Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

Wisconsin Structured Settlement Factoring Transactions

Description

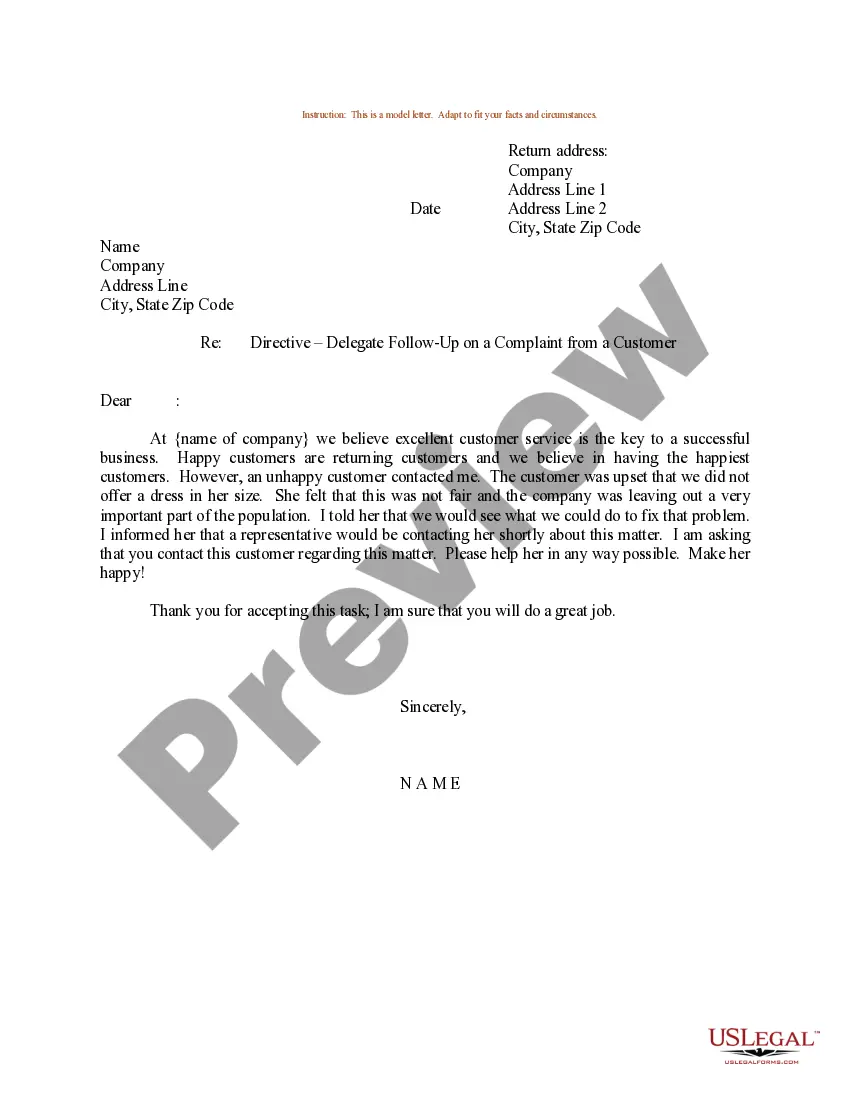

How to fill out Structured Settlement Factoring Transactions?

Choosing the best lawful file design could be a have difficulties. Needless to say, there are a variety of web templates available online, but how will you find the lawful develop you want? Make use of the US Legal Forms site. The services offers thousands of web templates, including the Wisconsin Structured Settlement Factoring Transactions, that you can use for organization and private requires. Every one of the types are examined by specialists and meet up with federal and state specifications.

Should you be already registered, log in to the bank account and click on the Down load option to have the Wisconsin Structured Settlement Factoring Transactions. Utilize your bank account to appear with the lawful types you possess bought earlier. Visit the My Forms tab of the bank account and acquire an additional copy of your file you want.

Should you be a brand new user of US Legal Forms, listed below are easy directions so that you can follow:

- First, make certain you have selected the right develop for your personal city/area. It is possible to look over the form using the Preview option and look at the form description to make certain it is the right one for you.

- In the event the develop does not meet up with your expectations, make use of the Seach industry to discover the appropriate develop.

- When you are sure that the form is suitable, click on the Buy now option to have the develop.

- Choose the costs plan you want and type in the needed information. Make your bank account and pay for the transaction with your PayPal bank account or credit card.

- Pick the submit structure and obtain the lawful file design to the device.

- Total, change and print and indicator the received Wisconsin Structured Settlement Factoring Transactions.

US Legal Forms is definitely the greatest collection of lawful types where you can find various file web templates. Make use of the service to obtain skillfully-created files that follow status specifications.

Form popularity

FAQ

Different Types of Structured Settlement Payouts Temporary life annuity. Joint and survivor annuity. Deferred lump-sum. Percentage increase annuity. Step annuities.

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date.

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

Cashing out a structured settlement can be a good way to access a significant amount of cash. But before making such a significant decision, review all of the costs carefully. If you decide to proceed with a sale, get offers from at least two to three different buyers to ensure you're getting the best deal possible.

Structured Settlement calls people on old and expired debts, to get your Debit or Credit Card and make payments that are usually outside the statute of limitations.

What is a Structured Settlement? A structured settlement annuity (?structured settlement?) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime.