Title: Understanding the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance Introduction: The Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is a comprehensive contractual agreement between an insurance agency or producer and an insurance company, pertaining to the exclusive representation of all lines of insurance in the state of Wisconsin. This agreement aims to establish a mutually beneficial relationship between the parties involved, allowing the agency to act as the sole representative of the insurance company's products and services in the state. Types of Wisconsin Insurance General Agency Agreement with Exclusive Representation: 1. Auto Insurance General Agency Agreement: This type of agreement focuses exclusively on providing exclusive representation for all lines of auto insurance within Wisconsin. It covers policies related to private passenger vehicles, commercial vehicles, and any other automobile insurance products offered by the insurance company. 2. Property Insurance General Agency Agreement: With a focus on property insurance, this agreement outlines the exclusive representation of various lines of property insurance including homeowners insurance, commercial property insurance, renter's insurance, landlord insurance, and other related products within Wisconsin. 3. Health Insurance General Agency Agreement: Designed specifically for health insurance coverage, this agreement establishes the exclusive representation for health insurance policies, including individual health insurance, group health insurance, medicare plans, and other health-related insurance products. 4. Commercial Insurance General Agency Agreement: This agreement encompasses exclusive representation for a wide range of commercial insurance products, such as general liability insurance, professional liability insurance, workers' compensation insurance, business interruption insurance, and other commercial lines of insurance within Wisconsin. Key Elements of the Agreement: 1. Exclusive Representation: The agreement grants the agency the sole authority to represent and sell all lines of insurance offered by the insurance company in Wisconsin. This exclusivity ensures that the agency becomes the primary point of contact for all insurance-related matters within its designated territory. 2. Binding Authority: The agency is granted the power to issue policies, bind coverage, and collect premiums within certain predefined limits. This authority enables the agency to act on behalf of the insurance company in underwriting risks and settling claims. 3. Commissions and Compensation: The agreement specifies the commission structure and compensation terms for the agency's services. It outlines the percentage or fee the agency will receive for the sale and service of insurance policies. It may also include provisions for residual commissions, bonuses, or incentives based on performance metrics. 4. Responsibilities and Obligations: The agreement sets forth the obligations and responsibilities of both the insurance company and the agency. It outlines marketing and advertising requirements, reporting procedures, customer service standards, compliance with state regulations, and other operational guidelines. 5. Termination and Renewal: The agreement specifies terms related to termination, renewal, or non-renewal of the agreement. It outlines the notice period, conditions for termination, and any potential penalties or repercussions for breach of contract. Conclusion: The Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance serves as a critical framework for establishing a trusted partnership between insurance companies and agencies. By delineating the rights, obligations, and responsibilities of each party, it ensures a harmonious and mutually beneficial working relationship within Wisconsin's insurance industry.

Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance

Description

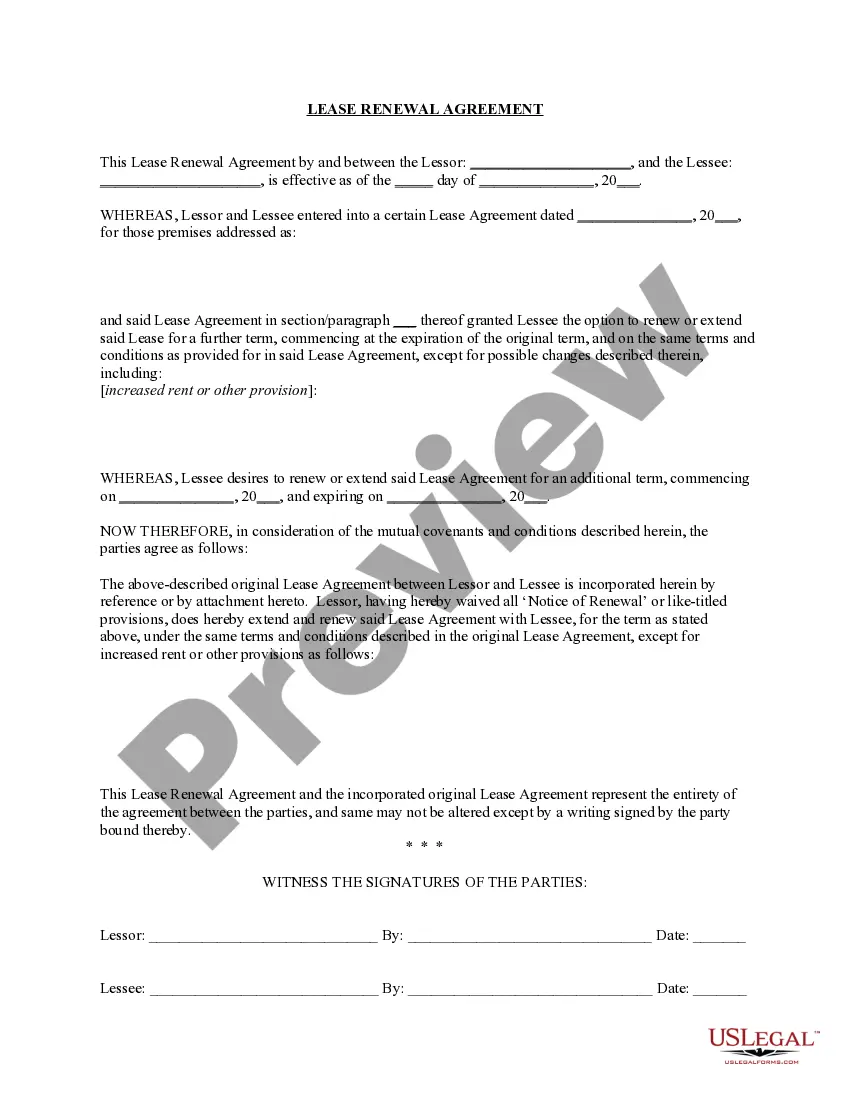

How to fill out Wisconsin Insurance General Agency Agreement With Exclusive Representation For All Lines Of Insurance?

Selecting the most suitable legal documentation template can be challenging.

Clearly, there is an abundance of templates accessible online, but how can you secure the legal document you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and review the document summary to ensure it is suitable for your needs.

- All of the documents are verified by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and then click the Get button to obtain the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

- Use your account to browse through the legal documents you may have previously purchased.

- Visit the My documents tab of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward steps you can follow.

- First, ensure that you have selected the correct form for your locality/region.

Form popularity

FAQ

The primary difference between an agency agreement and other contracts lies in the nature of the relationship established. An agency agreement, such as the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, empowers one party to act on behalf of another. Other contracts, like service agreements, often focus on the delivery of specific tasks or services without granting representation rights.

'Agency' in insurance refers to the relationship between an insurer and an agent who sells its products. In the framework of the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, the agency acts as the intermediary that helps clients secure insurance coverage. This arrangement allows for better service and increased efficiency in policy management and claims handling.

An agency contract is a legally binding document that defines the relationship between a principal, such as an insurance company, and an agent. In the context of the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, this contract outlines how the agent will conduct business on behalf of the principal. This contract protects both parties by setting clear expectations and terms of engagement.

The purpose of a Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is to establish a formal relationship between an insurance company and an agency. This agreement clarifies the roles, responsibilities, and obligations of both parties. It enables the agency to represent the insurance company exclusively, ensuring a streamlined approach to managing policies and claims.

An insurance agent can indeed represent more than one company if they operate as an independent agent. This role provides clients with various insurance solutions, tailored to their needs and preferences. While the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance focuses on exclusive agents, independent agents play a vital role by expanding the choices available to consumers.

The agent that represents only one insurance company is typically referred to as an exclusive agent or captive agent. This type of agent works under the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, focusing solely on the products and services of a single insurer. This specialization can lead to enhanced customer service and deeper knowledge of one company's offerings.

Yes, an agent can represent more than one insurance company if they are an independent agent. This arrangement allows them to provide clients with a wide range of policy options that match their individual requirements. The Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance usually pertains to exclusive agents, but understanding independent agents can help you make more informed decisions regarding your insurance.

Agents who represent a single insurer are known as exclusive or captive agents. These professionals dedicate themselves to the products and services of one specific insurance carrier. The Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance often involves these types of agents, ensuring that customers receive specialized assistance and knowledge about their insurance options.

Independent insurance agents do not work for one particular company. Instead, they represent multiple insurance carriers, allowing them to offer clients a variety of options. This flexibility aligns well with the principles of the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, enabling customers to compare different policies and select the one that best fits their needs.

Agents working on behalf of one specific insurance carrier are called exclusive agents. Under the Wisconsin Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, these agents provide dedicated support to a single insurer, helping customers navigate products and services tailored to their needs. By focusing on one company, these agents develop expertise in that insurer’s offerings, which enhances the service they provide to clients.

Interesting Questions

More info

If you prefer, you can download this form to fill out online or fax this form to. A&P will send you an exclusive A&P Insurance Group quotation for your property. If you own a primary residence, this insurance helps to mitigate certain types of financial harm. An exclusive A&P insurance plan guarantees reimbursement of medical expenses you incur for medical care. Specialty insurance is designed to help mitigate the impact on homeowners or businesses if you suffer a casualty that affects your personal property and your personal rights. For example: Assumption of Risk For homeowners, the exclusivity of A&P's exclusive A&P coverage could help reduce the impact on your property, your home and your home equity. For Businesses, this exclusivity provides an additional level of protection to protect businesses from potential harm caused by catastrophes, such as fire. Property Loss insurance can help homeowners and businesses recover losses on their property.