of the lease, while the lessee not only has operating control over the asset, but also some share of the economic risks and returns from the change in