Wisconsin Employment of Executive with Stock Options and Rights in Discoveries In the state of Wisconsin, employment of executives can be accompanied by stock options and rights in discoveries, providing a unique compensation and incentive structure for top-level corporate leaders. These arrangements allow executives to acquire shares of their company's stock and gain rights to potential breakthroughs and inventions made during their tenure. The Wisconsin statute governing executive employment with stock options and rights in discoveries is designed to promote innovation, reward executive performance, and align the interests of executives with those of the company and its shareholders. Stock options form a significant part of executive compensation packages in Wisconsin. They give executives the option to purchase company stock at a predetermined price, known as the strike or exercise price, within a specified timeframe. The idea behind stock options is to motivate executives to boost the company's performance and increase its stock value, as they stand to gain financially from a rise in share prices. Options can be exercised after a vesting period, allowing executives to buy shares at the strike price and potentially sell them for a profit at a later date. Additionally, executives may be granted rights in discoveries that occur during their employment. These rights come into play when an executive contributes to or oversees significant research and development efforts resulting in new inventions, patents, or other intellectual property. By being granted rights in discoveries, executives gain a financial stake in any commercial success or monetization of these technologies. Different types of employment arrangements that involve stock options and rights in discoveries include: 1. Standard Stock Option Plans: Many companies adopt standard stock option plans for executive compensation. These plans outline the terms and conditions governing the issuance, vesting, and exercise of stock options. They may include provisions related to performance metrics, time-based vesting schedules, and limits on the number of options granted. 2. Restricted Stock Units (RSS): RSS are an alternative form of stock-based compensation where executives are granted units, rather than options, which convert into company stock once specific conditions are met, such as performance goals or a predetermined time period. RSS provide executives with the opportunity to receive company stock directly without having to purchase it. 3. Performance-Based Stock Options: In certain cases, executive employment may involve performance-based stock options. These options are tied explicitly to the achievement of predetermined performance targets, such as revenue growth, profit margins, or market share. Executives earn the right to exercise these options only if the specified performance objectives are met, ensuring that their compensation is connected to the company's success. 4. Intellectual Property Rights-Based Compensation: Some executives may negotiate specific provisions addressing their rights in discoveries. These provisions may grant executives a share of the profits derived from licensing or commercializing intellectual property resulting from their efforts, providing an additional layer of incentive and reward for innovation. In conclusion, the Wisconsin Employment of Executive with Stock Options and Rights in Discoveries represents a dynamic approach to executive compensation. By offering stock options and rights in discoveries, Wisconsin-based companies aim to attract and retain top talent, promote innovation, and align executive interests with those of the organization and its shareholders.

Wisconsin Employment of Executive with Stock Options and Rights in Discoveries

Description

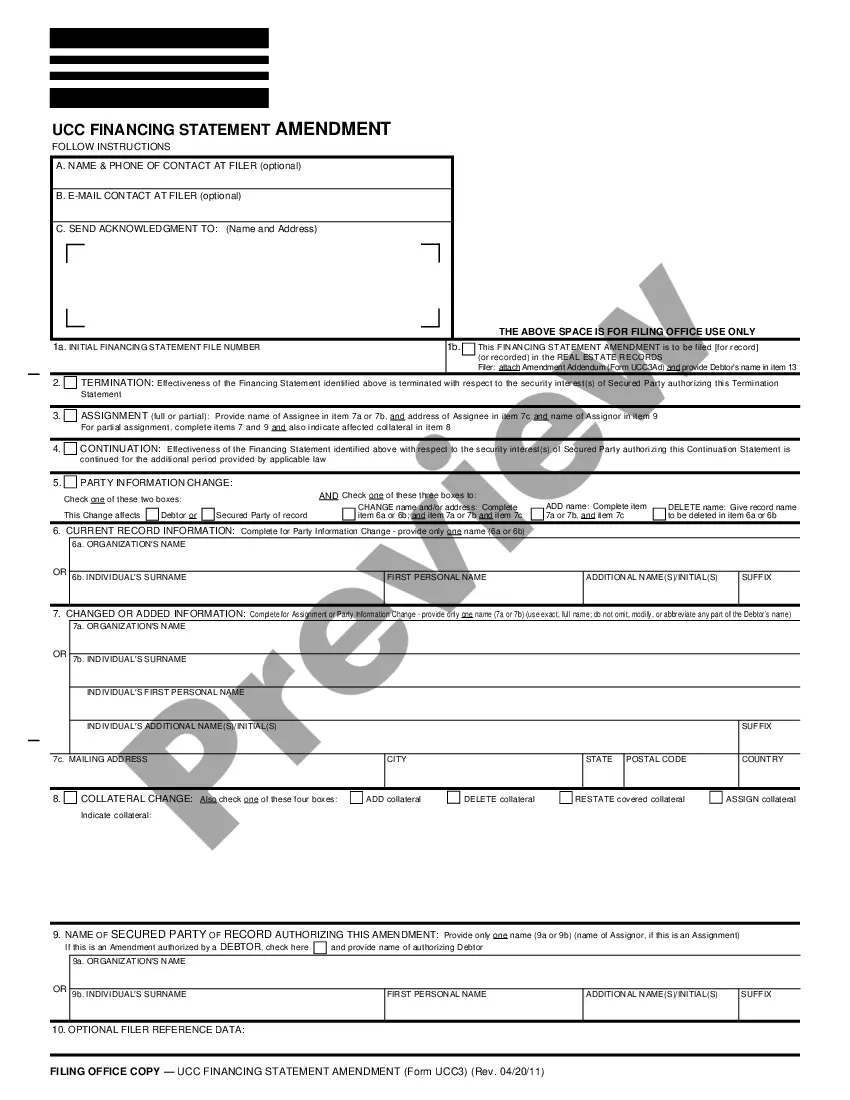

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

Choosing the best authorized file template can be quite a battle. Of course, there are plenty of themes available on the net, but how would you discover the authorized develop you need? Take advantage of the US Legal Forms website. The assistance offers a large number of themes, like the Wisconsin Employment of Executive with Stock Options and Rights in Discoveries, which can be used for company and private requires. Every one of the kinds are checked out by specialists and fulfill state and federal needs.

When you are already listed, log in for your account and click on the Acquire button to get the Wisconsin Employment of Executive with Stock Options and Rights in Discoveries. Utilize your account to check with the authorized kinds you may have acquired earlier. Proceed to the My Forms tab of the account and acquire an additional backup from the file you need.

When you are a brand new user of US Legal Forms, allow me to share straightforward guidelines that you can comply with:

- Initial, make certain you have chosen the appropriate develop for your town/state. You may look over the form using the Review button and study the form description to guarantee this is basically the right one for you.

- If the develop is not going to fulfill your requirements, use the Seach discipline to find the appropriate develop.

- Once you are sure that the form is suitable, go through the Purchase now button to get the develop.

- Pick the costs prepare you need and enter the needed information. Design your account and buy the order utilizing your PayPal account or charge card.

- Choose the file formatting and down load the authorized file template for your product.

- Full, change and print out and signal the obtained Wisconsin Employment of Executive with Stock Options and Rights in Discoveries.

US Legal Forms will be the greatest library of authorized kinds for which you can find a variety of file themes. Take advantage of the company to down load skillfully-created files that comply with condition needs.

Form popularity

FAQ

Stock Options and Equity Are Not Wages: In IBM v. Bajorek (1999) 191 F. 3d 1033, the Ninth Circuit Court of Appeals held that equity is not considered a wage because it has no monetary value.

Five Advantages of Employee Stock Ownership Plans (ESOPs)Increased Productivity. Most ESOPs we work with are in industries that recognize strong employee loyalty but low 401(k) participation.Alternate Exit Strategy for Aging Owners.Tax Advantages.Attracting Top Talent and Employee Retention.No Change in Governance.25-Jan-2021

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.

Taken together, our results are consistent with the view that stock options granted to non-executive employees increase risk-taking incentive, enhance failure-bearing capacity, encourage long-term commitment, and promote teamwork of employees, leading to greater innovation success.

Statutory Stock OptionsYou have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

Your W-2 includes income from any other compensation sources you may have, such as stock options, restricted stock, restricted stock units, employee stock purchase plans, and cash bonuses.

The statute does not apply because its words read literally and in light of its purposes do not apply stock options are not wages. Wages are defined by the statute as all amounts for labor performed by employees of every description, whether the amount is fixed or ascertained by the standard of time, task, piece,

Equity compensation, sometimes called stock compensation or sharebased compensation, is a noncash payout to employees via restricted shares and stock options. Employees who received this perk gain stake in their companies, which means they hold partial ownership of the business and its profits.

Investing in an ESPP can be a good idea, but it should complement your financial goals. These goals can be either long-term or short-term objectives for your overall financial health. Depending on when you buy and sell your shares, your ESPP could fit well into both.