The Wisconsin Expense Reimbursement Request is a formal process where individuals and employees in the state of Wisconsin can seek reimbursement for their legitimate business-related expenses. This request form allows individuals to claim back funds that have been spent on authorized expenses while performing their professional duties. The Wisconsin Expense Reimbursement Request aims to ensure that employees are not burdened with out-of-pocket expenses incurred while fulfilling their work responsibilities. By submitting this request, individuals can seek reimbursement for expenses such as travel, meals, accommodation, transportation, supplies, equipment, and any other costs directly associated with conducting official state business. The reimbursement request process typically starts with the individual filling out the Wisconsin Expense Reimbursement Form, providing detailed information regarding the type, date, and purpose of the expense incurred. It is important to accurately record the expenses and provide supporting documentation, such as receipts or invoices, to verify the legitimacy of the claimed expenses. It is worth noting that there might be different types or categories of Wisconsin Expense Reimbursement Requests, depending on the nature of the expenses. Some common types of reimbursement requests in Wisconsin include: 1. Travel Expenses: This category covers costs associated with transportation (airfare, mileage, etc.), lodging, meals, and parking fees incurred during official state business-related trips. 2. Miscellaneous Expenses: This category encompasses a wide range of reimbursable expenses that do not fall under specific categories. It may include costs such as office supplies, equipment repairs, telephone bills, postage fees, and other necessary expenses incurred while carrying out official duties. 3. Conference and Seminar Expenses: Reimbursement for expenses related to attending conferences, seminars, workshops, or trainings can also be requested. This may include registration fees, transportation, accommodation, meals, and other associated costs. 4. Business Related Meals: Individuals who incur expenses while having business-related meals can submit reimbursement requests for these costs. Wisconsin Expense Reimbursement Request allows for reasonable expenses, keeping in mind the official nature of the meal and the individuals involved. To ensure the smooth processing of the reimbursement request, it is essential to complete the Wisconsin Expense Reimbursement Form accurately and attach all relevant supporting documents. Additionally, it is vital to comply with the reimbursement policies and guidelines set by the state to avoid any delays or rejection of the request. In conclusion, the Wisconsin Expense Reimbursement Request is an essential mechanism for employees and individuals in Wisconsin to claim reimbursement for authorized expenses incurred while conducting official state business. By submitting detailed and accurate reimbursement requests, individuals can ensure their expenses are appropriately reimbursed, thereby reducing the financial burden associated with their professional duties.

Wisconsin Expense Reimbursement Request

Description

How to fill out Wisconsin Expense Reimbursement Request?

Choosing the right legitimate papers template can be a struggle. Needless to say, there are plenty of themes accessible on the Internet, but how will you obtain the legitimate kind you will need? Take advantage of the US Legal Forms internet site. The assistance provides 1000s of themes, like the Wisconsin Expense Reimbursement Request, that you can use for organization and private needs. Each of the varieties are checked out by specialists and satisfy federal and state requirements.

If you are already registered, log in to your accounts and then click the Obtain switch to get the Wisconsin Expense Reimbursement Request. Make use of accounts to appear throughout the legitimate varieties you possess bought formerly. Go to the My Forms tab of your own accounts and obtain one more copy from the papers you will need.

If you are a brand new end user of US Legal Forms, listed below are easy instructions that you can comply with:

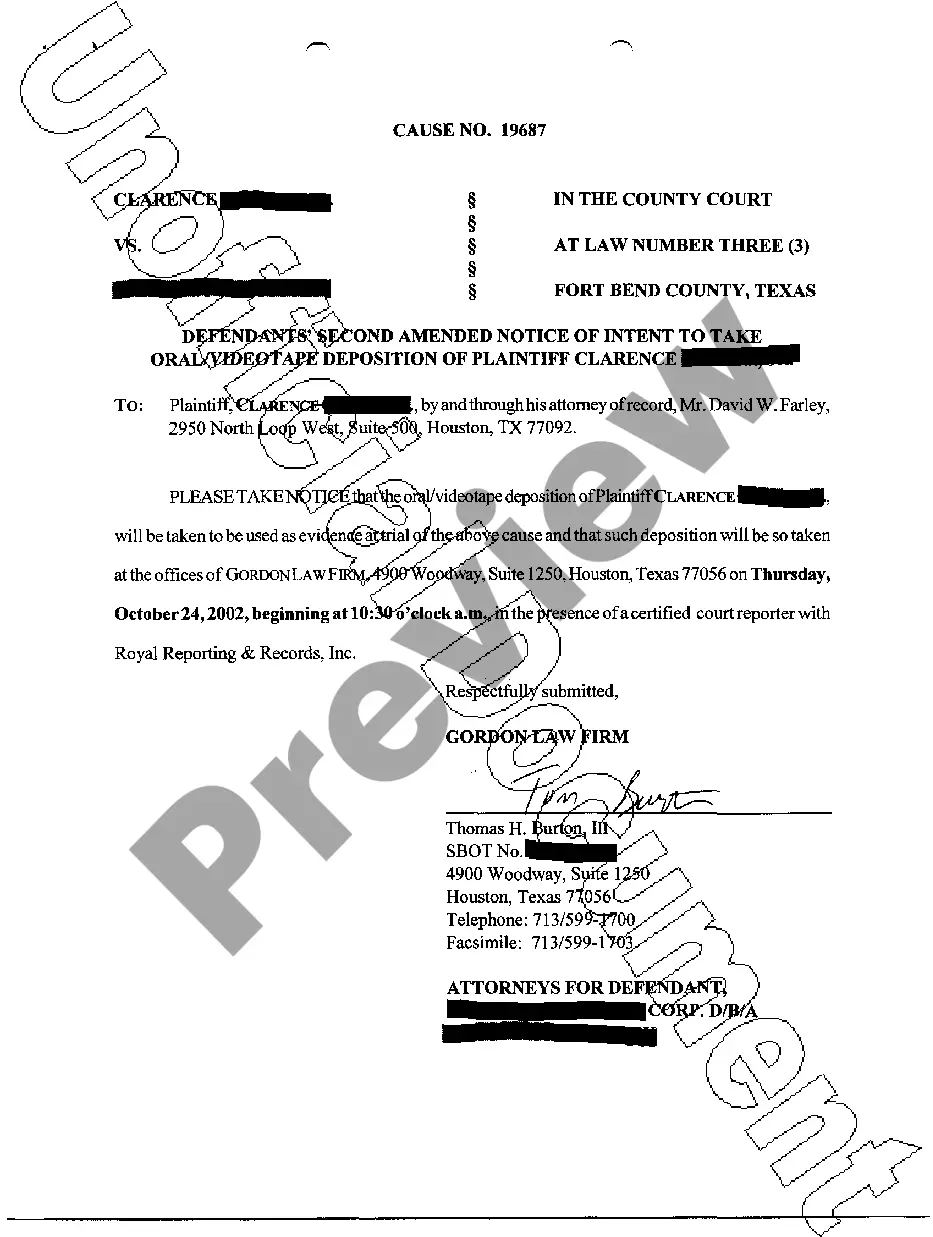

- Initially, ensure you have chosen the correct kind for your personal city/county. You are able to check out the shape utilizing the Review switch and browse the shape explanation to make certain it is the right one for you.

- If the kind will not satisfy your expectations, make use of the Seach area to find the appropriate kind.

- Once you are certain the shape is acceptable, click the Acquire now switch to get the kind.

- Opt for the pricing plan you want and enter the necessary info. Build your accounts and purchase the transaction with your PayPal accounts or Visa or Mastercard.

- Choose the data file formatting and download the legitimate papers template to your system.

- Comprehensive, edit and produce and sign the obtained Wisconsin Expense Reimbursement Request.

US Legal Forms is the greatest library of legitimate varieties for which you can see numerous papers themes. Take advantage of the service to download skillfully-created papers that comply with status requirements.