Wisconsin Direct Deposit Authorization

Description

How to fill out Direct Deposit Authorization?

Have you found yourself in a circumstance where you require documents for both organizational or personal tasks nearly every day.

There are numerous legitimate document templates available online, but locating ones you can trust is not simple.

US Legal Forms offers thousands of template options, such as the Wisconsin Direct Deposit Authorization, that are designed to comply with state and federal regulations.

If you find the right document, click Get now.

Select the pricing plan you prefer, provide the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, just Log In.

- After that, you can download the Wisconsin Direct Deposit Authorization template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

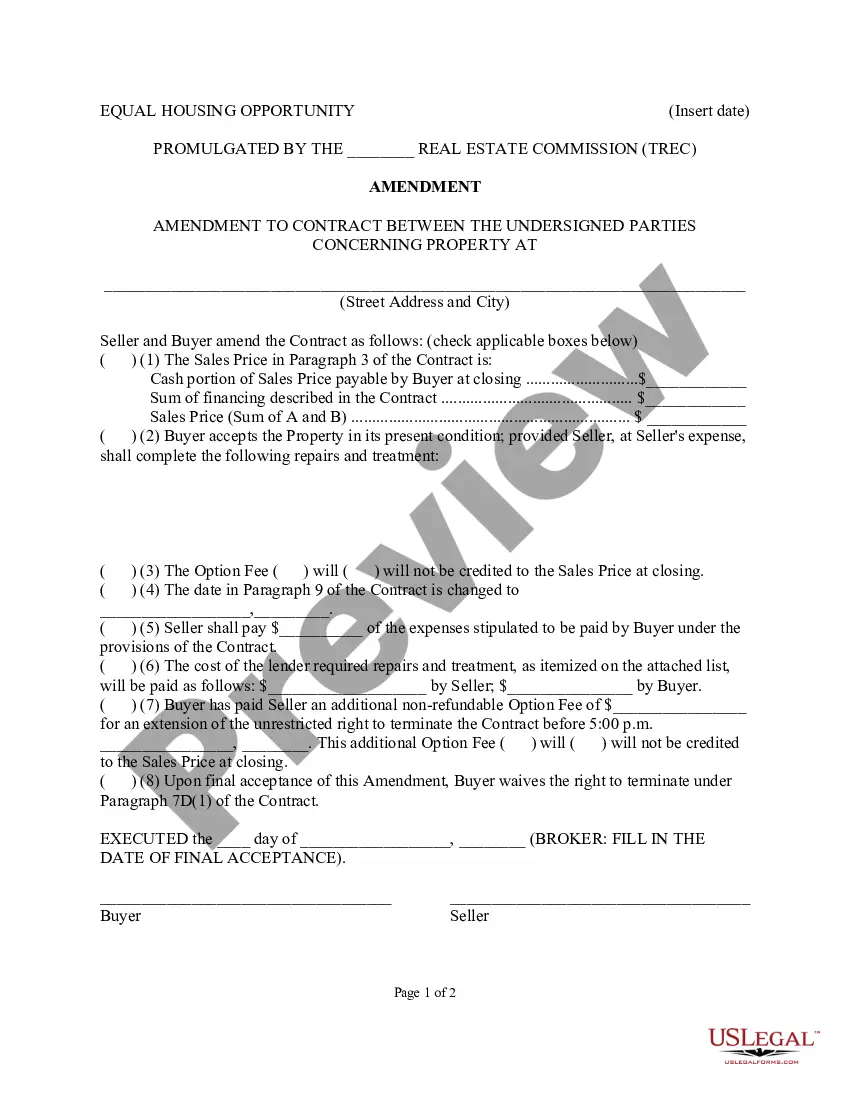

- Use the Review button to examine the document.

- Read the description to ensure you have selected the correct document.

- If the document is not what you require, use the Search field to find the document that meets your needs.

Form popularity

FAQ

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

In order for an employer to deposit your pay directly into your account, they need to have your authorization to do so. In addition to getting permission, the employer also collects information like your bank account number and routing number.

Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider. This wait period applies every time new employees are added to the system.

How to Set Up Direct DepositGet a direct deposit form from your employer.Fill in account information.Confirm the deposit amount.Attach a voided check or deposit slip, if required.Submit the form.

One of the biggest benefits of direct deposit is that it happens very quickly, usually one to three days but sometimes up to five business days. This varies depending on who is actually sending the funds and may even get faster in the future. (Learn more about transferring money from one bank to another.)

No, you do not need your bank's approval or signature for direct deposit. All you will need is your bank routing number and your account number, which are listed at the bottom of every check. (Note: Do not use numbers from the bottom of a deposit slip.

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due.