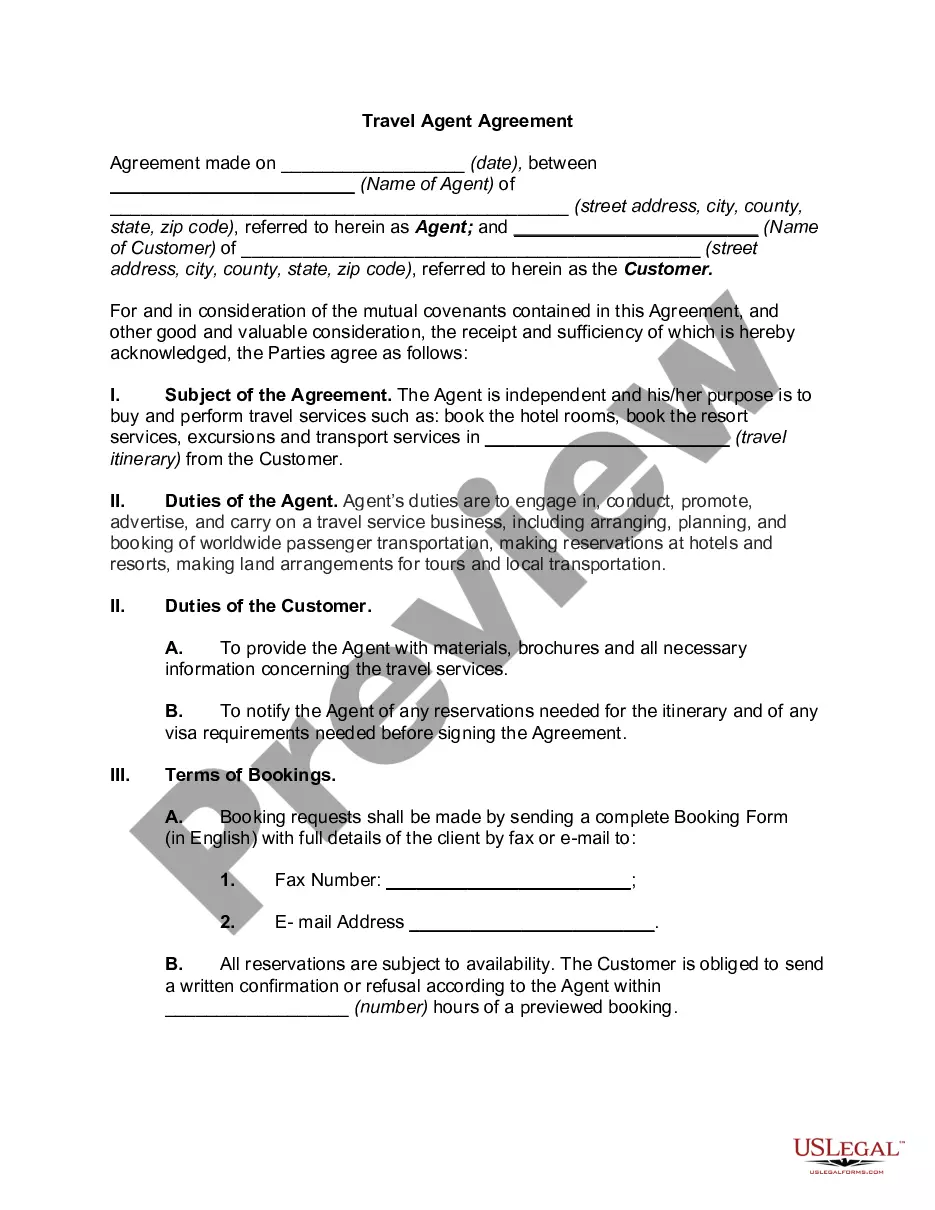

The Wisconsin Irrevocable Pot Trust Agreement is a legal document that establishes an arrangement where a granter transfers assets into a trust, and a trustee manages those assets for the benefit of multiple beneficiaries. This type of trust is known as a "pot" trust because the assets are pooled together, and the trustee has discretion on how to distribute them among the beneficiaries. The primary purpose of a Wisconsin Irrevocable Pot Trust Agreement is to provide financial protection and support for beneficiaries. It ensures that the granter's assets are managed and distributed according to their wishes, even after their death. By designating the trust as "irrevocable," the granter forfeits their ability to modify or revoke the terms of the trust without the consent of all beneficiaries. There are different variations of Wisconsin Irrevocable Pot Trust Agreements, each catering to specific situations or planning goals. These include: 1. Family Pot Trust: This type of trust is commonly used by families who wish to provide for multiple generations. The assets held in the trust can be distributed to children, grandchildren, and even future descendants, ensuring ongoing financial stability. 2. Charitable Pot Trust: Some individuals may choose to establish a Wisconsin Irrevocable Pot Trust to support charitable causes. In this case, the trust assets are managed for the benefit of specific charities or nonprofit organizations, allowing the granter to contribute to their chosen causes even after their passing. 3. Special Needs Pot Trust: Individuals with disabled or special needs family members might utilize this type of trust. The assets are managed in a way that doesn't jeopardize the beneficiary's eligibility for government assistance programs, ensuring they receive financial support without interrupting their access to vital benefits. 4. Medicaid Planning Pot Trust: For individuals seeking to protect their assets from being depleted due to nursing home or long-term care expenses, a Wisconsin Irrevocable Pot Trust can be established. By transferring assets into the trust, the granter may be able to qualify for Medicaid benefits while safeguarding assets for their intended beneficiaries. When drafting a Wisconsin Irrevocable Pot Trust Agreement, it is essential to consult with an experienced attorney to ensure compliance with state laws and to address specific family dynamics or financial goals. The agreement should outline the powers, responsibilities, and limitations of the trustee, the distribution guidelines, and any conditions or provisions set by the granter.

Wisconsin Irrevocable Pot Trust Agreement

Description

How to fill out Wisconsin Irrevocable Pot Trust Agreement?

You are able to commit time on the Internet trying to find the lawful file web template that fits the federal and state requirements you need. US Legal Forms offers a large number of lawful forms which are analyzed by pros. You can easily obtain or printing the Wisconsin Irrevocable Pot Trust Agreement from our service.

If you already have a US Legal Forms account, you may log in and click on the Acquire switch. Next, you may full, revise, printing, or sign the Wisconsin Irrevocable Pot Trust Agreement. Each and every lawful file web template you acquire is your own forever. To have yet another backup of the acquired form, check out the My Forms tab and click on the related switch.

Should you use the US Legal Forms site the first time, keep to the basic directions below:

- Initially, be sure that you have chosen the proper file web template for that state/city of your choice. Read the form explanation to ensure you have picked the appropriate form. If offered, utilize the Preview switch to check from the file web template as well.

- If you want to locate yet another variation of the form, utilize the Look for discipline to get the web template that meets your requirements and requirements.

- After you have found the web template you desire, just click Acquire now to proceed.

- Choose the rates plan you desire, enter your references, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can use your Visa or Mastercard or PayPal account to cover the lawful form.

- Choose the formatting of the file and obtain it to the product.

- Make changes to the file if necessary. You are able to full, revise and sign and printing Wisconsin Irrevocable Pot Trust Agreement.

Acquire and printing a large number of file templates utilizing the US Legal Forms Internet site, which provides the largest selection of lawful forms. Use specialist and status-distinct templates to tackle your business or specific demands.