Wisconsin FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

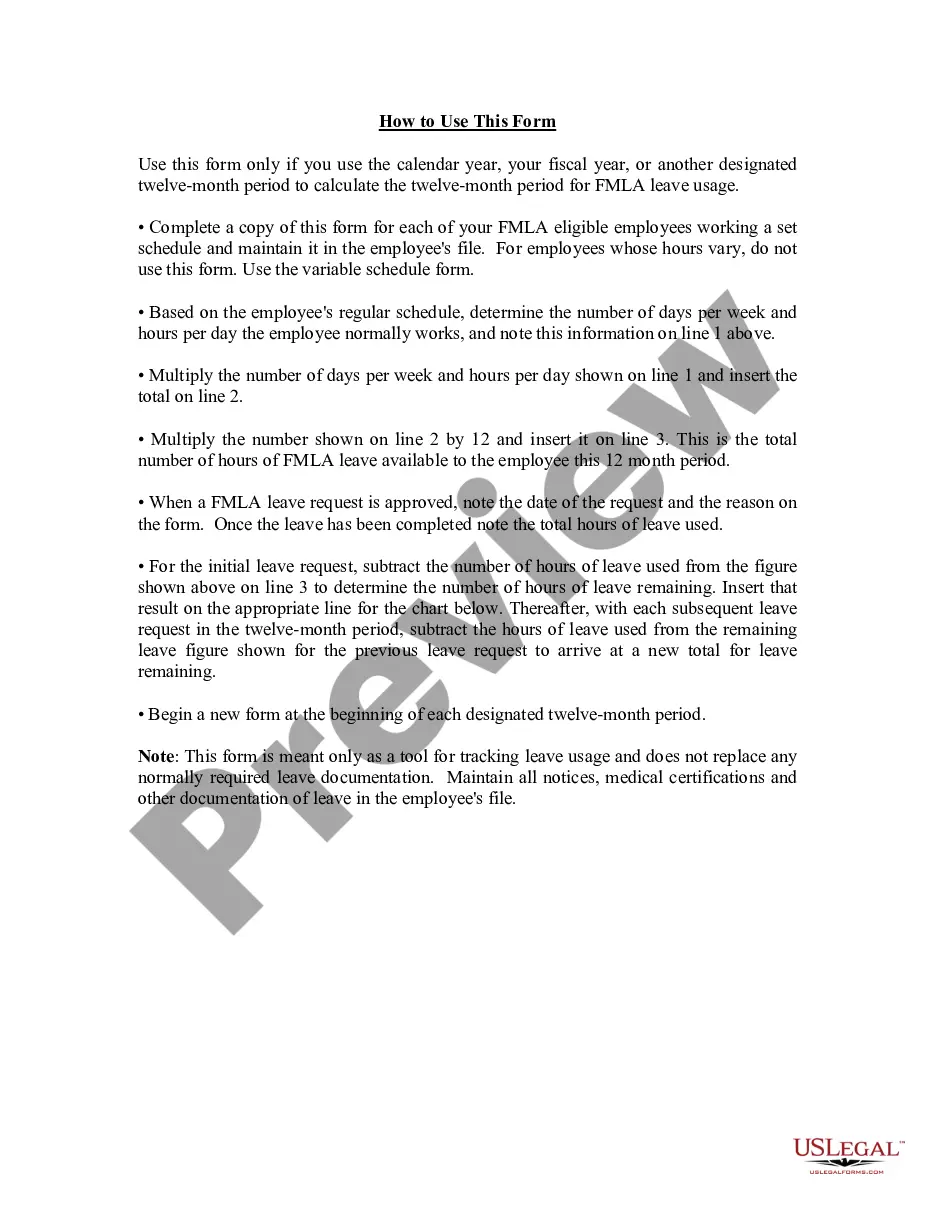

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

If you require to obtain, acquire, or print out valid document templates, utilize US Legal Forms, the biggest collection of valid forms available online.

Utilize the site’s simple and user-friendly search to discover the documents you need.

Different templates for business and personal uses are organized by categories and titles, or keywords.

Step 4. Once you have discovered the form you need, click on the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Select the format of the valid form and download it to your device.

- Use US Legal Forms to locate the Wisconsin FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule in just a few clicks.

- If you are currently a customer of US Legal Forms, Log In to your account and click on the Download button to obtain the Wisconsin FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule.

- You may also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the valid form format.

Form popularity

FAQ

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

For the rolling backwards method, each time an employee requests more FMLA leave, the employer uses that date and measures 12 months back from it. An employee would be eligible for remaining FMLA leave he or she has not used in the preceding 12-month period. For example, Mrs.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

An eligible employee may take all 12 weeks of his or her FMLA leave entitlement as qualifying exigency leave or the employee may take a combination of 12 weeks of leave for both qualifying exigency leave and leave for a serious health condition.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

FMLA leave may be taken in periods of whole weeks, single days, hours, and in some cases even less than an hour. The employer must allow employees to use FMLA leave in the smallest increment of time the employer allows for the use of other forms of leave, as long as it is no more than one hour.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.