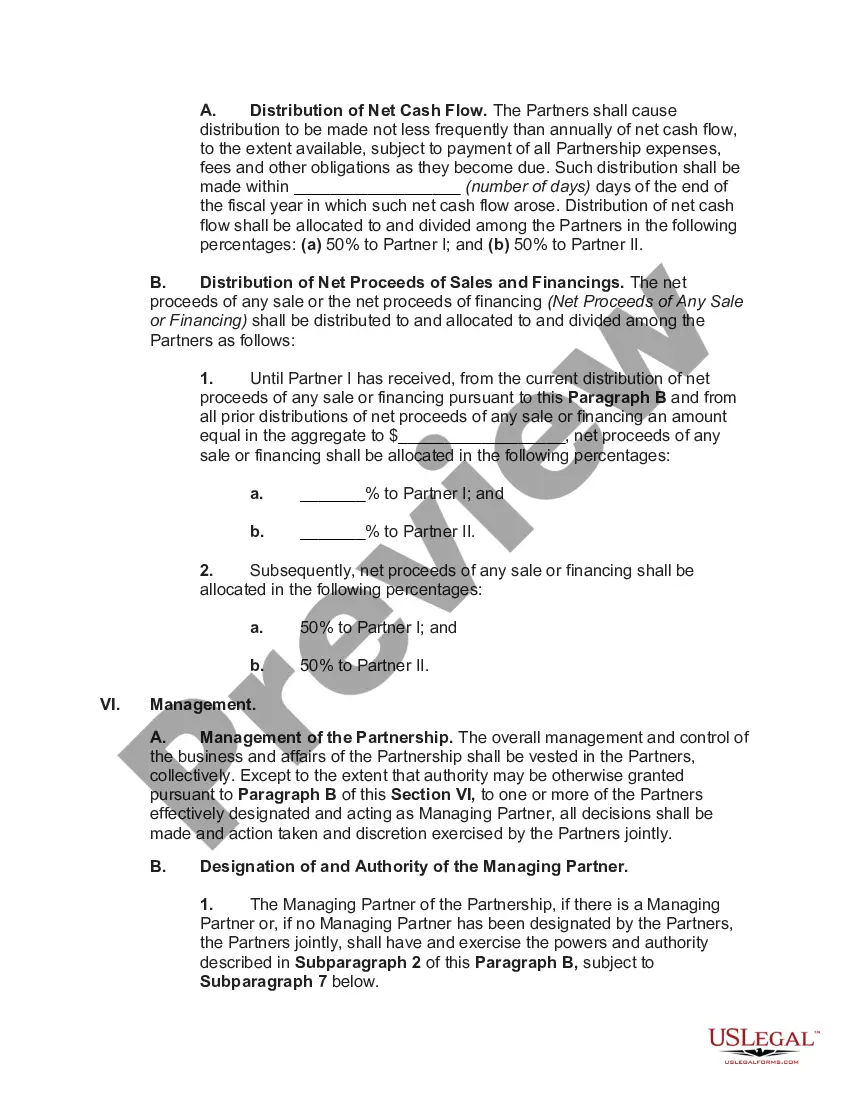

The Wisconsin Partnership Agreement for a Real Estate Development is an essential legal document that outlines the terms and conditions agreed upon by multiple parties involved in a real estate project in the state of Wisconsin. This agreement governs the collaboration and partnership between individuals, entities, or organizations entering into a joint venture to develop, manage, and profit from a real estate venture. The agreement typically covers various aspects such as project goals, financial contributions, responsibilities, profit sharing, decision-making processes, dispute resolution mechanisms, and termination clauses. In Wisconsin, there are different types of partnership agreements that can be used for real estate development, each serving specific purposes and catering to various business models. Some common types include: 1. General Partnership Agreement: This is the most basic type of partnership agreement, where two or more partners come together to jointly own and operate a real estate development project. Partners share profits, losses, and management responsibilities equally unless stated otherwise in the agreement. 2. Limited Partnership Agreement: This type of agreement enables the creation of a partnership with two types of partners: general partners and limited partners. General partners have unlimited liability and play an active role in managing the venture, while limited partners contribute capital but have limited liability and are typically not involved in day-to-day operations. 3. Limited Liability Partnership (LLP) Agreement: LLP agreements provide liability protection to all partners involved. This means that partners are not personally responsible for the acts, debts, or obligations of other partners. This structure is often preferred when partners want to limit their personal exposure to risks associated with real estate development projects. 4. Joint Venture Agreement: Joint ventures are formed between two or more parties for a specific real estate project or set of projects. This agreement outlines the partnership terms, contribution of resources, responsibilities, profit distribution, and termination conditions. Joint ventures are flexible and can be tailored to accommodate the unique needs of each project. 5. Real Estate Syndication Agreement: This type of agreement allows multiple investors to pool their resources together to invest in a real estate development project. The syndicated, who acts as the managing partner, oversees the project while individual investors enjoy the benefits of passive investment and shared profits. In conclusion, the Wisconsin Partnership Agreement for a Real Estate Development is a crucial legal document that establishes the framework for collaboration, profit-sharing, and decision-making in real estate projects. Depending on the nature of the project and the desired level of liability protection and involvement, one can choose from various types of partnership agreements, including general partnerships, limited partnerships, Laps, joint ventures, and real estate syndication.

Wisconsin Partnership Agreement for a Real Estate Development

Description

How to fill out Wisconsin Partnership Agreement For A Real Estate Development?

Are you currently in a scenario where you require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of template forms, including the Wisconsin Partnership Agreement for a Real Estate Development, that are designed to comply with state and federal requirements.

If you locate the appropriate form, click on Buy now.

Select the pricing plan you want, fill in the required information to create your account, and pay for the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Partnership Agreement for a Real Estate Development template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/region.

- Use the Preview button to review the form.

- Check the information to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

Partnerships typically use Form 1065 to report income and deductions to the IRS. This form is essential for maintaining transparency and compliance under the Wisconsin Partnership Agreement for a Real Estate Development. You may also need to file additional forms, such as Schedule K-1 to report each partner's share of income, deductions, and credits.

Typically, a partnership must file its tax return by the 15th day of the third month following the close of its tax year. For example, if your tax year ends on December 31, then you should file your return by March 15. Timely filing ensures that your Wisconsin Partnership Agreement for a Real Estate Development remains valid and avoids potential penalties.

Yes, even if your partnership does not generate income, it still must file a tax return. The IRS requires partnerships to report their income, expenses, and distributions, regardless of whether there was any income. By filing, you maintain compliance and keep your Wisconsin Partnership Agreement for a Real Estate Development in good standing.

When forming a partnership in Wisconsin, you must create a Wisconsin Partnership Agreement for a Real Estate Development. You need to register the partnership with the appropriate state agency and file a partnership registration form if you intend to operate under a fictitious name. Additionally, make sure that all partners meet the legal qualifications for forming a partnership, ensuring that you comply with state requirements.

Determining a fair percentage for a partnership often depends on the contribution of each partner, including capital, expertise, and time committment. It’s important to have open discussions and negotiate terms that reflect each partner’s value in the partnership. A Wisconsin Partnership Agreement for a Real Estate Development should specify these percentages to avoid future disagreements. Consulting with professionals can ensure that your arrangements are fair and legally binding.

drafted partnership agreement should include the names of all partners, the purpose of the partnership, and the duration of the partnership. It should also outline the capital contributions required from each partner and detail how profits and losses will be allocated. Lastly, including provisions for resolving disputes can safeguard your partnership in a Wisconsin Partnership Agreement for a Real Estate Development. Comprehensive agreements help maintain clarity and minimize conflicts among partners.

Structuring a partnership agreement involves clearly defining the roles, responsibilities, and contributions of each partner in your Wisconsin Partnership Agreement for a Real Estate Development. You should include sections on profit sharing, decision-making processes, and conflict resolution strategies. Additionally, specifying the terms for adding new partners or dissolving the partnership can prevent future misunderstandings. Utilizing a reliable template can help you cover all necessary aspects effectively.

To set up a limited partnership for real estate, you’ll start by drafting a Wisconsin Partnership Agreement for a Real Estate Development that outlines the roles of general and limited partners. Next, you need to file a Certificate of Limited Partnership with the Wisconsin Department of Financial Institutions. Be sure to obtain any necessary licenses and permits for your real estate projects. Consulting with a legal expert can streamline this process and ensure your partnership operates smoothly.

To draft a Wisconsin Partnership Agreement for a Real Estate Development, start by outlining the roles and responsibilities of each partner. Include essential elements such as profit-sharing, decision-making processes, and dispute resolution methods. You can simplify this process by utilizing resources provided by US Legal Forms, which offer templates and guidance tailored to your specific needs. This approach ensures that you protect your interests and create a clear understanding among partners.

You do not need an LLC to form a partnership, but it may provide added benefits such as liability protection. A Wisconsin Partnership Agreement for a Real Estate Development can help establish the terms of your business without requiring an LLC. However, if you seek to limit personal liability, forming an LLC may be a beneficial alternative.

Interesting Questions

More info

Contact address change your location address change your contact name and add phone number.