Wisconsin Software Sales Agreement is a legal contract that outlines the terms and conditions of selling software in the state of Wisconsin. It provides a comprehensive framework for software sales transactions and helps protect the rights and interests of both the software developers or vendors and the purchasers. This agreement covers various important aspects such as the description and specifications of the software being sold, payment terms, delivery methods, intellectual property rights, warranties, liabilities, and dispute resolution procedures. It is crucial to have a well-drafted sales agreement in place to ensure a smooth software sales process and foster a good business relationship between the parties involved. There are different types of Wisconsin Software Sales Agreements catering to various software sales scenarios, including: 1. Standard Software Sales Agreement: This agreement is used for the sale of pre-packaged software, which is not customized or tailored specifically for the buyer. It includes common terms and conditions applicable to most software sales transactions. 2. Custom Software Sales Agreement: This agreement is drafted when software is developed or modified specifically for a buyer's unique requirements. It includes provisions related to software development, customization, ownership of intellectual property, and confidentiality. 3. Software Maintenance and Support Agreement: This type of agreement focuses on providing ongoing maintenance, updates, and technical support services for the software after its initial sale. It outlines the scope of services, response times, service-level agreements, and fees associated with the maintenance and support services. 4. Software as a Service (SaaS) Agreement: SaaS agreements are used for the sale of cloud-based software applications, where the software is hosted and accessed remotely by the buyer. It covers subscription terms, usage restrictions, data privacy, and service-level commitments. 5. Software Distribution Agreement: This agreement is designed for software vendors who wish to authorize third-party resellers or distributors to sell their software products. It includes provisions related to pricing, territory restrictions, marketing responsibilities, and intellectual property rights. Regardless of the type of Wisconsin Software Sales Agreement, it is essential to consult with legal professionals experienced in software licensing and sales to ensure that the agreement meets the specific requirements and complies with applicable laws and regulations.

Wisconsin Software Sales Agreement

Description

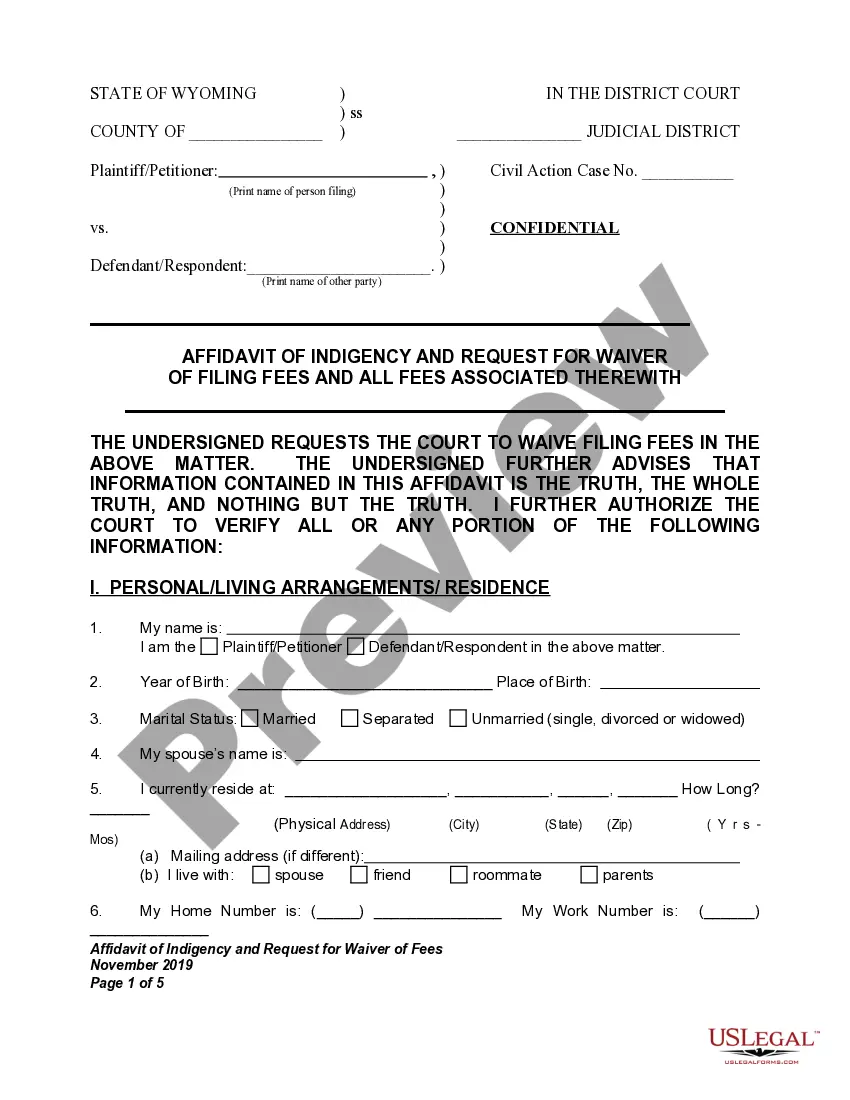

How to fill out Wisconsin Software Sales Agreement?

Choosing the best legitimate record web template could be a have difficulties. Of course, there are tons of templates available on the net, but how would you get the legitimate type you need? Use the US Legal Forms website. The services gives a large number of templates, such as the Wisconsin Software Sales Agreement, which can be used for business and private needs. Every one of the kinds are inspected by professionals and meet up with state and federal demands.

When you are presently signed up, log in in your account and click the Download switch to find the Wisconsin Software Sales Agreement. Make use of your account to search from the legitimate kinds you might have ordered earlier. Check out the My Forms tab of your own account and acquire another backup from the record you need.

When you are a fresh consumer of US Legal Forms, allow me to share easy instructions that you should stick to:

- Very first, make certain you have chosen the right type to your area/area. You may look over the form making use of the Preview switch and read the form information to make sure it will be the best for you.

- If the type will not meet up with your requirements, utilize the Seach area to discover the correct type.

- Once you are certain the form is acceptable, go through the Acquire now switch to find the type.

- Select the rates plan you desire and enter in the essential information and facts. Design your account and pay money for the transaction utilizing your PayPal account or charge card.

- Choose the document formatting and obtain the legitimate record web template in your system.

- Comprehensive, modify and produce and indication the obtained Wisconsin Software Sales Agreement.

US Legal Forms is the largest local library of legitimate kinds for which you can see various record templates. Use the company to obtain appropriately-produced files that stick to state demands.

Form popularity

FAQ

Charges for prewritten computer software that is downloaded to the customer's equipment (or equipment that the customer has access to and control over) in Wisconsin are taxable.

The sale, lease, or license of computer software, except custom computer software, in Wisconsin is subject to Wisconsin sales or use tax unless an exemption applies, regardless of how it is delivered to the customer (diskette vs. electronically).

Prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Wisconsin are subject to sales tax.

Section 77.52 (2) (a) 13m., Stats., imposes Wisconsin sales tax on the sale of contracts, including service contracts, maintenance agreements, computer software maintenance contracts for prewritten computer software, and warranties, that provide, in whole or in part, for the future performance of or payment for the

Each license is a separate sale of tangible personal property. The purchase price of the prewritten computer software is not allocated; the sale of each license is taxable or not taxable to Wisconsin, depending on where it was delivered. Software as a Service (SaaS) is not treated as the sale or license of software.

The sale, lease, or license of computer software, except custom computer software, in Wisconsin is subject to Wisconsin sales or use tax unless an exemption applies, regardless of how it is delivered to the customer (diskette vs. electronically).

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.

The purchase price of the prewritten computer software is not allocated; the sale of each license is taxable or not taxable to Wisconsin, depending on where it was delivered. Software as a Service (SaaS) is not treated as the sale or license of software.