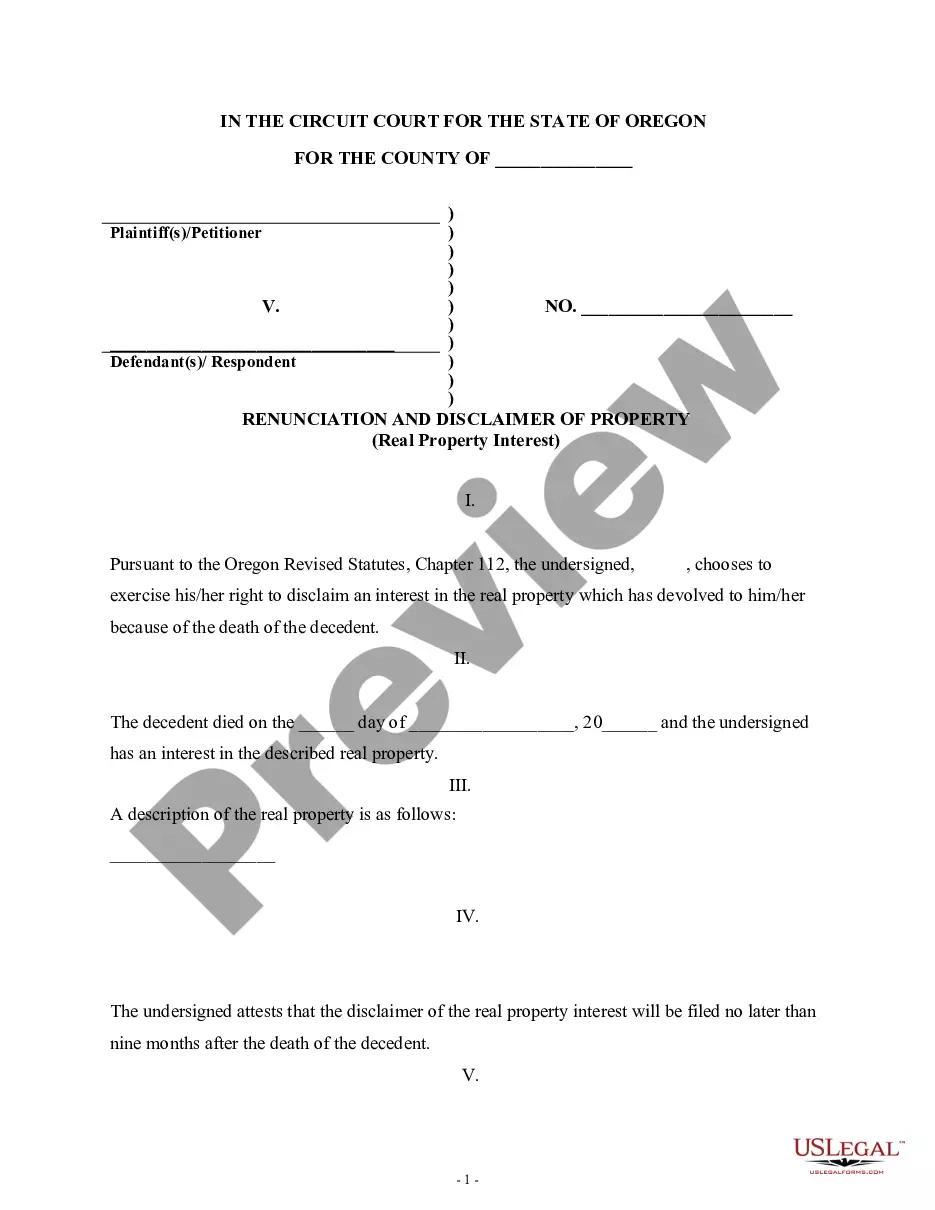

Wisconsin Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print. Through the website, you can locate thousands of documents for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents such as the Wisconsin Agreement to Reimburse for Insurance Premium in just seconds.

If you already have a monthly subscription, Log In and obtain the Wisconsin Agreement to Reimburse for Insurance Premium from the US Legal Forms library. The Download button will appear on every document you view.

- Access all previously saved documents in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure that you have selected the correct document for your city/state.

- Click the Preview button to review the form’s content.

- Check the form outline to make certain you have the correct document.

Form popularity

FAQ

Yes, when a Wisconsin Medicaid recipient has other health insurance, the Wisconsin Medicaid program will reimburse according to the Wisconsin Agreement to Reimburse for Insurance Premium. The program pays for the insurance premiums you have already covered, reducing your overall healthcare costs. This reimbursement is essential for recipients to maintain access to necessary health insurance while benefiting from Medicaid services.

After a filing has been given public notice, the Rate Regulation Division has 60 days to review the filing and approve the filing or issue a notice of hearing. A public intervenor may request a hearing on any filing within 45 days after public notice is given.

When an insurance company sends a policy to the insured with an attached application, the element that makes the application part of the contract between the insured and the insurer is called the? Entire Contract provision. An insured must notify an insurer of a medical claim within how many days after an accident? 20.

The entire contract consists of the policy, riders (endorsements and amendments), and a copy of the application.

Taxability of Reimbursements to Employees If an employee pays the premiums on personally owned health insurance or incurs medical costs and is reimbursed by the employer, the reimbursement generally is excluded from the employee's gross income and not taxed under both federal and state tax law.

A time of payment of claims provision states the number of days that the insurance company has to pay or deny a submitted claim. This provision is included to minimize the amount of time that a policyholder has to wait for his/her payment or for a decision about his/her claim.

Which of the following is attached to the policy to alter or add to the policy provisions? Endorsement - An endorsment is written amendment to the policy that also broadens or restricts the policy provisions and takes precedence over the original policy language.

A health insurance claim is when you request reimbursement or direct payment for medical services that you have already obtained. The way to obtain benefits or payment is by submitting a claim via a specific form or request. There are two ways to submit your health insurance claim.

Reimbursement is compensation paid by an organization for out-of-pocket expenses incurred or overpayment made by an employee, customer, or another party. Reimbursement of business expenses, insurance costs, and overpaid taxes are common examples.

In case of the reimbursement claim process, the following steps have to be adhered to:Step 1: Verify the details. Before signing on the bill, verify whether the details are accurate.Step 2: Collect the documents.Step 3: Follow up for documents.Step 4: Submit the documents.Step 5: Wait for payment processing.