Wisconsin Annuity as Consideration for Transfer of Securities: A Detailed Description Wisconsin annuity as consideration for transfer of securities refers to a financial arrangement where an individual or entity transfers securities, such as stocks, bonds, or mutual funds, to an insurance company in exchange for an annuity contract. An annuity is a financial product offered by insurance companies that provides regular income payments either immediately or in the future. In Wisconsin, this particular type of annuity serves as a means to facilitate the transfer of securities, allowing individuals or entities to convert their investment assets into a steady income stream. The process involves giving up ownership of the securities and investing the proceeds into an annuity contract. This can be an attractive option for those who desire a reliable income source while still benefiting from potential market growth. There are several types of Wisconsin annuities available as consideration for the transfer of securities, each offering different features and benefits. Some common types include: 1. Fixed Annuities: These annuities guarantee a fixed interest rate over a specified period. They are suitable for those seeking stable income payments without exposure to market risk. 2. Variable Annuities: Unlike fixed annuities, variable annuities allow individuals to invest in a range of investment options, such as stocks and bonds, within the annuity. The income payments fluctuate based on the performance of these underlying investments, exposing the annuitant to market risk. 3. Indexed Annuities: Indexed annuities offer returns linked to the performance of an underlying index, typically a stock market index such as the S&P 500. These annuities provide the potential for higher returns than fixed annuities while also offering downside protection. 4. Immediate Annuities: Immediate annuities provide immediate income payments following a lump sum investment. They are suitable for individuals who require an immediate income stream. 5. Deferred Annuities: Deferred annuities, on the other hand, allow the annuitant to accumulate funds over a specific period before starting the income payments. This can be advantageous for those who want to build a nest egg for retirement. By exploring the different types of annuities available, individuals in Wisconsin can choose the most suitable option that aligns with their financial goals, risk tolerance, and income needs. Moreover, transferring securities as consideration for an annuity allows individuals to diversify their investment portfolio while benefiting from the potential advantages of annuity contracts, such as tax-deferred growth. In summary, the Wisconsin annuity as consideration for transfer of securities is a financial strategy that facilitates the conversion of investment assets into a steady income stream. With various types of annuities available, individuals can tailor their choice to match their specific requirements. By understanding the options and evaluating the benefits, individuals can make informed decisions about their financial future and retirement planning.

Wisconsin Annuity as Consideration for Transfer of Securities

Description

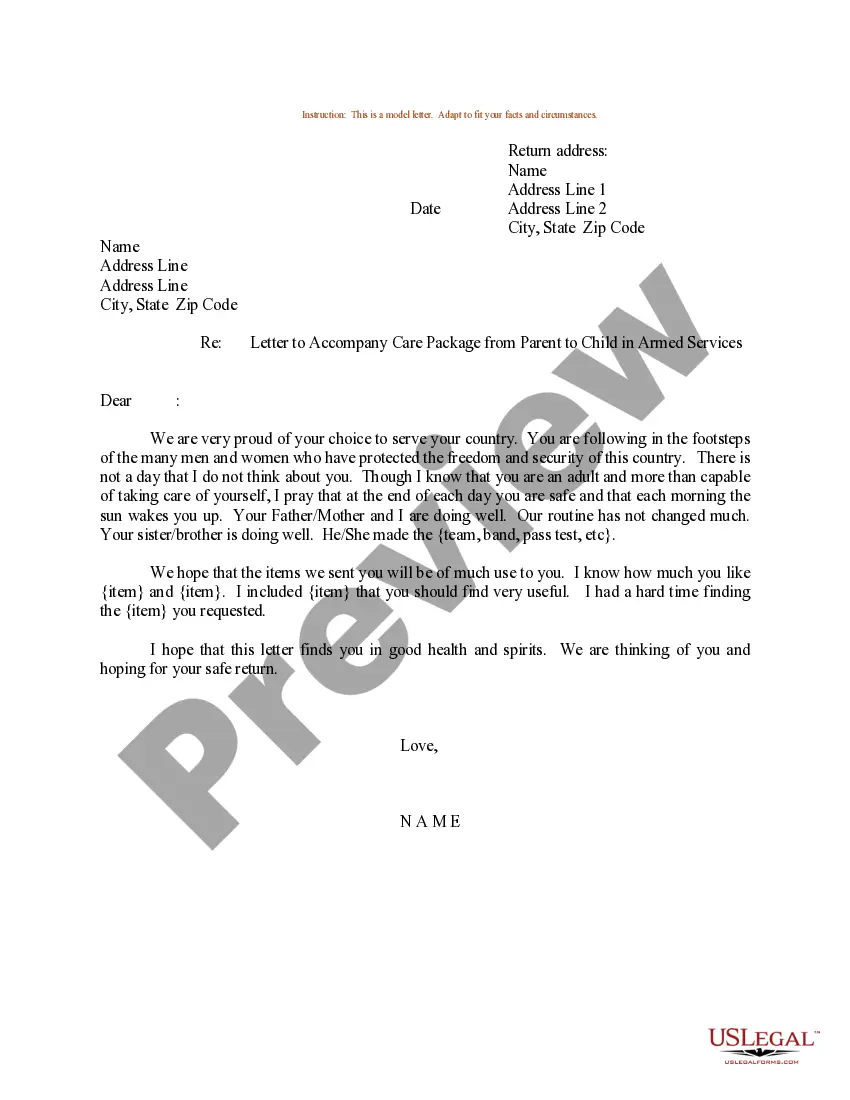

How to fill out Wisconsin Annuity As Consideration For Transfer Of Securities?

Discovering the right legitimate document design might be a have a problem. Naturally, there are a variety of layouts available online, but how do you find the legitimate kind you need? Utilize the US Legal Forms site. The assistance provides 1000s of layouts, such as the Wisconsin Annuity as Consideration for Transfer of Securities, that can be used for business and private requirements. All the kinds are examined by experts and meet up with federal and state requirements.

Should you be currently registered, log in to the bank account and click the Acquire switch to have the Wisconsin Annuity as Consideration for Transfer of Securities. Use your bank account to appear through the legitimate kinds you might have ordered previously. Go to the My Forms tab of your own bank account and have another copy from the document you need.

Should you be a whole new user of US Legal Forms, allow me to share basic instructions for you to adhere to:

- Initial, make certain you have chosen the right kind for your personal area/area. You may look through the form using the Preview switch and read the form description to make certain this is the best for you.

- In case the kind will not meet up with your requirements, utilize the Seach industry to get the proper kind.

- When you are positive that the form is suitable, select the Acquire now switch to have the kind.

- Choose the costs plan you would like and type in the necessary details. Build your bank account and buy the order utilizing your PayPal bank account or credit card.

- Select the file format and download the legitimate document design to the system.

- Full, revise and produce and indication the attained Wisconsin Annuity as Consideration for Transfer of Securities.

US Legal Forms is definitely the greatest catalogue of legitimate kinds that you can discover various document layouts. Utilize the company to download appropriately-manufactured paperwork that adhere to state requirements.