A Wisconsin Depreciation Schedule is a document that outlines the method and schedule for depreciating assets owned by businesses or individuals in the state of Wisconsin. It is crucial for accurate accounting and tax purposes as it assists in determining the value of an asset over time. The Wisconsin Depreciation Schedule follows the guidelines set by the Internal Revenue Service (IRS) but incorporates specific rules and regulations applicable in the state. It is important to note that depreciation schedules may vary based on the type of asset being depreciated. There are several types of Wisconsin Depreciation Schedules designated for different categories of assets. These include: 1. Personal Property Depreciation: This category encompasses assets such as equipment, machinery, vehicles, and furniture used for business purposes. Wisconsin's businesses need to determine the useful life of each asset and select an appropriate depreciation method, such as straight-line or accelerated depreciation, to calculate yearly depreciation expense. 2. Real Property Depreciation: Real property, including buildings, improvements, and other structures, also depreciates over time. Wisconsin offers different methods like straight-line, declining balance, and sum-of-years' digits for depreciating real property. The depreciation schedule for real property typically spans a longer period compared to personal property. 3. Intangible Asset Depreciation: Intangible assets, such as patents, copyrights, trademarks, and intellectual property, also require depreciation. The Wisconsin Depreciation Schedule for intangible assets considers factors like the asset's useful life, expiration dates, and legal rights associated with it. Wisconsin Depreciation Schedules play a vital role in tax planning and compliance. These schedules are essential for determining the depreciation expense to be deducted each year, reducing taxable income and potentially lowering tax liabilities. It is crucial for businesses and individuals in Wisconsin to maintain accurate and up-to-date depreciation schedules to comply with state regulations and optimize their financial strategies. In summary, a Wisconsin Depreciation Schedule is a detailed document that outlines the estimated depreciation of various assets owned by businesses or individuals in the state. It helps in determining the value of assets over time, accounting for wear and tear, obsolescence, and expiration dates. Different types of assets, including personal property, real property, and intangible assets, may require separate depreciation schedules in Wisconsin.

Wisconsin Depreciation Schedule

Description

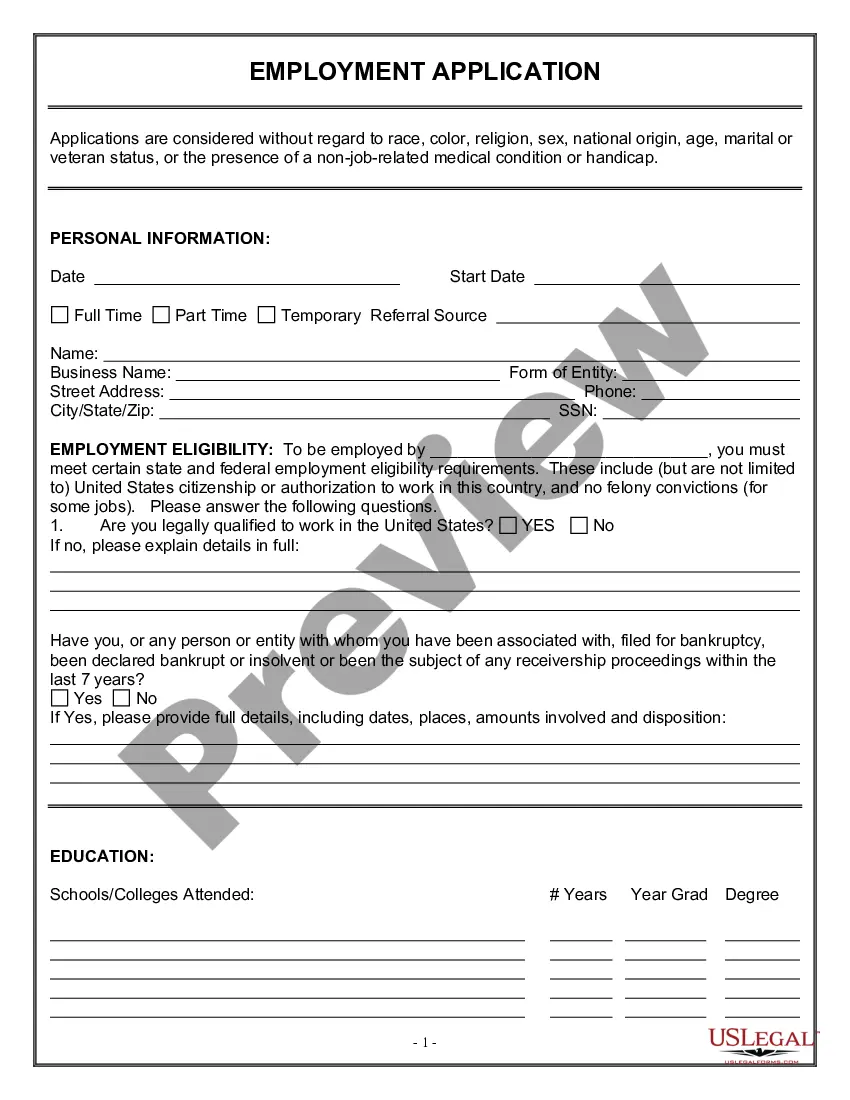

How to fill out Wisconsin Depreciation Schedule?

US Legal Forms - one of several most significant libraries of authorized kinds in the United States - delivers a wide range of authorized papers templates you can obtain or produce. Using the internet site, you can get 1000s of kinds for enterprise and individual functions, categorized by types, states, or search phrases.You will discover the most up-to-date types of kinds such as the Wisconsin Depreciation Schedule in seconds.

If you have a membership, log in and obtain Wisconsin Depreciation Schedule through the US Legal Forms local library. The Download key can look on each develop you look at. You have accessibility to all previously saved kinds within the My Forms tab of the profile.

If you would like use US Legal Forms initially, allow me to share straightforward directions to obtain started:

- Be sure to have selected the right develop for your personal metropolis/state. Go through the Preview key to examine the form`s articles. See the develop explanation to ensure that you have chosen the proper develop.

- In case the develop does not match your demands, take advantage of the Lookup area on top of the screen to obtain the one that does.

- If you are pleased with the form, validate your choice by clicking the Purchase now key. Then, choose the prices program you favor and provide your credentials to register for the profile.

- Procedure the purchase. Use your credit card or PayPal profile to perform the purchase.

- Find the formatting and obtain the form in your gadget.

- Make alterations. Fill out, revise and produce and signal the saved Wisconsin Depreciation Schedule.

Every single format you put into your bank account lacks an expiry time and is also the one you have for a long time. So, if you wish to obtain or produce one more backup, just visit the My Forms segment and click on in the develop you need.

Gain access to the Wisconsin Depreciation Schedule with US Legal Forms, by far the most extensive local library of authorized papers templates. Use 1000s of skilled and state-particular templates that meet your organization or individual demands and demands.