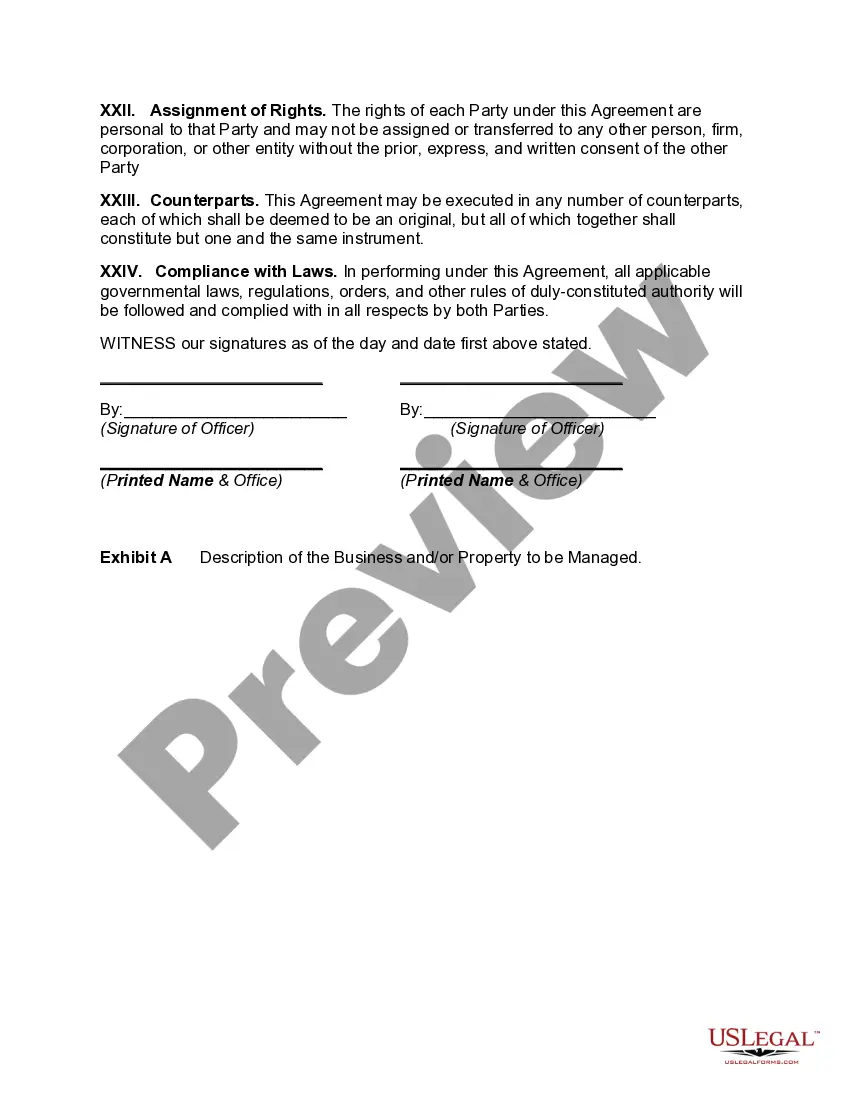

Wisconsin Agreement to Manage Business

Description

How to fill out Agreement To Manage Business?

Are you currently in the circumstance where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast selection of form templates, including the Wisconsin Agreement to Manage Business, designed to comply with state and federal regulations.

Once you've identified the suitable form, click Get now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Wisconsin Agreement to Manage Business template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review button to inspect the form.

- Check the description to confirm you have selected the right document.

- If the form isn't what you're seeking, use the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Yes, Wisconsin LLCs have to pay a $25 annual report fee every year. Visit our Wisconsin LLC Annual Report guide for more information.

Benefits of starting a Wisconsin LLC:Protects your personal assets from your business liability and debts.Easy tax filing and potential advantages for tax treatment.Quick and simple filing, management, compliance, regulation and administration.Low cost to file ($130)

Wisconsin calls this a franchise tax. In Wisconsin, the franchise tax is a flat 7.9% of net income. The tax is payable to the state's Department of Revenue (DOR). Use the state's corporation income tax return (Form 4) to pay the tax.

Every Wisconsin LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. Many states also impose ongoing fees, such as annual report and/or franchise tax fees. Check with your Secretary of State's office.

Some of the benefits of an LLC include personal liability protection, tax flexibility, their easy startup process, less compliance paperwork, management flexibility, distribution flexibility, few ownership restrictions, charging orders, and the credibility they can give a business.

This information can generally be found on your Secretary of State website. Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision.

A Wisconsin LLC operating agreement is a legal document that forms an organization/company that is member-managed by its contributing members. The document is designed to assist the members in outlining the many aspects of the entity, including the degree of ownership and the duties and responsibilities of all members.